ChatGPT vs. Grok vs. Gemini: 6 AIs Predict AppLovin (APP) Stock

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

At TheDayAfterAI News, we believe in leveraging the collective intelligence of multiple AI systems to provide our readers with comprehensive market insights. In this analysis, we tasked six leading AI chatbots—ChatGPT, Grok, Claude, Gemini, Copilot, and Perplexity—with predicting the stock price movement of AppLovin Corp (APP) for the five trading days from January 20 to January 26, 2026.

AppLovin, the mobile advertising and gaming company, has experienced significant volatility recently, declining approximately 22.5% from its December highs amid SEC investigation concerns and broader market pressures from geopolitical tensions. This analysis captures how different AI models interpret the same market conditions and arrive at varying predictions.

KEY FINDING: Four of six AI chatbots predict APP will close higher by January 26, with predicted closing prices ranging from $540 (Grok, most bearish) to $625 (Perplexity, most bullish). The consensus suggests cautious optimism amid significant uncertainty.

Methodology

Each AI chatbot was provided with identical prompts requesting a five-day stock price forecast for APP from January 20–26, 2026. The chatbots were asked to provide: predicted opening price (January 20), predicted closing price (January 26), estimated trading range, probability of price increase versus decrease, and supporting analysis including technical indicators, market sentiment, and fundamental catalysts.

Comparative Prediction Summary

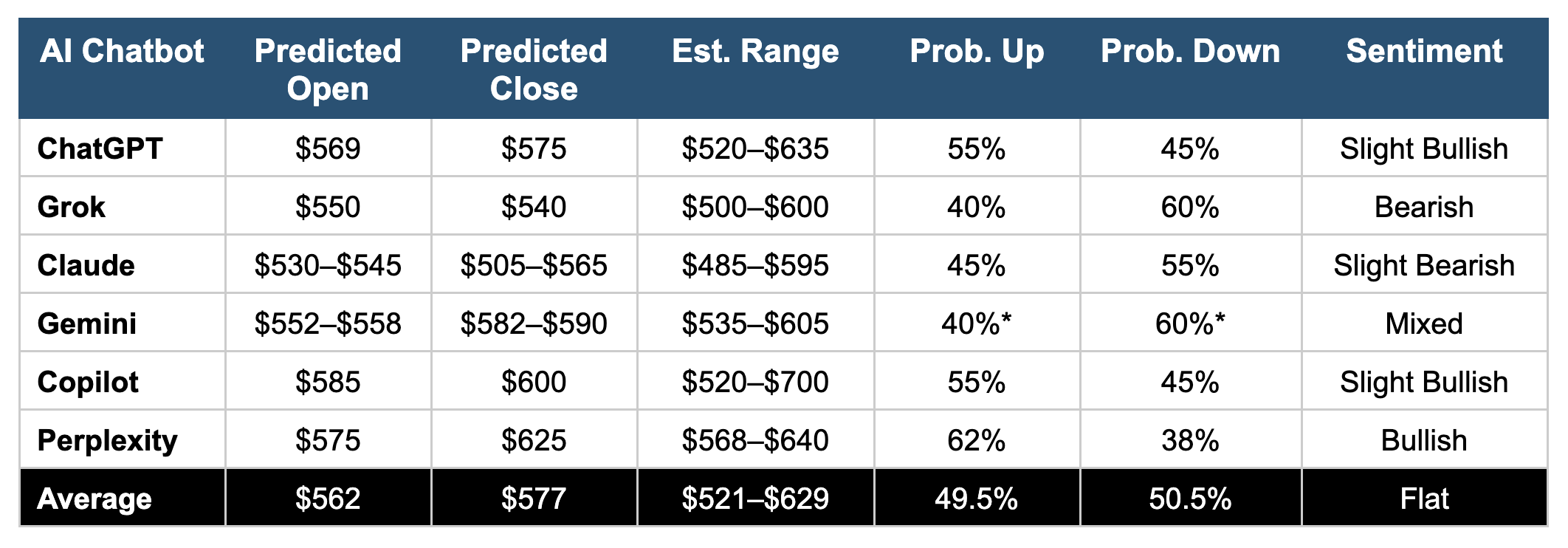

The following table summarises the key predictions from each AI chatbot:

*Gemini compares the probability up/down vs. Jan 16 Close

Individual AI Analysis Summaries

1. ChatGPT Analysis

ChatGPT delivered a balanced, technically-focused analysis emphasising oversold conditions (RSI ~35.7) and near-term support levels. The model predicted a slight upward bias with a 55% probability of gains, citing mean reversion potential after the sharp 22% decline from December highs.

Key observations: ChatGPT highlighted the stock trading below key moving averages (5-day SMA ~$624, 20-day SMA ~$664) as overhead resistance. The model noted elevated implied volatility (84% vs 58% historical) suggesting traders expect continued large moves. Support levels identified at $560, $547, and $526 provide a framework for risk management.

2. Grok Analysis

Grok provided the most bearish forecast among the six chatbots, predicting a net decline from $550 opening to $540 closing. The model heavily weighted geopolitical concerns, particularly U.S.–Europe trade tensions over Greenland, as a primary driver of risk-off sentiment.

Key observations: Grok emphasised fundamental catalysts including robust Q3 results (revenue $1.41B, +17% YoY; EBITDA margin 82%) but noted these were overshadowed by macro uncertainty. The model flagged elevated VIX levels (18.84) and tech sector weakness as near-term headwinds. Short interest at 5.34% with 5.3 days to cover provides some squeeze potential if positive catalysts emerge.

3. Claude Analysis

Claude’s analysis was notably cautious, incorporating the Capitalwatch short report published January 19 alleging money laundering by major shareholders. This company-specific risk factor contributed to the model’s slightly bearish 55/45 probability split favouring downside.

Key observations: Claude predicted a gap-down opening ($530–$545) reflecting Frankfurt’s 6% decline on the MLK Day holiday. The model presented detailed scenario analysis: 45% base case (volatile stabilisation at $525–$555), 35% bear case (breakdown below $500), and 20% bull case (relief rally to $590–$620). RSI at 29.01 indicated extreme oversold conditions warranting caution on aggressive short positions.

4. Gemini Analysis

Gemini produced the most comprehensive technical analysis, incorporating options market microstructure, gamma positioning, and Max Pain calculations. Despite assigning 60% probability to a lower weekly close, the model predicted price recovery toward $582–$590 by week’s end through mean reversion mechanics.

Key observations: Gemini highlighted Max Pain at $620 for January 23 expiration as a potential magnet, though acknowledged the large gap from current prices would likely prevent full convergence. The model provided detailed day-by-day predictions: gap-down Tuesday to $555, stabilisation Wednesday at $562, grind higher Thursday–Friday toward $578, and positioning for earnings on Monday at $585. The “Dual Growth Engine” thesis (gaming ad-tech dominance + e-commerce expansion) provided fundamental support.

5. Copilot Analysis

Copilot delivered a concise, options-focused analysis predicting moderate upside from $585 opening to $600 closing. The model assigned 55% probability to a net price increase, emphasising unusual options activity and elevated implied volatility as key market signals.

Key observations: Copilot noted short interest of approximately 15.7 million shares (5–6% of float) with 3–5 days to cover, creating potential for short squeeze dynamics. The model predicted a wide intraweek range ($520–$700), acknowledging high uncertainty ahead of the February 11 earnings report. Bull case drivers included pre-earnings positioning and sector rotation into AI/ad-tech names; bear case drivers included VIX spikes and negative options hedging flows.

6. Perplexity Analysis

Perplexity provided the most bullish forecast, predicting an 8.7% weekly gain from $575 opening to $625 closing with 62% probability of price appreciation. The model emphasised mean reversion dynamics amplified by elevated short interest and oversold technical conditions.

Key observations: Perplexity delivered detailed daily progression forecasts: Tuesday bounce to $588, Wednesday continuation to $595, Thursday consolidation at $602, Friday options expiration push to $615, and Monday momentum carry to $625. The model noted Williams %R at –88.53 indicating genuine oversold conditions historically associated with reversal attempts. Institutional accumulation (Vanguard +39.4% holdings in Q3) suggested long-term confidence despite near-term volatility.

Common Themes Across AI Analyses

Despite varying conclusions, several themes emerged consistently across all six AI chatbot analyses:

Oversold Technical Conditions: All six chatbots identified APP as technically oversold, with RSI readings between 26–42 and Williams %R below –80. This created consensus around potential bounce conditions, though models differed on whether fundamental headwinds would override technical signals.

Regulatory Uncertainty: The ongoing SEC investigation into AppLovin’s data practices was cited by all models as a significant overhang. Claude and Gemini additionally incorporated the January 19 Capitalwatch short report allegations, contributing to their more cautious outlooks.

Macro Headwinds: The “Greenland Tariff” shock and U.S.–Europe trade tensions were identified by all models as creating a risk-off environment for high-beta technology stocks. Nasdaq futures down 1.5% pre-market and VIX at elevated levels (15–19) supported this concern.

Strong Fundamentals: All models acknowledged AppLovin’s robust operating performance: Q3 2025 revenue of $1.41B (+68% YoY), EBITDA margins of 82%, and strong analyst support with average price targets around $732–$770. This fundamental backdrop provided a floor for the bearish scenarios.

Key Divergences in AI Predictions

The most significant divergences occurred in three areas:

Opening Price Expectations: Predictions for January 20 opening ranged from $530 (Claude) to $585 (Copilot)—a $55 spread reflecting different assessments of pre-market weakness and gap-down severity. Models incorporating Frankfurt trading data (Claude, Gemini) predicted steeper declines.

Weighting of Technical vs. Fundamental Factors: Perplexity and Copilot weighted technical oversold signals more heavily, arriving at bullish conclusions. Claude and Grok prioritised fundamental risks (regulatory, geopolitical), producing bearish forecasts despite similar technical readings.

Scenario Probability Distributions: Models differed significantly in their probability assessments: Perplexity assigned 62% probability to upside, while Grok and Gemini assigned only 40%. This 22-percentage-point spread demonstrates how identical market data can yield divergent probabilistic interpretations.

Conclusion and Investment Implications

This multi-AI analysis reveals both the potential and limitations of using artificial intelligence for short-term stock prediction. While all six chatbots identified similar technical patterns, support/resistance levels, and fundamental catalysts, their ultimate conclusions varied from bearish (Grok: $540 target) to bullish (Perplexity: $625 target).

The consensus view suggests a trading range of approximately $500–$620 for the week, with a slight bullish bias (average 49.5% probability of gains). Key levels to watch include $550 support and $600–$620 resistance. The February 11 earnings report looms as the next major catalyst that will likely resolve the current uncertainty.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.