6 AI Chatbots Predict BABA Stock: Bullish Consensus vs. Gemini’s Warning

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In an unprecedented experiment, TheDayAfterAI News tasked six leading AI chatbots with the same challenge: predict Alibaba Group Holding Limited (NYSE: BABA) stock performance for the trading week of January 9-15, 2026. Each model was given identical market data and asked to provide opening price predictions, closing price forecasts, expected trading ranges, and probability assessments for price direction.

The results reveal a striking divergence in AI reasoning capabilities: five models predicted bullish outcomes with varying confidence levels, while one model took a contrarian bearish stance. This analysis examines how different AI architectures interpret identical financial data and the implications for AI-assisted investment research.

The Models Tested

We selected six widely-accessible AI chatbots representing the current state of large language model technology:

Claude (Anthropic) - Known for nuanced reasoning and detailed analysis

ChatGPT (OpenAI) - The industry benchmark for conversational AI

Gemini (Google) - Multi-modal capabilities with real-time data access

Perplexity - Research-focused AI with citation capabilities

Grok (xAI) - Real-time social media integration

Copilot (Microsoft) - Enterprise-focused with financial data access

Prediction Summary

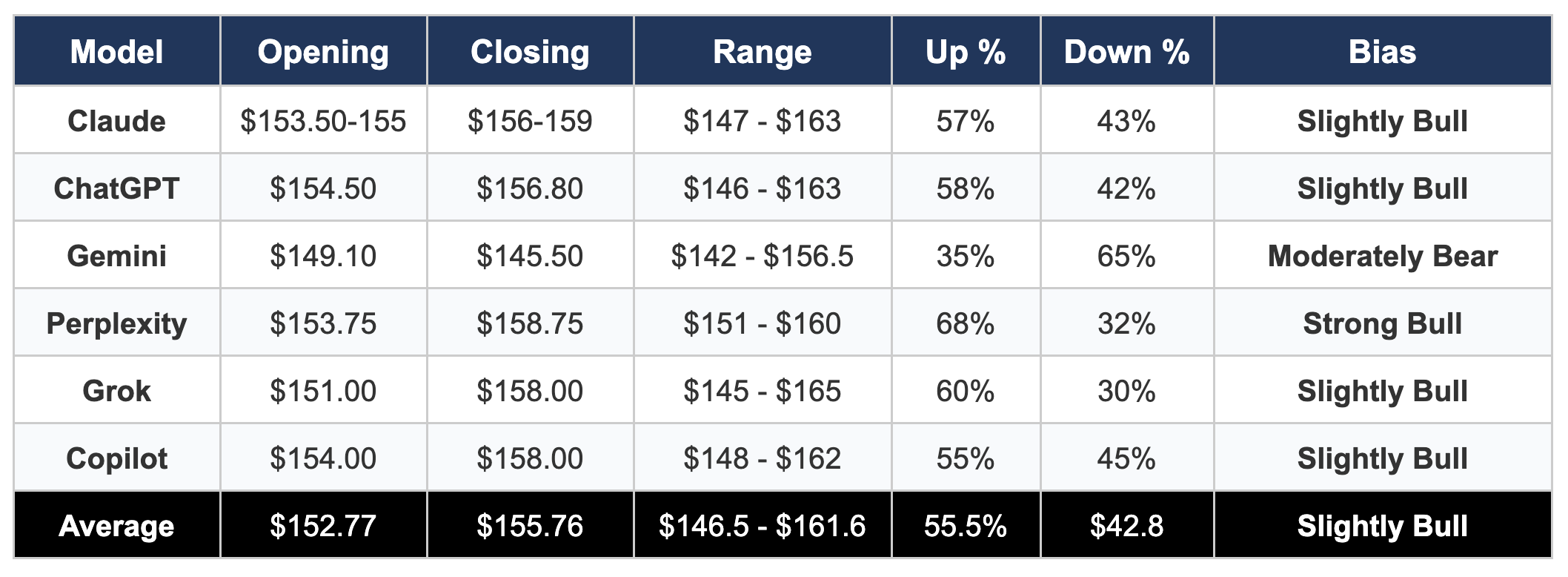

The following table presents each model's core predictions for BABA stock during the January 9-15, 2026 trading period:

Consensus Analysis

The Bull Case (5 of 6 Models)

Five models converged on a moderately bullish outlook, projecting BABA to close between $156 and $159. The bullish consensus was driven by several shared observations:

Technical Recovery: The January 8 bounce of 5.26% from the $145.27 intraday low demonstrated strong support, with volume 63% above average suggesting institutional accumulation.

Options Positioning: Put/call ratios between 0.50-0.60 indicated bullish sentiment, with significant call open interest at the $150 and $155 strikes.

Nvidia H200 Catalyst: Reports of potential China approval for Nvidia H200 chip imports provided a fundamental catalyst for Alibaba's cloud computing ambitions.

Golden Cross Formation: Multiple models noted the 50-day MA trading above the 200-day MA, a historically bullish technical signal.

The Bear Case (Gemini)

Gemini stood alone with a bearish prediction, forecasting BABA to decline from $149.10 to $145.50 with a 65% probability of decrease. The contrarian thesis rested on:

Max Pain Divergence: A critical $10 gap between the January 9 weekly options max pain ($150) and January 16 monthly max pain ($140) suggested downward pressure as dealer hedging obligations shifted.

China Deflationary Spiral: December 2025 CPI missed expectations at +0.8% YoY, while PPI remained deeply negative at -1.9%, signaling persistent deflationary pressures on consumer spending.

Moving Average Breakdown: Gemini identified BABA trading below all key moving averages in pre-market, characterizing this as a "failed breakout" scenario.

H200 Liquidity Drain: Rather than viewing the Nvidia chip news as purely bullish, Gemini noted that 200,000 units at $30,000+ each would require approximately $6 billion in upfront capital, potentially reducing buyback capacity.

Key Event Risks Identified

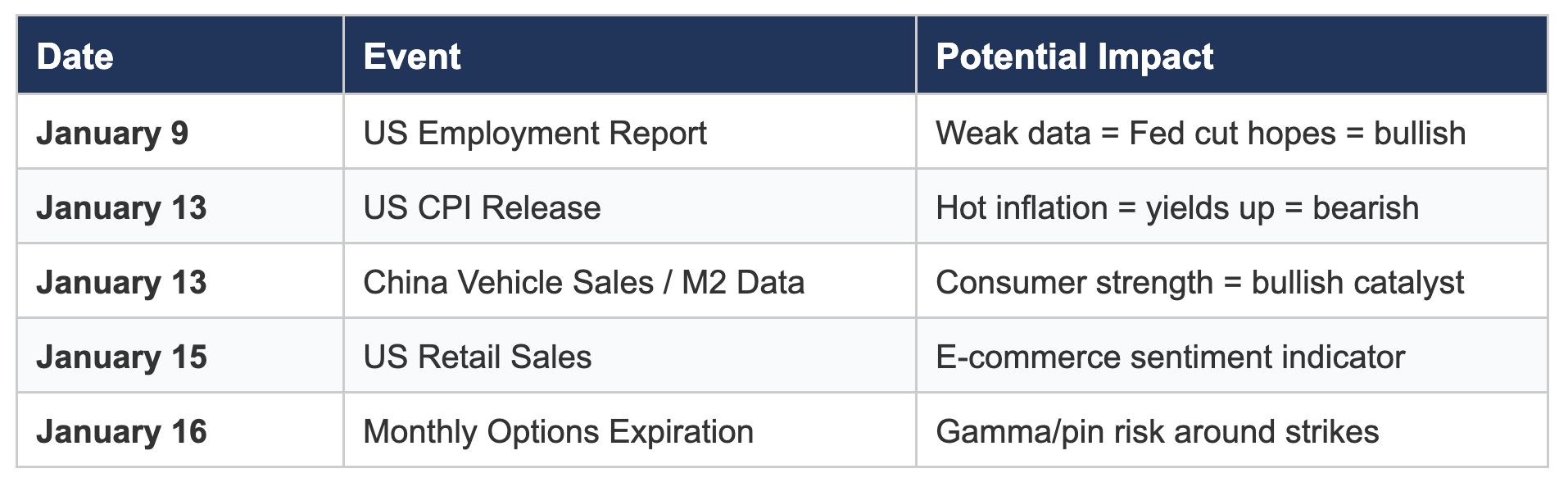

All six models identified similar catalysts that could drive significant price movement during the forecast period:

Methodological Observations

This experiment revealed notable differences in how each AI model approaches financial analysis:

Claude provided the most comprehensive analysis with extensive sourcing, balancing technical, fundamental, and sentiment factors while acknowledging uncertainty ranges.

ChatGPT offered a structured probabilistic framework with clear day-by-day scenarios tied to specific economic events.

Gemini demonstrated the most contrarian thinking, emphasizing options market microstructure and gamma effects that other models overlooked.

Perplexity delivered the most bullish forecast (68% upside probability) with detailed technical indicator analysis and institutional flow data.

Grok integrated social media sentiment and real-time positioning data, offering actionable trigger patterns for traders.

Copilot provided concise, market-structure-focused analysis emphasizing VIX levels and options flow as primary drivers.

Conclusion

This multi-model analysis demonstrates both the potential and limitations of AI-assisted investment research. While five of six models reached similar bullish conclusions, the divergent bearish thesis from Gemini highlights how different analytical frameworks can produce materially different outcomes from identical inputs.

The consensus view suggests BABA is more likely to appreciate during the January 9-15 trading period, supported by technical momentum, bullish options positioning, and the Nvidia H200 catalyst. However, the January 13 CPI release represents a significant binary risk that could invalidate bullish assumptions if inflation data surprises to the upside.

TheDayAfterAI News will publish a follow-up analysis after January 15 to evaluate which model's predictions proved most accurate, providing valuable insights into the reliability of AI-generated financial forecasts.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.