6 Top AI Models Predict Intel Stock: Split Forecasts Ahead of Q4 Earnings (Jan 2026)

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In an unprecedented experiment in AI-powered financial forecasting, TheDayAfterAI News tasked six of the world's leading AI chatbots with analyzing Intel Corporation (NASDAQ: INTC) stock performance for the five-day trading period of January 22-28, 2026. This analysis comes at a critical juncture: Intel closed at $54.25 on January 21, 2026, marking a stunning 11.72% single-day surge and approximately 45% year-to-date gain, with Q4 2025 earnings scheduled for release after market close on January 22.

The AI models analyzed include Gemini (Google), Grok (xAI), ChatGPT (OpenAI), Perplexity, Claude (Anthropic), and Copilot (Microsoft). Each was provided with identical market data and asked to deliver predictions for opening price, closing price, price range, and probability assessments. The results reveal fascinating divergences in AI reasoning and risk assessment methodologies.

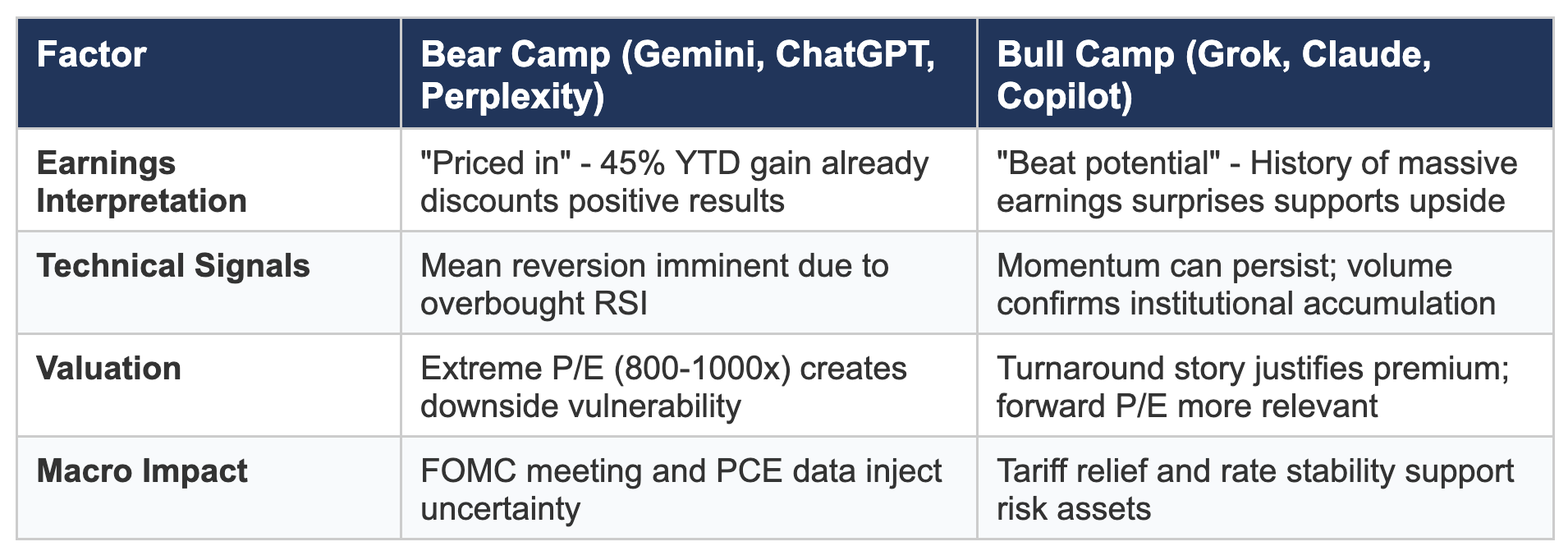

KEY FINDING: The AI community is split. Three models (Gemini, ChatGPT, Perplexity) predict a decline, while three (Grok, Claude, Copilot) forecast gains. Predicted closing prices range from $51.25 to $58.50, representing a $7.25 spread, or approximately 13% variance.

The Contenders: Six AI Models, Six Perspectives

Each AI chatbot brought unique analytical frameworks and reasoning approaches to this challenge. Here is how they stack up:

*Perplexity provided a probability-weighted mean closing price

Detailed Analysis: What Each AI Sees

Gemini (Google): The Technical Purist

Gemini delivered the most comprehensive equity research report, spanning 13 pages with detailed technical, fundamental, and sentiment analysis. Its bearish stance (70% probability of decrease) centers on the classic "sell-the-news" phenomenon. Gemini argues that with INTC already up 45% YTD and RSI readings above 70 (indicating overbought conditions), the stock has priced in a near-perfect earnings scenario.

Key insight: Gemini identified the "whisper number" of $0.12 EPS versus the official consensus of $0.08, suggesting the real bar Intel must clear is significantly higher than published estimates. The model also provided detailed Elliott Wave analysis, suggesting Intel is in a "Wave 5 Extension" terminal rally phase.

Grok (xAI): The Momentum Believer

Grok emerged as the most bullish forecaster, predicting a $58.50 close, representing a 7.8% gain from current levels. The xAI model emphasizes positive momentum indicators, including MACD crossover signals and bullish moving average alignments. Grok weighs heavily on Intel's AI and data center recovery narrative.

Key insight: Grok highlights institutional ETF inflows ($1 billion weekly into SMH semiconductor fund) and the favorable geopolitical backdrop (Trump's tariff retreat) as underappreciated tailwinds. However, Grok acknowledges the stretched P/E ratio of 904x as a contrarian concern.

ChatGPT (OpenAI): The Cautious Pragmatist

ChatGPT offered a nuanced view, predicting only a marginal decline from $54.20 to $53.80, essentially forecasting a flat week. With a 53% probability of decrease versus 47% for increase, ChatGPT demonstrates the highest uncertainty among all models. The analysis emphasizes the binary nature of the earnings catalyst.

Key insight: ChatGPT provides a detailed scenario analysis: 45% probability for a base case where results are "good but not enough," 30% for a bull case pushing toward $58-$61, and 25% for a bear case dropping to $48-$51. This probabilistic framework offers traders actionable range-bound strategies.

Perplexity: The Quantitative Analyst

Perplexity delivered the most methodologically rigorous analysis, using probability-weighted scenarios to arrive at a $51.88 expected closing price. The model explicitly assigns 50% probability to a base case, 25% to bull, and 25% to bear scenarios, creating a formal expected value calculation.

Key insight: Perplexity flags the critical disconnect between Intel's current $54.25 price and the consensus analyst target of $38-$39, implying 28-32% downside based on Wall Street estimates. This valuation gap creates asymmetric downside risk that other models underweight.

Claude (Anthropic): The Catalyst Hunter

Claude focuses heavily on Intel's fundamental catalysts, particularly the 18A process node progress and upcoming Panther Lake consumer laptop launch on January 27. With a 58% probability of increase and $56.50 price target, Claude represents the moderate bull case.

Key insight: Claude emphasizes Intel's remarkable 577% average earnings beat over the past four quarters, creating asymmetric upside potential if the pattern continues. The model also highlights the $11.1 billion in government CHIPS Act funding and the Trump administration's 9.9% equity stake as validation of Intel's strategic importance.

Copilot (Microsoft): The Options Strategist

Copilot uniquely predicts a lower opening price of $50.00, suggesting potential pre-market weakness, before rallying to $55.50 by week's end. This creates the largest predicted intraweek move among all models. The analysis leans heavily on options market positioning.

Key insight: Copilot highlights heavy bullish options positioning ahead of earnings, with 9 of the last 10 unusual options trades being calls concentrated in the $38-$52 strike range. The model assigns 40% probability to a bull case, 35% to base, and 25% to bear scenarios.

Areas of Agreement

Despite divergent conclusions, all six AI models converge on several key observations:

1. High Volatility Expected: All models predict significant price swings, with implied volatility in the 96th+ percentile and options pricing approximately ±8% moves around earnings.

2. Overbought Technical Conditions: Every model acknowledges RSI readings above 70 and stretched momentum indicators, though they disagree on whether this signals imminent reversal or continued strength.

3. Earnings as Binary Catalyst: The Q4 earnings release is unanimously identified as the dominant price driver, with guidance commentary deemed more important than backward-looking results.

4. Support at $50-$51: All models identify the $50-$51 zone as critical technical support, representing the recent breakout level that bulls must defend.

Key Points of Divergence

Conclusion

The split verdict among leading AI models reflects the genuine uncertainty surrounding Intel's critical earnings week. With three models predicting gains and three predicting declines, the average probability of increase sits at a near-coin-flip 49.2%. This divergence underscores a fundamental truth: even the most sophisticated AI systems, analyzing identical data, can reach opposing conclusions when markets face binary catalyst events.

For investors, the key takeaway may not be which AI is "right," but rather the range of plausible outcomes all models identify. The consensus support at $50-$51 and resistance in the $58-$61 zone provide actionable reference points regardless of directional bias. As Intel's turnaround story meets the harsh reality of quarterly numbers, the market will ultimately render its own verdict, one that may challenge the assumptions of both AI bulls and bears alike.

TheDayAfterAI News will publish a follow-up analysis after January 28, 2026 comparing actual results against each AI model's predictions, continuing our mission to evaluate AI capabilities in real-world financial forecasting.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.