6 AIs Predict Chevron (CVX) Stock: The Venezuela Catalyst & Jan 5-9 Forecasts

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In a groundbreaking experiment, TheDayAfterAI News tasked six leading AI chatbots with analysing Chevron Corporation (NYSE: CVX) stock and predicting its price movement for the trading week of January 5-9, 2026. This week presents a unique analytical challenge: the U.S. military intervention in Venezuela over the weekend has created unprecedented volatility for CVX — the only major American oil company with active operations in Venezuela.

Each AI was given identical parameters: analyse technical indicators, market sentiment, fundamental catalysts, and macroeconomic factors to predict CVX's opening price on Monday, closing price on Friday, and the probability of price increase versus decrease for the period.

The results reveal fascinating divergences in AI reasoning, risk assessment, and market interpretation — offering investors a unique multi-perspective view of one of the most consequential weeks in energy sector history.

The AI Participants

We selected six widely-used AI chatbots representing different approaches to market analysis:

Claude (Anthropic) – Known for nuanced reasoning and balanced analysis

Perplexity – Real-time web search integration with citation-rich responses

ChatGPT (OpenAI) – The market leader with broad general knowledge

Grok (xAI) – Real-time X/Twitter integration with contrarian perspectives

Copilot (Microsoft) – Bing-powered search with financial data integration

Gemini (Google) – Deep analytical capabilities with extensive research framework

The Venezuela Catalyst: Why This Week Matters

Before examining each AI's predictions, it's essential to understand the extraordinary circumstances driving this analysis. Over the weekend of January 3-4, 2026, the Trump administration executed a military intervention in Venezuela, capturing President Nicolás Maduro and signalling intentions to revitalise Venezuela's oil industry with U.S. investment.

CVX closed at $155.90 on Friday, January 2, 2026. By Monday morning's pre-market session, shares had surged approximately 7-8% to around $167-169, creating a dramatic gap-up scenario that all six AIs had to evaluate.

Key question for each AI: Will the Venezuela catalyst sustain momentum, or will profit-taking and gap-fill mechanics dominate the week?

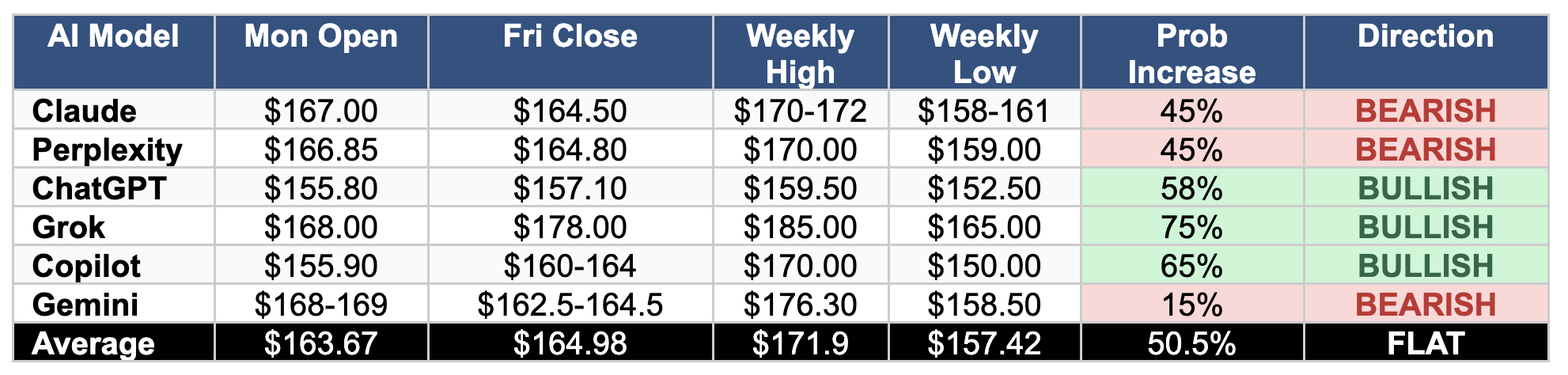

Head-to-Head Comparison: The Predictions

The following table summarises each AI's core predictions for the January 5-9, 2026 trading period:

The Great Divide: Bulls vs Bears

The most striking finding from this experiment is the clear division among AI models. Three AIs (Claude, Perplexity, and Gemini) predict the week will close lower than it opens, while three AIs (ChatGPT, Grok, and Copilot) predict net gains. This 50/50 split reflects the genuine uncertainty surrounding gap-up scenarios following major catalysts.

The Bear Case: Gap-Fill Mechanics

Claude, Perplexity, and Gemini all emphasise a critical statistical reality: large gap-ups of 7%+ historically retrace 60-70% of the time within 1-5 trading sessions. Their reasoning centres on:

Profit-taking pressure: Institutional traders who bought on Venezuela headlines will likely secure gains

Friday's jobs report: The December employment data (released January 9) introduces significant macro uncertainty

Technical exhaustion: RSI readings above 80 and extreme stochastic levels suggest overbought conditions

Death Cross concern: The weekly chart shows the 50-week MA below the 200-week MA, a longer-term bearish signal

The Bull Case: Transformative Catalyst

ChatGPT, Grok, and Copilot argue that the Venezuela catalyst is genuinely transformative and cannot be treated as a typical gap-up scenario. Their reasoning includes:

First-mover monopoly: CVX is the only major U.S. oil company with active Venezuela operations, creating asymmetric upside

Bullish options flow: Put/call ratio of 0.37 indicates strong call buying and bullish positioning

Institutional support: Berkshire Hathaway's $17.47 billion position and 67-72% institutional ownership provide a floor

Seasonal tailwinds: Energy stocks historically perform well in early January (14-20% average gains through Q2)

Individual AI Analysis Highlights

Claude: The Statistical Pragmatist

Claude's analysis stands out for its rigorous application of gap-fill statistics and clear probability framework. With a 55% probability of weekly decline (comparing Friday close to Monday open), Claude acknowledges the Venezuela catalyst's long-term significance while emphasising short-term mean reversion tendencies.

Key insight: "The asymmetric positioning of CVX as the only major U.S. oil company operating in Venezuela creates genuine long-term value, but short-term traders should recognise that gap fills are the norm, not the exception."

Claude suggests that pullbacks toward the $158-162 gap-fill zone may present attractive entry points for longer-term investors ahead of Q4 earnings on January 30.

Perplexity: The Citation-Heavy Researcher

Perplexity delivered the most citation-rich analysis, drawing from Reuters, Trading Economics, and multiple financial data sources. Its probability-weighted closing price of $164.80 represents a -1.23% decline from the predicted opening — nearly identical to Claude's forecast.

Unique contribution: Perplexity provided detailed scenario analysis with three distinct outcomes: Bullish (45% probability, $168-172 target), Base Case (35% probability, $164-166 target), and Bearish (15% probability, $159-162 target).

The analysis emphasised OFAC licensing risk as the primary execution uncertainty, noting that "Venezuela access is fundamentally positive for 2026-2027 free cash flow" but immediate follow-through remains uncertain.

ChatGPT: The Conservative Optimist

ChatGPT provided the most conservative opening price estimate ($155.80), apparently not fully incorporating the pre-market surge observed by other models. This methodological difference led to a bullish directional call despite predicting a relatively modest Friday close of $157.10.

Notable methodology: ChatGPT offered detailed day-by-day price estimates with specific ranges, showing a gradual appreciation pattern from Monday through Wednesday before pre-positioning volatility on Thursday and Friday.

The 58% probability of price increase reflects ChatGPT's assessment that "price above 5/10/20D MAs + constructive put/call + moderate IV support a slightly positive skew."

Grok: The Aggressive Bull

Grok delivered the most bullish forecast by a significant margin, predicting a Friday close of $178.00 — representing a 5.9% gain from its $168.00 opening estimate. With 75% probability of price increase, Grok's analysis reflects maximum conviction in the Venezuela catalyst.

Differentiating factors: Grok emphasised the "gamma squeeze" potential from market makers hedging short call positions, combined with the bull flag pattern on weekly charts suggesting an upside target of $190 if confirmed.

The analysis noted heavy volume (60 million+ shares in extended sessions) as confirmation of institutional accumulation, dismissing overbought indicators as secondary to the fundamental catalyst.

Copilot: The Balanced Pragmatist

Copilot occupied middle ground with a 65% probability of price increase and a target range of $160-164. Its analysis was the most concise, focusing on actionable trading levels and risk triggers rather than exhaustive scenario modelling.

Practical focus: Copilot provided clear invalidation criteria: "Break below ~$152.8 (support) → higher odds of a move to $150 and possibly $147-148. Break above ~$159.2 with follow-through → opens room to $160+."

The analysis notably emphasised WTI crude price action as the key external variable, suggesting that "oil weakness would cap gains" despite company-specific tailwinds.

Gemini: The Institutional Strategist

Gemini produced the most comprehensive analysis at approximately 4,500 words, reading like an institutional research report. Its 85% probability of price decrease (comparing Friday close to Monday open) represents the strongest bearish conviction among all models.

Sophisticated framework: Gemini introduced concepts like "gamma squeeze mechanics," "max pain dislocation," and "OFAC licensing risk" while providing detailed technical dashboards comparing pre-event and projected indicator values.

The recommendation to "fade the extreme opening strength if RSI hits >85" reflects Gemini's tactical trading orientation, while acknowledging that "core positions" remain justified given the "fundamental shift in asset quality and growth potential."

Consensus Points and Key Divergences

Where All Six AIs Agree

Venezuela is transformative: All models acknowledge CVX's unique first-mover advantage and the long-term significance of the catalyst

High volatility expected: Weekly ranges span $15-20, reflecting elevated uncertainty

Friday's jobs report matters: All models flag the December employment data as a key risk event

Technical overbought conditions: RSI, Stochastics, and Bollinger Band readings indicate short-term exhaustion

Support at $155-162: Gap-fill zone provides a floor for pullback scenarios

Where Models Diverge Significantly

Opening price estimates: Range from $155.80 (ChatGPT) to $169 (Gemini) — a $13.20 or 8.5% spread

Friday close targets: Range from $157.10 (ChatGPT) to $178.00 (Grok) — a $20.90 or 13.3% spread

Gap-fill weighting: Bears weight historical reversion patterns heavily; bulls dismiss them as inapplicable to "breakaway gaps"

Time horizon emphasis: Bears focus on 5-day tactical positioning; bulls emphasise structural value creation

Conclusion: What Can Investors Learn?

This experiment reveals both the power and limitations of AI-assisted financial analysis. While all six models delivered sophisticated, well-reasoned arguments, their predictions span a remarkably wide range — reflecting the genuine uncertainty inherent in short-term market forecasting.

Key takeaways for investors:

Diversify your AI sources: No single model captures the full complexity of market dynamics

Focus on consensus areas: When all AIs agree (e.g., high volatility, Friday risk), pay attention

Understand the assumptions: Bulls and bears often agree on facts but weight them differently

Use AI as input, not oracle: These predictions should inform, not replace, your own analysis

We will publish a follow-up article later, comparing each AI's predictions against actual market outcomes. Stay tuned to see which model, if any, accurately captured the week's price action.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.