Meta Stock Forecast: Comparing Predictions from 6 Top AI Chatbots

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

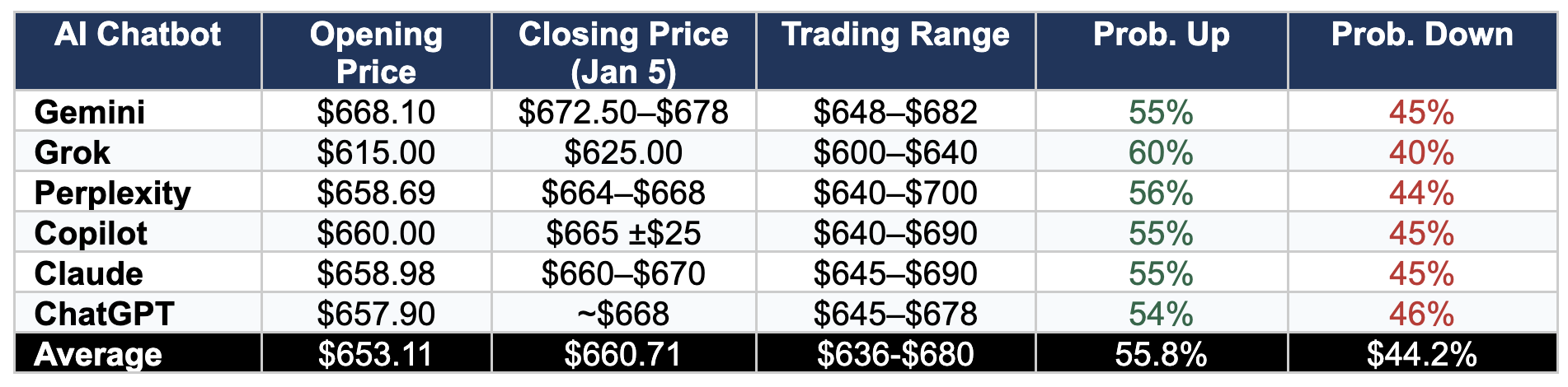

In an unprecedented experiment, TheDayAfterAI News tasked six leading AI chatbots with analyzing Meta Platforms (NASDAQ: META) stock and providing price forecasts for the four trading days spanning December 30, 2025 to January 5, 2026. Each AI system was given identical parameters and asked to deliver opening price estimates, closing price predictions, expected trading ranges, and probability assessments for price movement direction.

The results reveal fascinating consensus on certain metrics while exposing significant divergence in others—highlighting both the potential and limitations of AI-powered financial analysis. This comparison offers unique insights into how different AI architectures approach market forecasting and interpret identical market conditions.

The AI Contenders

Six prominent AI chatbots participated in this analysis, each representing different technological approaches and training methodologies:

Gemini (Google DeepMind) – Delivered a comprehensive 13-page strategic equity intelligence report

Grok (xAI) – Provided technical analysis with momentum indicators and sentiment data

Perplexity – Offered a detailed 4-day trading analysis with visual charts and probability distributions

Copilot (Microsoft) – Delivered a concise summary with key driver analysis

Claude (Anthropic) – Provided comprehensive analysis covering technical, sentiment, and fundamental factors

ChatGPT (OpenAI) – Supplied day-by-day forecasts with support/resistance level analysis

Head-to-Head Prediction Comparison

The following table presents the core predictions from each AI chatbot, allowing for direct comparison across key metrics:

Key Findings

Consensus Points

Directional Agreement: All six AI systems predicted a slightly bullish bias, with probability of price increase ranging from 54% to 60%. This remarkable consensus suggests the models identified similar underlying bullish signals in the market data.

Modest Expectations: Five of six chatbots (excluding Grok) predicted relatively modest gains of $5–$15 over the four-day period, reflecting the holiday-shortened trading week and thin liquidity conditions.

Risk Awareness: Every AI highlighted similar risk factors including FOMC minutes release, holiday liquidity concerns, and options expiration mechanics.

Notable Divergences

The Grok Outlier: Grok's analysis appears to have used outdated price data, citing an opening price of $615 versus the actual ~$658 level. This resulted in predictions approximately $40–$50 below other models—a critical reminder that AI outputs are only as good as their input data.

Range Width Variation: Perplexity projected the widest trading range ($640–$700, a $60 spread), while ChatGPT was most conservative ($645–$678, a $33 spread). This reflects different volatility assumptions across models.

Gemini's Optimism: Gemini provided the most bullish closing price target ($672.50–$678), approximately $8–$10 higher than the consensus midpoint.

Catalyst Analysis: What the AIs Focused On

Each AI identified similar catalysts but weighted them differently:

Manus AI Acquisition: Gemini and Claude provided extensive coverage of the $2B+ deal; others mentioned it briefly. Gemini called it a "strategic pivot toward Agentic AI."

FOMC Minutes: All six AIs flagged the Dec 30 release as the primary macro catalyst. Consensus: hawkish surprise = downside risk; dovish confirmation = support for tech stocks.

Holiday Liquidity: Universal concern about thin trading volumes (~50% of normal). Claude and Perplexity specifically warned of "amplified price swings on minimal volume."

Options Expiration: Gemini and Perplexity analyzed Jan 2 weekly expiration in detail. Both identified "max pain" pinning dynamics around $660–$700 strikes.

January Effect: Gemini and Claude referenced seasonal tailwinds; Claude noted the historical 78% success rate for Santa Claus rally but cautioned about 2024–2025's anomalous loss.

Methodology & Approach Comparison

Each AI demonstrated distinct analytical approaches:

Gemini delivered the most comprehensive report (13 pages) with extensive sourcing, including 38 cited works. Heavy emphasis on fundamental analysis and macroeconomic context.

Perplexity provided the most visually rich analysis with embedded charts showing price scenarios and probability distributions. Strong technical analysis focus.

Claude balanced technical, fundamental, and sentiment analysis with detailed support/resistance levels. Notable coverage of regulatory risks (EU antitrust, Italy WhatsApp order).

ChatGPT offered practical day-by-day forecasts with specific intraday ranges—the most actionable for short-term traders.

Copilot provided a concise executive summary style—efficient for quick decision-making but less detailed.

Grok demonstrated strong technical indicator coverage but was compromised by apparent data staleness issues.

Lessons for AI-Assisted Investment Analysis

Data Quality Matters Most: Grok's outlier prediction demonstrates that AI analysis is only as reliable as its underlying data. Always verify that AI systems are working with current market information.

Consensus Adds Confidence: When multiple AI systems with different architectures reach similar conclusions, it strengthens the signal. The 54–56% bullish probability consensus across five models is more compelling than any single prediction.

AI Excels at Risk Identification: All six systems identified similar risk factors—FOMC minutes, holiday liquidity, options expiration—suggesting AI is particularly useful for systematic risk assessment.

Different Tools for Different Needs: Gemini suits deep fundamental research, ChatGPT offers actionable trading levels, Perplexity provides visual analysis—selecting the right AI for your analytical needs matters.

Human Judgment Remains Essential: No AI predicted with certainty. The consistent ~55/45 probability split acknowledges inherent market uncertainty—a reminder that AI augments rather than replaces human decision-making.

About This Series

This article is part of TheDayAfterAI News' ongoing series comparing AI chatbot capabilities across various analytical tasks. By presenting identical challenges to multiple AI systems, we aim to illuminate their respective strengths, limitations, and appropriate use cases. Follow our publication for future comparisons across stock analysis, research synthesis, and other AI applications.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.