AI Showdown: ChatGPT, Gemini & Grok Predict Netflix (NFLX) Stock

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In an unprecedented experiment, TheDayAfterAI News tasked six of the world's leading AI chatbots with the same challenge: predict Netflix's stock price movement for the five trading days spanning January 21-27, 2026. Following Netflix's Q4 2025 earnings release on January 20, which beat expectations but offered muted guidance, combined with the dramatic news of its $82.7 billion all-cash bid for Warner Bros. Discovery, NFLX shares plummeted over 6% in after-hours trading.

We provided identical market data, technical indicators, fundamental analysis, and macroeconomic context to ChatGPT, Claude, Gemini, Grok, Perplexity, and Copilot. The results reveal fascinating divergences in how different AI models interpret the same financial data and arrive at markedly different conclusions.

The Context: A Perfect Storm of Uncertainty

Netflix closed at $87.26 on January 20, 2026, before releasing Q4 earnings that exceeded analyst expectations with EPS of $0.56 (vs. $0.55 expected) and revenue of $12.05 billion. However, the market's reaction was decidedly negative, driven by several factors:

2026 guidance of 12-14% revenue growth fell short of the 16% 'whisper number'

The revised all-cash $82.7 billion Warner Bros. Discovery acquisition raised leverage concerns

Share buybacks were suspended to preserve liquidity for the deal

Geopolitical tensions (Trump's Greenland tariff rhetoric at Davos) added macro uncertainty

Technical indicators showed extreme oversold conditions (RSI below 25)

Head-to-Head Predictions Comparison

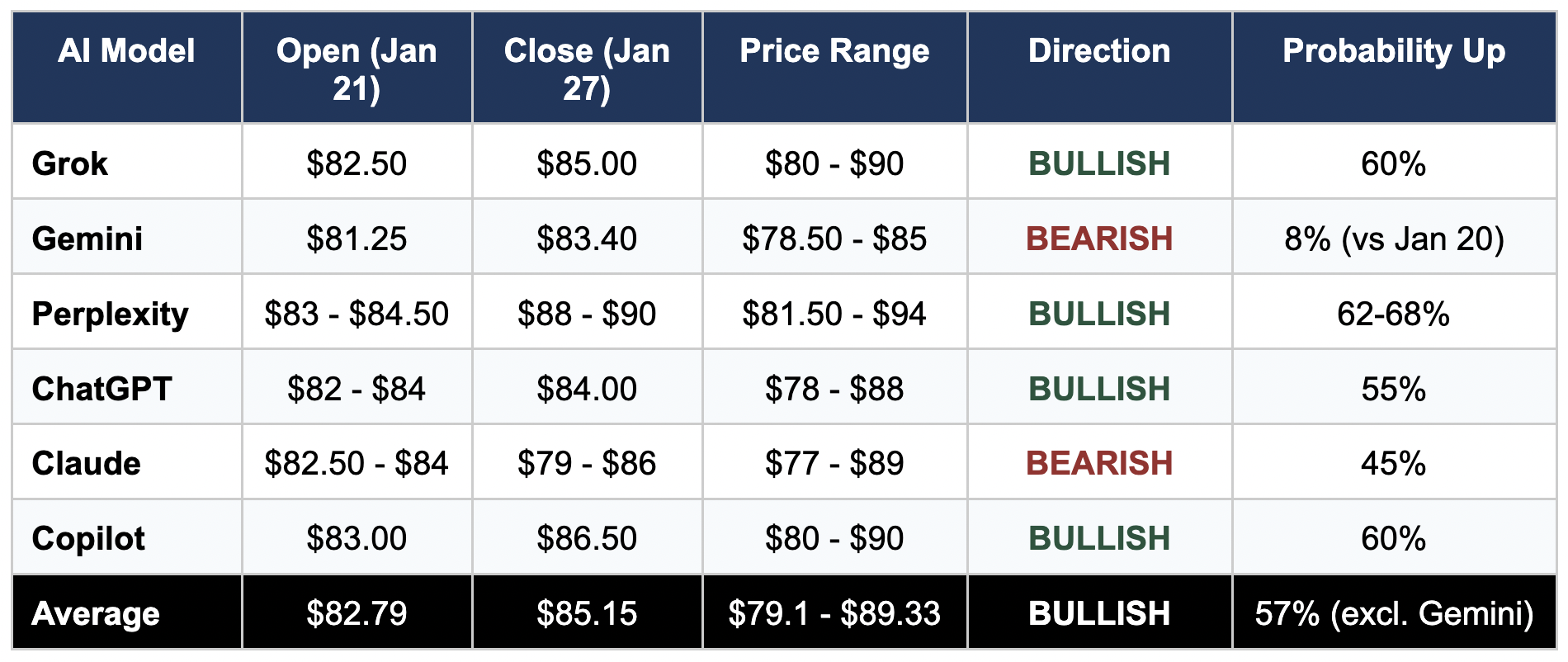

The following table summarizes each AI chatbot's key predictions for the January 21-27, 2026 trading period:

Individual AI Analysis Breakdown

Grok (xAI)

Stance: Moderately Bullish

Grok's analysis emphasized the extreme oversold technical conditions, citing an RSI of 14.88 and Stochastic at 3.29 as historically reliable bounce indicators. The model acknowledged the WBD deal uncertainty and weaker 2026 guidance but weighted technical factors more heavily, predicting a modest rebound from $82.50 to $85.00. Grok provided detailed daily projections and highlighted that the equity put/call ratio of 0.52 and declining short interest suggested reduced bearish positioning.

Gemini (Google)

Stance: Strongly Bearish

Gemini delivered the most bearish assessment with an explicit 'UNDERPERFORM / SELL' rating and 92% probability of a net price decrease versus the January 20 close. The model produced a comprehensive 13-page equity research report emphasizing the structural transformation of Netflix from a growth stock to a leveraged media conglomerate. Gemini highlighted the 'death cross' technical pattern, potential negative gamma squeeze dynamics, and the fundamental concern that Netflix's premium valuation (34x P/E) must compress toward sector averages.

Perplexity AI

Stance: Moderately Bullish

Perplexity provided the most optimistic closing price target of $88-$90, representing a 5-8% recovery from the predicted open. The analysis heavily weighted the historical mean-reversion behavior when RSI drops below 25, assigning a 45% probability to an 'Oversold Relief Bounce' scenario. Perplexity's 17-page report included extensive citation of external sources and emphasized that institutional investors still own over 80% of shares, suggesting a potential floor from value-oriented funds.

ChatGPT (OpenAI)

Stance: Cautiously Bullish

ChatGPT took a measured approach, projecting a relatively flat outcome with the closing price matching or slightly exceeding the opening price. The model provided day-by-day estimates anticipating initial weakness followed by gradual stabilization. ChatGPT emphasized the interplay between technical oversold conditions and fundamental concerns, ultimately assigning a modest 55% probability to an upward move. The analysis was notably concise compared to peers.

Claude (Anthropic)

Stance: Moderately Bearish

Claude was one of only two models to predict a net decline, assigning a 55% probability of price decrease. The analysis emphasized the binary risk profile created by WBD deal uncertainty and noted significant insider selling ($171 million over 90 days) as a concerning signal. Claude provided the widest potential price range ($77-$89), reflecting high uncertainty, and identified the suspension of share buybacks as particularly damaging to near-term sentiment.

Copilot (Microsoft)

Stance: Moderately Bullish

Copilot delivered the most streamlined analysis, predicting a net gain from $83 to $86.50 with 60% confidence. The model focused on the technical setup and options positioning, noting that the expected move implied by options markets (±$6.35) suggested high volatility but not necessarily continued downside. Copilot's approach balanced multiple factors without the extensive detail of other models, making it accessible for general audiences.

Key Observations and Divergences

Opening Price Consensus: All six models converged remarkably on the predicted opening price, clustering between $81.25 and $84. This consensus reflects the clear premarket signals available at the time of analysis, with after-hours trading indicating a 5-7% gap down from the prior close.

Closing Price Divergence: The closing price predictions showed significant divergence: Perplexity's bullish $88-$90 target stands $5-$7 above Gemini's bearish $83.40 forecast. This 7-8% spread highlights how differently the models weigh technical bounce potential versus fundamental headwinds.

Technical vs. Fundamental Weighting: The bullish models (Grok, Perplexity, Copilot) emphasized oversold technical indicators and historical mean-reversion patterns. The bearish models (Gemini, Claude) focused more heavily on fundamental concerns: leverage, valuation compression, integration risk, and insider selling signals.

Analysis Depth and Style: Gemini and Perplexity produced the most comprehensive reports (13-17 pages), while ChatGPT and Copilot delivered concise 2-3 page summaries. Claude's analysis fell in between, notable for its explicit acknowledgment of uncertainty through wider confidence intervals.

Conclusion

This experiment reveals that even when provided identical information, leading AI models can reach substantially different conclusions about short-term stock price movements. The majority consensus (4 of 6 models) leans bullish, primarily driven by the compelling technical oversold setup. However, the two bearish outliers (Gemini and Claude) raise valid concerns about fundamental headwinds that could override technical signals.

The divergence underscores an important truth about financial markets: reasonable analysts can look at the same data and reach different conclusions. AI models, trained on different datasets and with different architectural designs, exhibit this same characteristic. Investors should view these predictions as one input among many rather than definitive guidance.

TheDayAfterAI News will continue to track NFLX's actual performance through January 27 and publish a follow-up analysis comparing each AI's prediction accuracy. Stay tuned for the results.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.