6 AI Chatbots Predict Alibaba Stock: Who Will Get It Right?

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In an unprecedented experiment, TheDayAfterAI News tasked six leading AI chatbots with the same challenge: predict Alibaba Group Holding Ltd (NYSE: BABA) stock performance for the trading week of December 29, 2025, to January 2, 2026. Each AI was given identical parameters and asked to provide probability assessments, price targets, and supporting analysis.

The results reveal fascinating divergences in how different AI models interpret market data, weigh geopolitical risks, and approach probabilistic forecasting. While all six chatbots analyzed similar technical indicators and macroeconomic factors, their conclusions ranged from cautiously bearish to moderately bullish — demonstrating that even artificial intelligence cannot achieve consensus on market movements.

This comparative analysis offers valuable insights into the current state of AI-powered financial analysis and raises important questions about the reliability and methodology of machine-generated investment guidance.

The AI Contestants

We selected six of the most widely-used AI chatbots currently available to consumers and professionals:

Gemini (Google DeepMind)

Copilot (Microsoft)

Grok (xAI)

Claude (Anthropic)

Perplexity (Perplexity AI)

ChatGPT (OpenAI)

Each AI was prompted with the same request: analyze BABA stock for the 4-trading-day period (noting markets closed January 1 for New Year's Day) and provide opening price estimates, closing price forecasts, probability of increase versus decrease, and expected trading range.

Market Context

Before diving into the predictions, it's important to understand the unique circumstances surrounding this trading period:

Holiday-Thinned Liquidity: The period spans year-end trading with reduced institutional participation, amplifying potential price swings.

Geopolitical Catalyst: China's "Justice Mission 2025" military exercises around Taiwan launched on December 29, creating significant headline risk for Chinese equities.

Technical Positioning: BABA had traded in a $147-$152 range in the preceding sessions, with key support near $145-$147 and resistance at $153-$156.

Macro Data: Key releases included FOMC meeting minutes (Dec 30), China Manufacturing PMI (Dec 31), and the first trading day of 2026 (Jan 2).

The Predictions: Side-by-Side Comparison

The following table summarizes each AI's key predictions:

Gemini: The Geopolitical Hawk

Gemini delivered the most comprehensive geopolitical analysis, producing a 14-page report that heavily weighted the "Justice Mission 2025" military exercises. The AI assigned a 55% probability to a "Bearish Capitulation" scenario, projecting prices between $145.50-$149.25.

Key insight: Gemini introduced the concept of "Max Pain" pinning at $150 — suggesting market makers would work to keep prices near this options strike price to maximize premium decay. This derivatives-focused analysis was unique among the six AIs.

Notable quote: "The trade for the week is not directional but rather volatility-based: selling premium or trading the range."

Copilot: The Technical Optimist

Copilot produced the most bullish outlook, projecting a close near $154 with a 55% probability of net gains. The AI emphasized technical factors: short-term uptrend, supportive moving averages, and bullish options flow.

Key insight: Copilot was notably less concerned about geopolitical risks, instead focusing on the low VIX environment (~13-14) as favorable for equity continuation.

Notable limitation: The opening price estimate of $152.24-$152.28 (prior close) failed to account for pre-market weakness that other AIs captured.

Grok: The Contrarian Bull

Grok assigned the highest upside probability at 60%, citing oversold technical conditions (RSI at 31.97) and a falling wedge pattern that often signals bullish reversal. The AI projected a close at $152.

Key insight: Grok uniquely highlighted Stock Connect outflows ($132M net outflow on Dec 29) as a contrarian indicator, noting that extreme institutional selling often precedes rebounds.

Notable approach: Grok was the only AI to explicitly acknowledge that declining volume during the pullback suggested consolidation rather than capitulation.

Claude: The Cautious Analyst

Claude emerged as the most bearish voice, assigning only a 40% probability of price increase. The AI cited bear flag pattern confirmation, EBITA decline (78% sequential), and new SAMR regulations as headwinds.

Key insight: Claude was the only AI to highlight the AMD MI308 chip deal ($480-600M potential order) as a positive catalyst, though it noted this was insufficient to overcome near-term technical weakness.

Notable quote: "The pre-market weakness of ~3% on Dec 29 suggests the week may start on a challenging note."

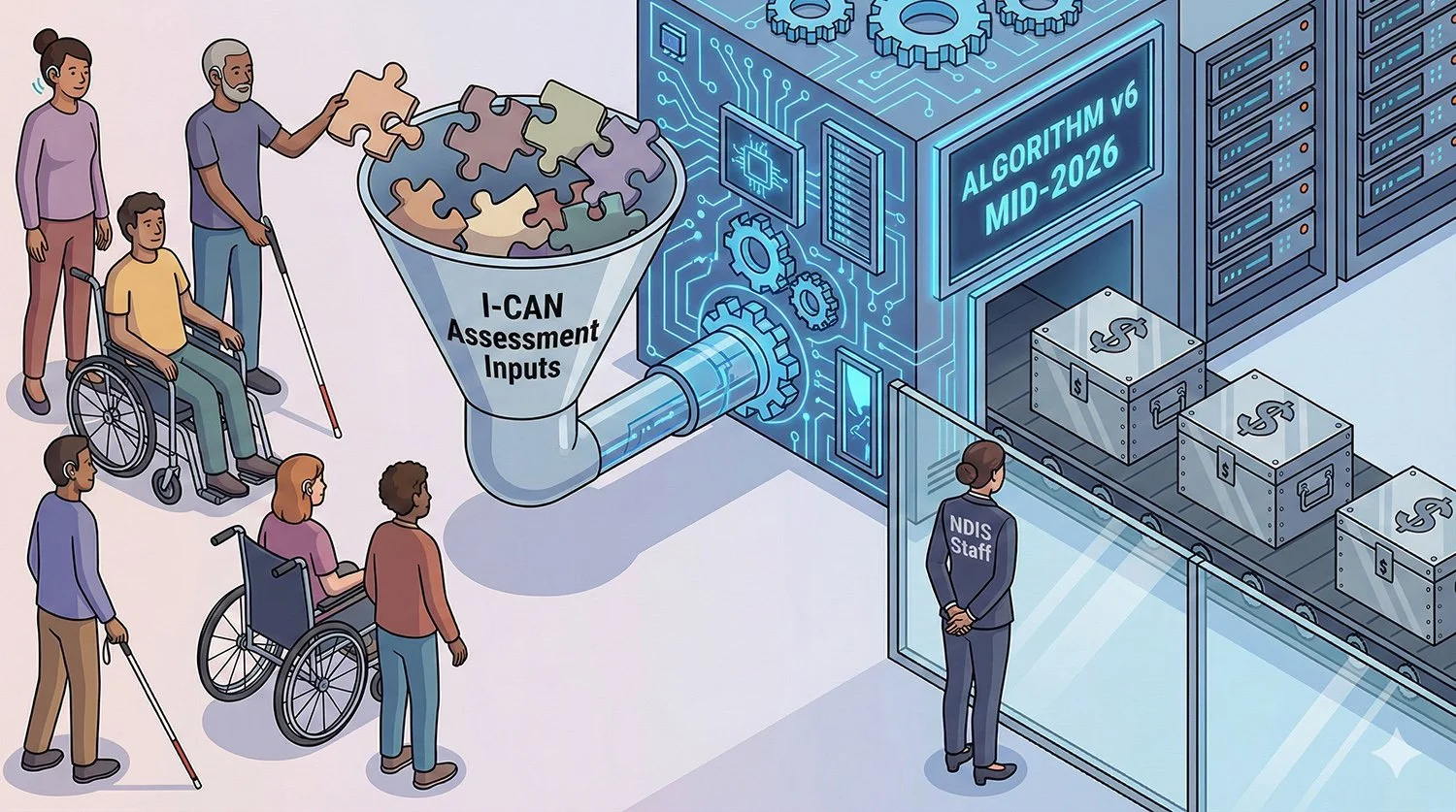

Perplexity: The Probability Engine

Perplexity provided the most granular probability breakdown, segmenting outcomes into five scenarios ranging from "Up 2-4%" (35% probability) to "Down >4%" (5% probability). The AI projected a closing price of $153.40-$154.50.

Key insight: Perplexity explicitly weighted its analysis: technical factors (40%), sentiment/positioning (30%), macro catalysts (20%), and calendar/structural factors (10%) — providing transparency into its reasoning process.

Notable detail: The AI flagged unusual options activity — 3,100 put contracts at the $200 strike — as institutional hedging against upside compression.

ChatGPT: The Balanced Synthesizer

ChatGPT delivered a measured analysis, projecting a modest gain to ~$150.50 with a 55% upside probability. The AI balanced technical support near $147 against resistance at $152-$155.

Key insight: ChatGPT explicitly stated that the gap-down open to $147-$148 positioned the stock near support, statistically favoring mean reversion unless new catalysts emerged.

Notable approach: ChatGPT was the only AI to provide explicit "invalidation" levels: sustained trade below $146.8 would shift odds toward $142-$145, while reclaiming $152 would target $154-$156.

Key Findings and Divergences

Where the AIs Agreed

Support Zone: All six AIs identified the $145-$148 range as critical support.

Resistance Zone: Consensus placed resistance at $152-$156.

Low Liquidity Risk: Every AI noted holiday-thinned trading would amplify volatility.

Mixed Technicals: All recognized conflicting signals between MACD (bullish) and broader trend indicators (bearish).

Where They Diverged

Geopolitical Weighting: Gemini heavily weighted "Justice Mission 2025"; Copilot virtually ignored it.

Opening Price: Estimates ranged from $147.50 (Gemini/Claude) to $152.28 (Copilot) — a $5 spread reflecting different approaches to pre-market data.

Closing Price: Targets ranged from $150 (Gemini) to $154.50 (Perplexity).

Directional Bias: Split 4-2 bullish (Copilot, Grok, Perplexity, ChatGPT) versus bearish (Gemini, Claude).

Methodology Observations

This experiment revealed significant methodological differences among AI systems:

Data Recency: Gemini and Claude incorporated real-time pre-market data; Copilot appeared to rely on prior close prices.

Source Citation: Gemini and Perplexity provided extensive citations (40+ sources); ChatGPT and Copilot offered minimal sourcing.

Analytical Depth: Gemini produced 14 pages of analysis; Copilot delivered 2 pages. Length did not correlate with accuracy.

Risk Acknowledgment: All AIs included disclaimers, but only Claude and Perplexity explicitly quantified downside scenarios.

This comparative analysis demonstrates that AI-powered financial analysis remains highly dependent on each model's training data, real-time information access, and analytical framework. While four of six AIs leaned bullish, the aggregate probability of increase (51.7%) barely exceeds a coin flip — suggesting that even sophisticated AI systems struggle to predict short-term stock movements with high confidence.

For investors, the key takeaway is not which AI to trust, but rather to use these tools as one input among many. The divergence in predictions — from Gemini's bearish capitulation thesis to Grok's contrarian bullishness — illustrates that reasonable analysis can support opposing conclusions.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.