Which AI Best Predicted Tesla's Stock?

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

This Monday, TheDayAfterAI News conducted an experiment: we asked five leading AI chatbots — Claude, Perplexity, Gemini, Grok, and ChatGPT — to predict Tesla (TSLA) stock performance for the trading week of December 15-19, 2025. Now that the week has concluded, we can evaluate each AI's accuracy across multiple dimensions.

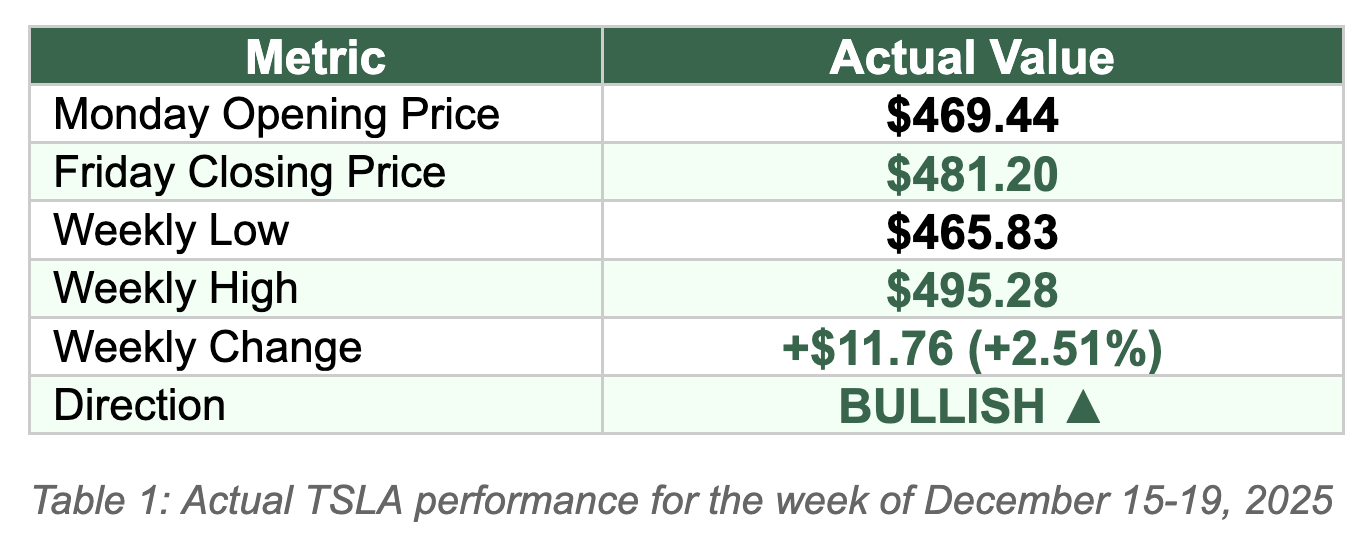

Actual TSLA Performance: December 15-19, 2025

Category-by-Category Rankings

We evaluated each AI across five categories, using percentage error from actual values. Lower percentage = better accuracy. Points awarded: 1st place = 5 pts, 2nd = 4 pts, 3rd = 3 pts, 4th = 2 pts, 5th = 1 pt. Wrong direction prediction = 0 pts.

Category 1: Best Trend/Direction Prediction

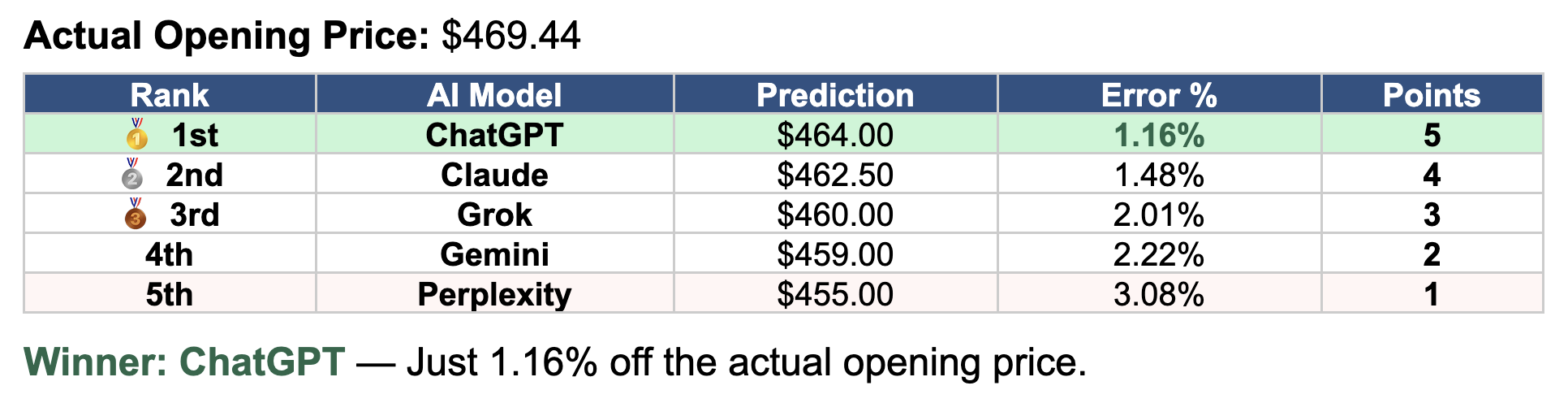

Category 2: Best Opening Price Prediction

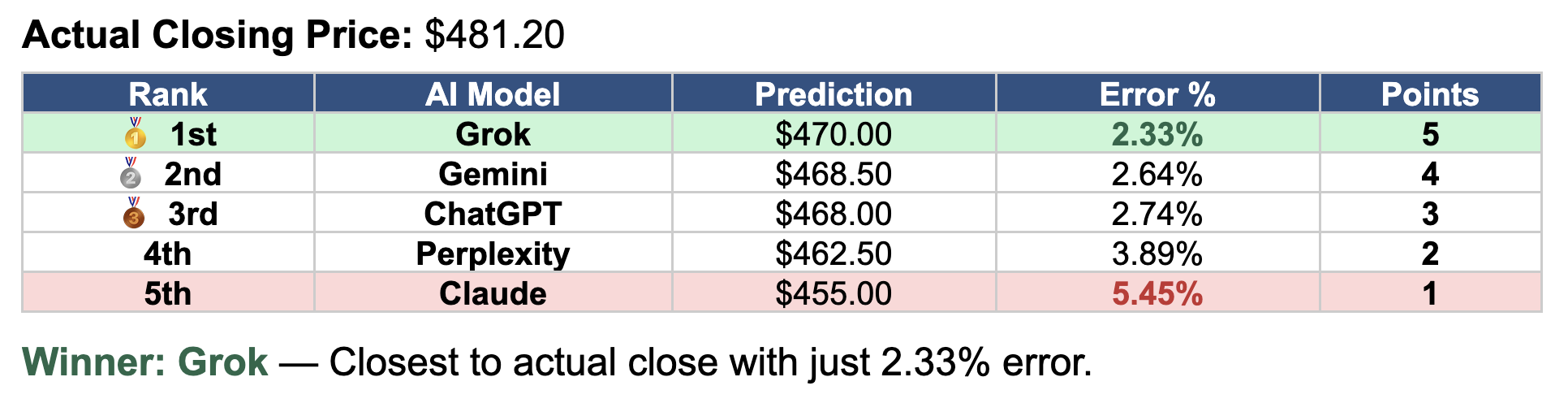

Category 3: Best Closing Price Prediction

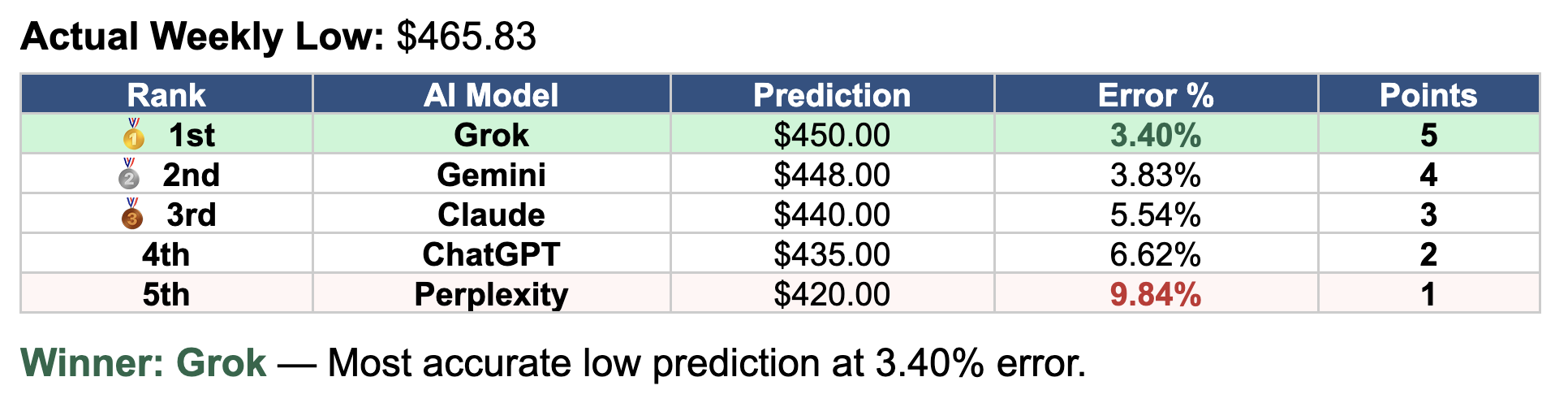

Category 4: Best Weekly Low Prediction

Category 5: Best Weekly High Prediction

Final Overall Rankings

Category Winners at a Glance

Best Trend Prediction: Gemini (65% bullish confidence — highest and correct)

Best Opening Price: ChatGPT (1.16% error)

Best Closing Price: Grok (2.33% error)

Best Weekly Low: Grok (3.40% error)

Best Weekly High: ChatGPT (0.06% error — almost perfect!)

Key Takeaways

Why Grok Won Overall: Grok's victory came from consistent performance across all categories rather than dominance in any single area. It won two categories outright (Close, Low) and placed respectably in all others. This balanced approach proved more valuable than ChatGPT's spectacular but isolated wins.

ChatGPT's Remarkable High Prediction: ChatGPT's prediction of $495 for the weekly high versus actual $495.28 represents a 0.06% error — the single most accurate prediction in the entire experiment. This near-perfect call on the upper range suggests ChatGPT may be particularly skilled at identifying upside potential in momentum stocks.

Claude's Direction Miss: Claude was the only AI to predict a bearish week (50% down vs 40% up), which proved incorrect. This wrong direction call earned 0 points in the most important category and dragged down its overall ranking. Notably, Claude actually had the second-best opening price prediction (1.48% error), showing that its technical analysis was sound — it simply overweighted bearish factors like December seasonality.

All AIs Underestimated TSLA's Strength: Every AI predicted both a lower open and lower close than actually occurred. The actual close of $481.20 was at least 2.33% higher than even the most optimistic closing prediction (Grok at $470). This systematic conservatism suggests current AI models may struggle to fully capture momentum in high-beta growth stocks.

Conclusion

This multi-category analysis reveals that no single AI dominates across all prediction types. Different chatbots excelled in different areas: Gemini was best at reading market direction, ChatGPT showed remarkable skill at identifying price ceilings, and Grok proved most accurate at predicting where the stock would actually close.

For investors considering AI-assisted analysis, the key insight is that ensemble approaches — consulting multiple AIs and synthesizing their views — may produce better results than relying on any single chatbot. The average of all five AIs' predictions would have been directionally correct and reasonably accurate on most metrics.

TheDayAfterAI News will continue this experiment with additional stocks to determine whether these patterns persist across different market conditions and asset types.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.