AI Chatbots Compared: 6 Models Predict SanDisk (SNDK) Stock Price

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In an unprecedented experiment, TheDayAfterAI News tasked six leading AI chatbots with the same challenge: predict SanDisk Corporation (NASDAQ: SNDK) stock price movement for the five trading days from January 7 to January 13, 2026. Following SNDK's extraordinary 27.56% single-day surge on January 6, 2026, we wanted to examine how different AI systems interpret the same market data and technical indicators.

The results reveal fascinating divergences in AI reasoning, with predictions spanning from cautious bearishness to confident bullishness. This comparative analysis offers valuable insights into both the capabilities and limitations of AI-powered financial forecasting.

The SNDK Context

SanDisk Corporation completed its spinoff from Western Digital on February 24, 2025, and has since experienced a remarkable 577% gain. The stock closed at $349.63 on January 6, 2026, following a stunning 28% single-day rally driven by AI-related memory demand optimism and CES 2026 announcements. Key factors all chatbots considered included:

RSI at 86.48 indicating extreme overbought conditions

Memory chip supercycle driven by AI infrastructure demand

Upcoming macro events: Jobs Report (Jan 9) and CPI data (Jan 13)

Stock trading well above analyst consensus price targets

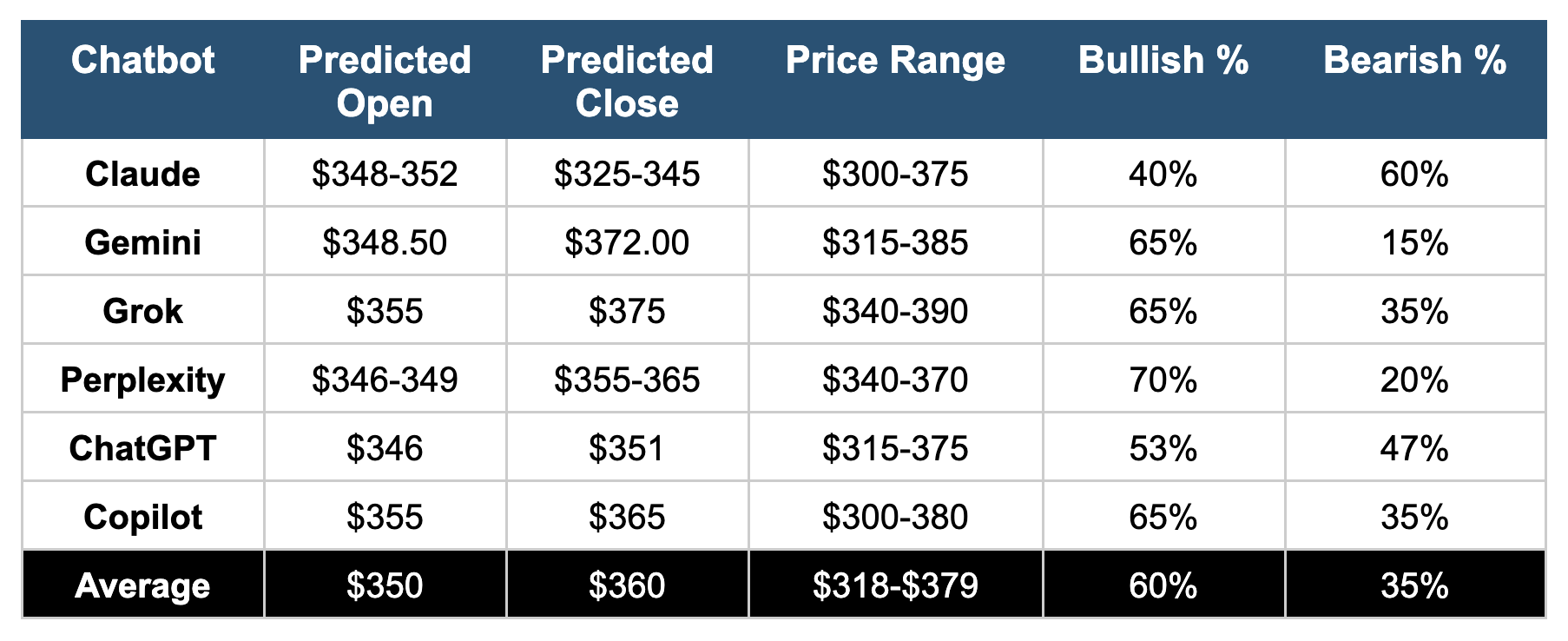

Head-to-Head: Prediction Comparison

The following table summarizes each chatbot's key predictions for the January 7-13, 2026 trading period:

Individual Chatbot Analysis

Claude (Anthropic) - The Cautious Contrarian

Stance: Bearish | Confidence: Low-Medium (40%)

Claude stood out as the most bearish of all six chatbots, assigning a 60% probability of price decrease. Its analysis heavily emphasized the extreme overbought technical conditions (RSI at 86+) and the stock trading 51% above its 200-day moving average. Claude viewed the 28% single-day gain as unsustainable and predicted mean reversion toward the $300-315 support zone.

Key Quote: "A 28% single-day gain in a $49 billion market cap stock attracts selling pressure as traders lock in gains."

Gemini (Google) - The Strategic Bull

Stance: Bullish | Confidence: High (65%)

Gemini delivered the most comprehensive and bullish analysis, framing the price action as a fundamental "re-rating" rather than mere speculation. Its 13-page report emphasized the "Memory Supercycle" narrative and gamma squeeze mechanics. Gemini predicted the stock would climb to $372 by January 13, recommending accumulation on dips.

Key Quote: "This movement represents a fundamental re-rating from a commoditized cyclical storage manufacturer to a critical infrastructure provider within the generative AI technology stack."

Grok (xAI) - The Momentum Rider

Stance: Moderately Bullish | Confidence: Medium (65%)

Grok provided a balanced but ultimately bullish outlook, acknowledging overbought conditions while emphasizing the AI-related demand catalyst. Its analysis highlighted the 897% one-year return and strong institutional interest. Grok projected a $375 close, citing the "high-tight flag pattern" and continued sector tailwinds.

Key Quote: "Evidence leans toward a 65% likelihood of a net price increase, acknowledging volatility from options expiration."

Perplexity - The Measured Optimist

Stance: Moderately Bullish | Confidence: Moderate-High (70%)

Perplexity offered the most thoroughly cited analysis, with over 90 source references. It predicted a modest 2-4% weekly gain while maintaining the most conservative price range ($340-370). The report emphasized consolidation as the likely outcome, viewing the week as a "digestion period" following the dramatic surge.

Key Quote: "The most probable outcome is modest consolidation with 2-4% upside, as the stock digests the 27.56% single-day rally."

ChatGPT (OpenAI) - The Neutral Pragmatist

Stance: Neutral | Confidence: Medium (53%)

ChatGPT delivered the most balanced assessment with a near 50/50 probability split (53% bullish vs. 47% bearish). Its concise analysis acknowledged both the strong AI/storage momentum and the binary risk from upcoming macro data. ChatGPT predicted relatively flat week-over-week performance with a $351 close.

Key Quote: "Jobs + CPI can swing yields and compress/expand risk appetite quickly... it's close to 50/50."

Copilot (Microsoft) - The Momentum Believer

Stance: Bullish | Confidence: Medium (65%)

Copilot provided a streamlined bullish analysis focusing on technical momentum and options flow. It emphasized the "very strong momentum" and predicted a $365 close with a 65% probability of gains. The analysis highlighted heavy bullish call flow and the potential for gamma squeeze dynamics.

Key Quote: "Momentum favors continuation into the week absent a major macro shock."

Key Findings and Observations

Consensus on Fundamentals, Divergence on Interpretation: All six chatbots agreed on the fundamental drivers: AI-driven memory demand, extreme overbought technical conditions, and binary macro event risk. However, they diverged significantly on how to weight these factors. Claude emphasized technical exhaustion; Gemini prioritized fundamental re-rating.

Bullish Majority: Five of six chatbots (Gemini, Grok, Perplexity, ChatGPT, and Copilot) predicted the stock would close higher than it opened, with probabilities ranging from 53% to 70%. Only Claude predicted a bearish outcome with 60% probability of decline.

Wide Range in Price Targets: Predicted closing prices ranged from $325-345 (Claude) to $372-375 (Gemini/Grok), representing a potential spread of up to $50 or approximately 14% of the stock price. This wide divergence highlights the inherent uncertainty in short-term price forecasting.

Different Analytical Approaches: The chatbots demonstrated notably different methodological approaches. Gemini provided the most detailed technical analysis with day-by-day projections. Perplexity offered the most extensively cited research. ChatGPT was the most concise. Claude focused heavily on risk factors.

Conclusion

This comparative analysis reveals that while AI chatbots can process vast amounts of financial data and generate sophisticated analyses, they can reach substantially different conclusions from the same inputs. The divergence between Claude's bearish stance and Gemini's bullish outlook demonstrates that AI systems, like human analysts, apply different weights to competing factors.

For investors, this exercise underscores an important principle: AI predictions should be viewed as one input among many, not as definitive guidance. The consensus suggests moderate bullishness, but the wide range of outcomes highlights the significant uncertainty inherent in short-term stock forecasting.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.