Which AI Best Predicted iRobot's Bankruptcy Stock Collapse?

Source: Google Finance

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

Last week, TheDayAfterAI News conducted an experiment: we asked five leading AI chatbots — Perplexity, Google Gemini, xAI's Grok, OpenAI's ChatGPT, and Anthropic's Claude — to predict iRobot Corporation (NASDAQ: IRBT) stock performance for the trading week of December 15–19, 2025. The company had just filed for Chapter 11 bankruptcy on December 14, making this an extraordinary stress test for AI financial analysis.

Now that the week has concluded, we can evaluate each AI's accuracy across multiple dimensions. Rather than simply declaring one winner, we've analysed performance across five distinct categories: trend direction, opening price, closing price, weekly low, and weekly high. All price errors are calculated as percentage deviations from actual values for meaningful comparison.

Important Note: Perplexity's analysis was conducted before the bankruptcy announcement, while the other four chatbots analysed the situation after the filing became public. This timing difference significantly disadvantaged Perplexity's predictions.

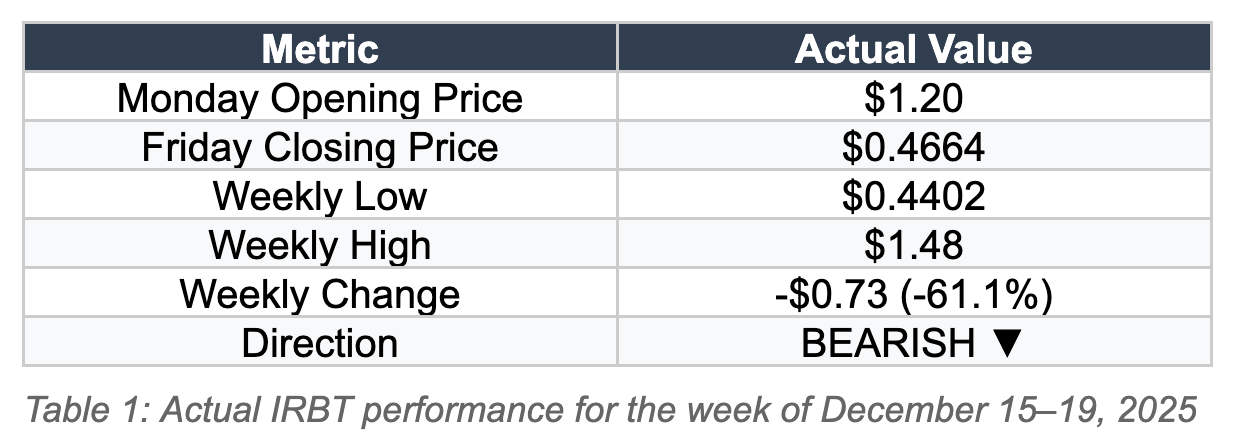

Actual IRBT Performance: December 15–19, 2025

Category-by-Category Rankings

We evaluated each AI across five categories, using percentage error from actual values. Lower percentage = better accuracy. Points awarded: 1st place = 5 pts, 2nd = 4 pts, 3rd = 3 pts, 4th = 2 pts, 5th = 1 pt.

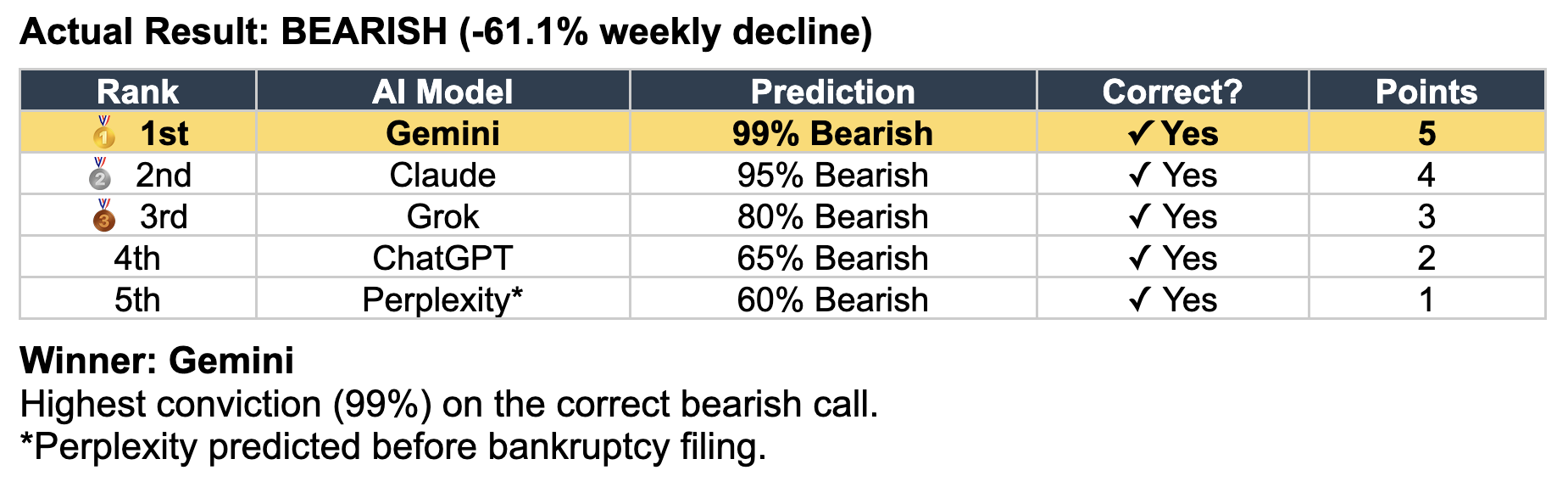

Category 1: Best Trend/Direction Prediction

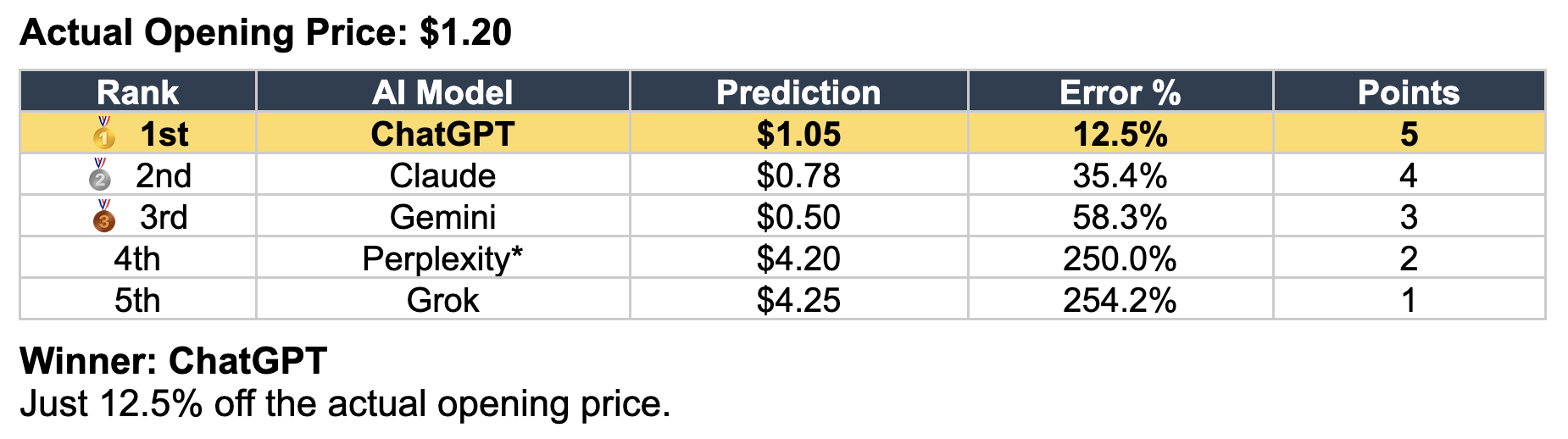

Category 2: Best Opening Price Prediction

Category 3: Best Closing Price Prediction

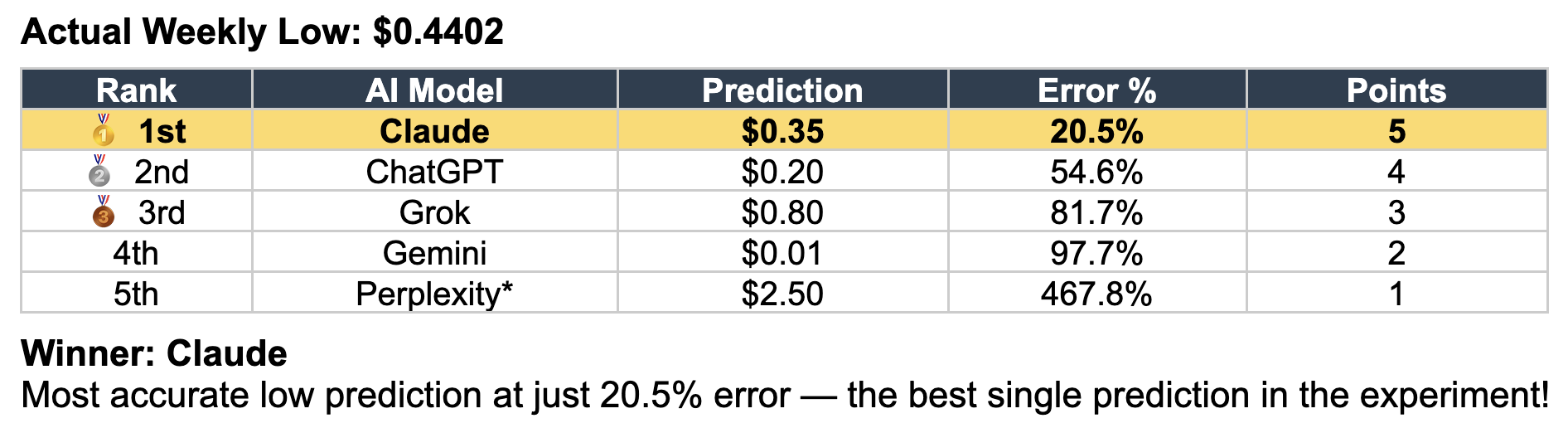

Category 4: Best Weekly Low Prediction

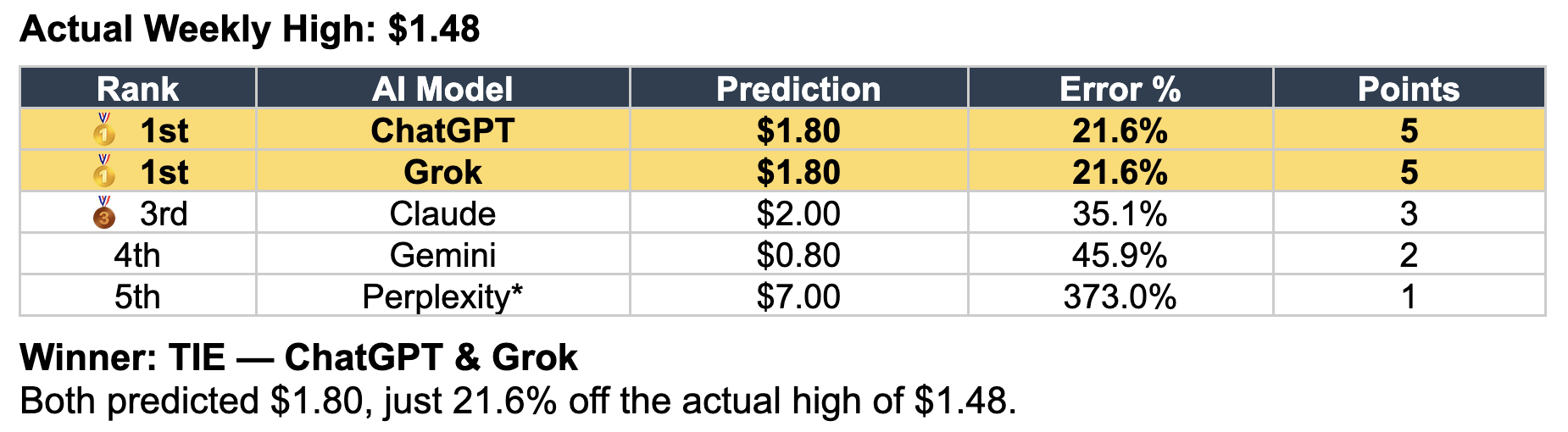

Category 5: Best Weekly High Prediction

Final Overall Rankings

Category Winners at a Glance

Best Trend Prediction: Gemini (99% bearish confidence — highest and correct)

Best Opening Price: ChatGPT (12.5% error)

Best Closing Price: ChatGPT (28.7% error)

Best Weekly Low: Claude (20.5% error — best single prediction!)

Best Weekly High: ChatGPT & Grok (TIE) (21.6% error each)

Key Takeaways

Why ChatGPT Won Overall: ChatGPT's victory came from consistent excellence in price predictions. It won three categories outright (Opening, Closing, and tied for High) and placed second in Weekly Low. Its "option on a court outcome" analytical framework proved particularly well-calibrated for this bankruptcy situation. While ChatGPT showed lower confidence in direction (65% bearish vs Gemini's 99%), its actual price estimates were substantially more accurate.

Claude's Excellent Floor Prediction: Claude's prediction of $0.35 for the weekly low was just 20.5% off the actual $0.4402 — the single most accurate prediction in the entire experiment. Claude's comprehensive scenario analysis and risk framework paid dividends, particularly in identifying downside boundaries. Its 95% bearish conviction also proved well-founded.

Gemini's Confident Direction Call: Google's Gemini expressed the highest conviction on direction (99% bearish) and was vindicated by the 61% actual decline. The "terminal event" framing was directionally correct. However, Gemini's price predictions were more extreme than reality — predicting a $0.01 low and $0.80 high versus actual $0.44 low and $1.48 high.

Information Timing Proved Critical: Perplexity's pre-bankruptcy analysis serves as a stark reminder that AI predictions are only as good as their information. With an 811% error on closing price, Perplexity's predictions were effectively worthless—not due to analytical failure, but simply because it lacked the crucial bankruptcy news. This underscores the importance of real-time data access for financial AI applications.

All Post-Bankruptcy AIs Got Direction Right: Every chatbot that analysed the situation after the bankruptcy filing correctly predicted IRBT would decline. In a terminal equity situation, getting direction right is arguably the most important call. This demonstrates fundamental competence in distressed equity analysis across all major AI platforms.

Contrast with Tesla Results

Interestingly, the IRBT results differ significantly from our concurrent TSLA experiment, where Grok won with 20 points. Key differences:

ChatGPT: 1st in IRBT (21 pts) vs 2nd in TSLA (18 pts) — Better at distressed situations?

Claude: 2nd in IRBT (20 pts) vs 5th in TSLA (9 pts) — Dramatic improvement in bankruptcy analysis

Grok: 4th in IRBT (14 pts) vs 1st in TSLA (20 pts) — Better at momentum stocks than distressed equities?

Gemini: 3rd in both experiments (15-17 pts) — Most consistent performer

Conclusion

This multi-category analysis reveals that ChatGPT demonstrated superior calibration in this extreme bankruptcy scenario, winning with 21 points versus Claude's close second at 20 points. The one-point margin highlights how competitive the top performers were.

For investors considering AI-assisted analysis of distressed securities, the key insight is that ensemble approaches — consulting multiple AIs and synthesising their views — may produce better results than relying on any single chatbot. Different AIs excelled in different areas: Gemini for direction confidence, ChatGPT for price accuracy, and Claude for downside boundary estimation.

TheDayAfterAI News will continue this experiment with additional stocks to determine whether these patterns persist across different market conditions and asset types.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.