Battle of the AI Chatbots: Palantir (PLTR) Stock Forecast Feb 2026

Image Credit: Austin Ramsey | Splash

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

Palantir Technologies (NYSE: PLTR) delivered what CEO Alex Karp called “indisputably the best results that I’m aware of in tech in the last decade” when the company reported Q4 2025 earnings after market close on Monday, February 2, 2026. Revenue surged 70% year-over-year to $1.41 billion, crushing the $1.33 billion consensus. Even more dramatic was the FY2026 revenue guidance of $7.18–7.20 billion — nearly $1 billion above Wall Street’s $6.27 billion estimate.

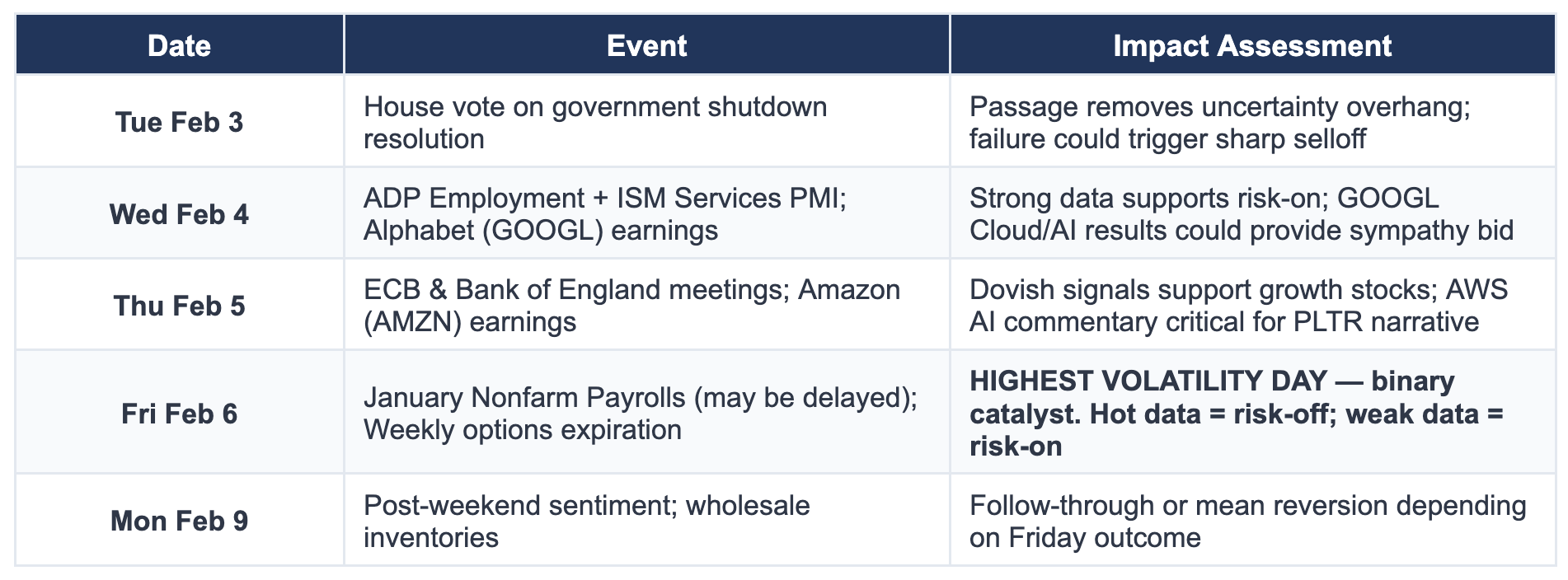

The stock responded with an 11–16% pre-market surge from Friday’s $147.76 close, setting the stage for a volatile and closely-watched trading week. With the January jobs report, weekly options expiration, and peer earnings from Alphabet and Amazon all on the calendar, the week of February 3–9 presents a rich testing ground for AI-powered financial analysis.

At TheDayAfterAI News, we put six of the most widely-used AI chatbots to the test: Claude, ChatGPT, Gemini, Perplexity, Copilot, and Grok. Each was given the same prompt and access to publicly available data. Here’s how they see Palantir’s week ahead.

The Earnings Catalyst: What Drove the Surge

Before examining each chatbot’s predictions, it is essential to understand the fundamental catalyst that dominates this week’s analysis. All six models anchored their forecasts on the same blockbuster earnings report:

Q4 2025 Revenue: $1.41B (+70% YoY) vs. $1.33B consensus

Adjusted EPS: $0.25 vs. $0.23 consensus (+8.7%)

FY2026 Revenue Guidance: $7.18–7.20B vs. $6.27B consensus (+$920M)

US Commercial Revenue Growth: +137% YoY to $507M

US Government Revenue Growth: +66% YoY to $570M

Rule of 40 Score: 127% (exceptional)

Pre-Market Reaction (Feb 3): +11–16% surge from $147.76 close

Head-to-Head: Six AI Chatbots, One Stock

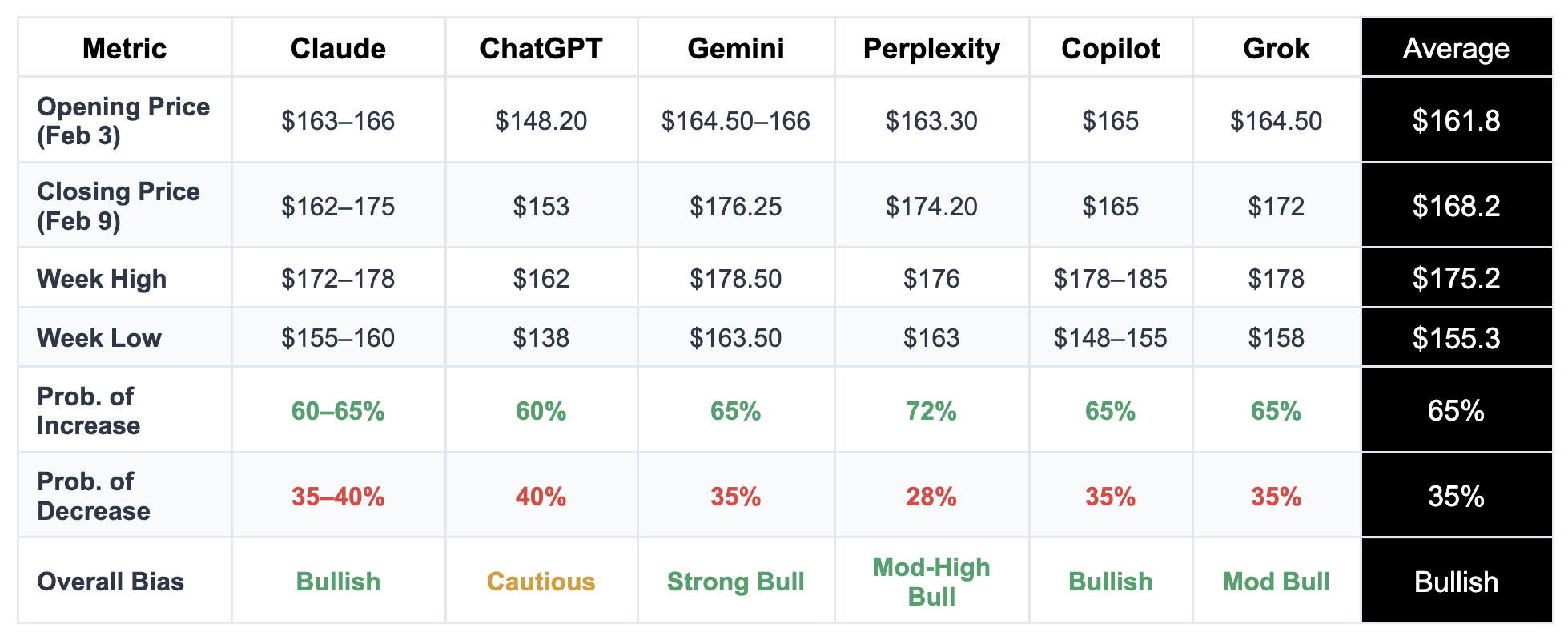

The table below presents each chatbot’s key predictions for the five trading days from Tuesday, February 3 through Monday, February 9, 2026. All models were queried on the same date with equivalent prompts.

Individual Chatbot Analysis Breakdown

Claude (Anthropic)

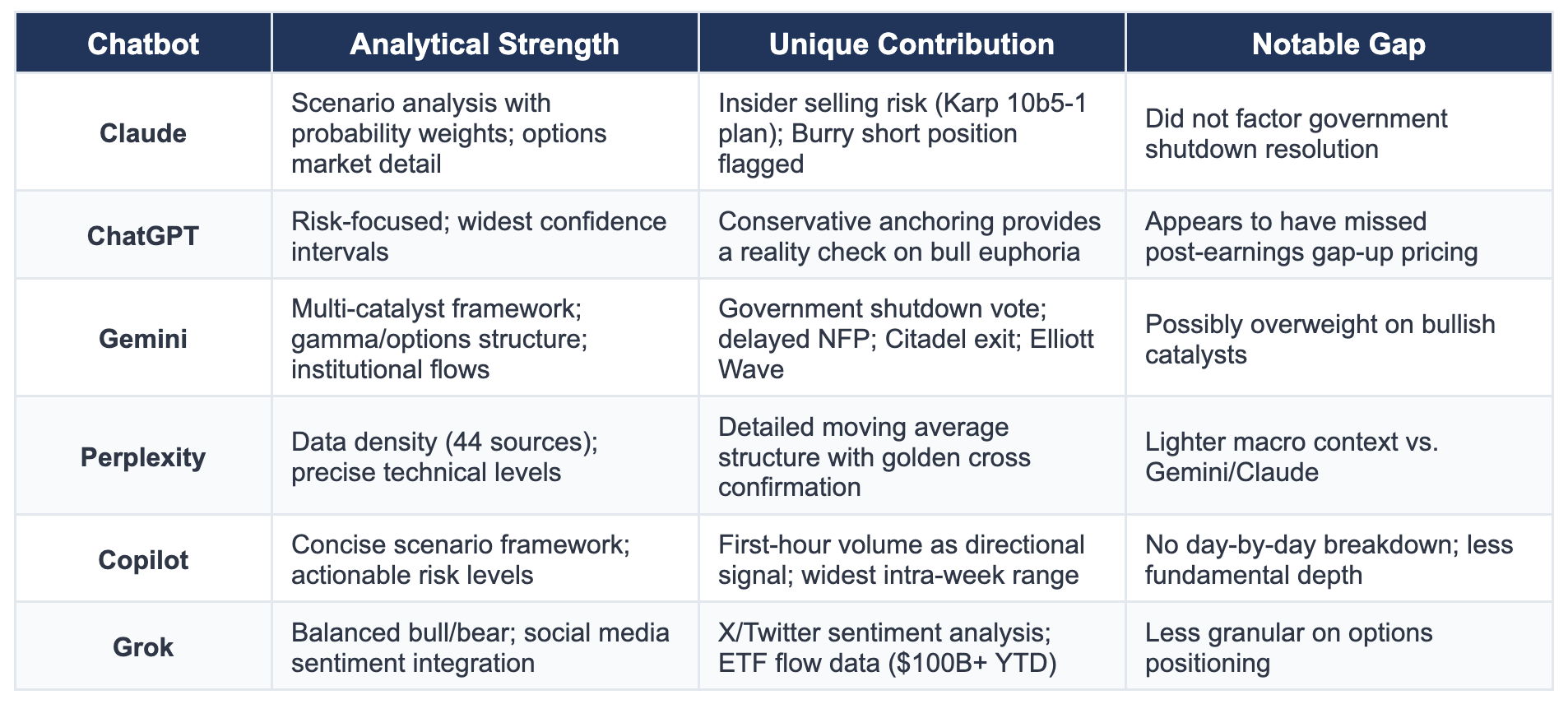

Verdict: Bullish bias with Friday volatility risk

Claude delivered the most scenario-balanced analysis, presenting three probability-weighted outcomes: strong continuation (35%, targeting $172–178), moderate consolidation (40%, targeting $162–170), and a pullback from open (25%, targeting $155–162). Its most likely outcome envisions PLTR opening around $164, testing $172–175 mid-week, encountering Friday jobs-report volatility, and closing the period around $165–170.

Claude’s analysis stood out for its detailed day-by-day narrative and emphasis on the options market, noting a put/call volume ratio of 0.61 (bullish) and the February 6 weekly expiration creating heightened gamma exposure. It also flagged CEO Karp’s amended 10b5-1 plan to sell up to 9.975 million shares and Michael Burry’s disclosed $1B+ short position as notable downside risks.

ChatGPT (OpenAI)

Verdict: Cautiously optimistic — the conservative outlier

ChatGPT emerged as the clear outlier among the six models. Its predicted opening of $148.20 and closing of $153 were dramatically lower than all other chatbots, reflecting a notably cautious reading of the post-earnings setup. While it acknowledged the strong fundamentals, ChatGPT appears to have anchored more heavily on the pre-market indicated price of $147.76 rather than the post-earnings gap-up levels that other models incorporated.

Its base-case range of $138–$162 (70% confidence) was the widest of any model, suggesting significant uncertainty. The wider tail range extended down to $134 on the downside. ChatGPT’s day-by-day path estimated modest moves: a $152 close on Tuesday rising only to $153–154 by week’s end, making it the only model to project an essentially flat week relative to the post-earnings open.

Gemini (Google)

Verdict: Strong Buy — the most bullish of the group

Gemini produced the most comprehensive and aggressive analysis, delivering a 15-page institutional-grade equity research report. Its primary bullish case (65% probability) targets $172–$180, with a point forecast of $176.25 for the February 9 close. Gemini’s bearish case carried just a 10% probability, the lowest downside risk assessment among all six models.

What set Gemini apart was its multi-dimensional catalyst framework. Beyond earnings, it identified the resolution of the US government shutdown (House vote on February 3), the delay of the January NFP report due to the shutdown (creating a “data vacuum” favourable to growth stocks), and sympathy rallies from peer earnings (Alphabet on Feb 4, Amazon on Feb 5). It also provided extensive analysis of gamma exposure and the $170 call wall, institutional flow dynamics including Citadel’s 91% stake exit, and Elliott Wave analysis suggesting the beginning of a bullish Wave 5.

Perplexity

Verdict: Moderate-High confidence bullish — the data-driven optimist

Perplexity assigned the highest probability of increase at 72%, with a predicted close of $174.20 on February 9 — a +6.67% weekly gain. Its analysis was heavily data-driven, citing 44 specific sources and providing precise technical levels including moving average structures (5-day EMA at $149.00 through 200-day EMA at $164.40).

The model emphasised that Palantir’s oversold RSI of 38.33 provides over 30 points of rebound potential before reaching overbought territory. It also noted that the 50-day MA above the 200-day MA confirms a “golden cross” bullish structure, with the $171–$175 band as the key resistance zone for the week.

Copilot (Microsoft)

Verdict: Bullish near-term bias with high-volatility caution

Copilot delivered a concise but data-rich analysis, projecting an opening of $165 and an end-of-week close of $165 — effectively predicting a volatile but flat outcome. However, the model’s intra-week range was the widest among the bullish models, with a high of $178–185 and a low of $148–155, reflecting its emphasis on the binary nature of the week’s catalysts.

It identified three clear scenarios: a bull case (40%) pushing toward $175–185 on institutional follow-through, a base case (35%) of $155–175 range-bound trading around options pinning, and a bear case (25%) reverting to $148–155 on macro shock. Copilot placed particular emphasis on the first 30–60 minutes of Tuesday trading as a key tell for the week’s direction.

Grok (xAI)

Verdict: Moderate bullish — earnings-led but valuation-conscious

Grok predicted an opening price of $164.50 and a closing price of $172 on February 9, representing a 65% probability of net increase. Its analysis balanced the strong earnings momentum against valuation concerns, noting PLTR trades at 102x sales — a level that “remains a debate.”

Grok’s technical analysis noted that RSI had cooled from prior overbought conditions to a neutral 58, with room to run, and identified a likely MACD positive crossover. It also incorporated sentiment analysis from X (Twitter) posts, noting the prevailing hype around PLTR as “the greatest software company” alongside valuation caution from more sober commentators.

Consensus View and Key Takeaways

The Bullish Majority: Five of the six AI chatbots — Claude, Gemini, Perplexity, Copilot, and Grok — predict that PLTR will close higher on February 9 than where it opens on February 3, with upside probabilities ranging from 60% to 72%. The consensus bullish target for the week-end close clusters in the $165–$176 range, representing a 12–19% premium above Friday’s $147.76 close.

The Cautious Contrarian: ChatGPT stands alone as the conservative voice, projecting a notably lower opening price ($148.20 vs. the $163–166 consensus) and a modest close of $153. This appears to stem from a methodological difference: ChatGPT anchored on the pre-market indicated price before the full post-earnings gap-up materialised, while the other five models incorporated the post-earnings pre-market surge into their opening assumptions.

The Most Aggressive Bull: Gemini takes the crown as the most bullish model, with a $176.25 target and just a 10% probability assigned to the bearish case. Its exhaustive 15-page analysis identified more catalysts than any other model, including the government shutdown resolution and the delayed NFP report as tailwinds unique to this particular week.

Key Events to Watch This Week

All six models identified a common set of macro and market events that could significantly influence PLTR’s trajectory:

Methodology and Analytical Observations

Each AI chatbot approached the analysis with distinct strengths and methodological emphases:

What the AI Consensus Tells Us

The overwhelming consensus across six AI chatbots is bullish for PLTR in the week of February 3–9, 2026. Five of six models project the stock will close higher than where it opens, with an average upside probability of approximately 65%. The consensus week-end closing price clusters around $170–$176 (excluding ChatGPT’s outlier projection).

The key areas of agreement include: Palantir’s Q4 2025 earnings represent a genuine fundamental inflection point, with the $920 million guidance beat forcing a structural repricing of the stock. The $170–$175 resistance zone (aligned with the 50-day and 100-day moving averages) is the critical technical battleground for the week. And Friday’s jobs report (or its absence, if delayed by the shutdown) represents the single biggest binary risk to the forecast.

The key area of disagreement centres on the magnitude of the post-earnings move. ChatGPT’s conservative view suggests that the market may have already priced in much of the good news, while Gemini’s aggressive stance implies that the earnings surprise is so large that the repricing will take multiple days to complete.

As always, we at TheDayAfterAI News will track actual market performance against these predictions and publish our scorecard next week. Which AI will prove most prescient? Stay tuned.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.