Broadcom Stock Forecast: 5 Top AI Models Predict Recovery

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

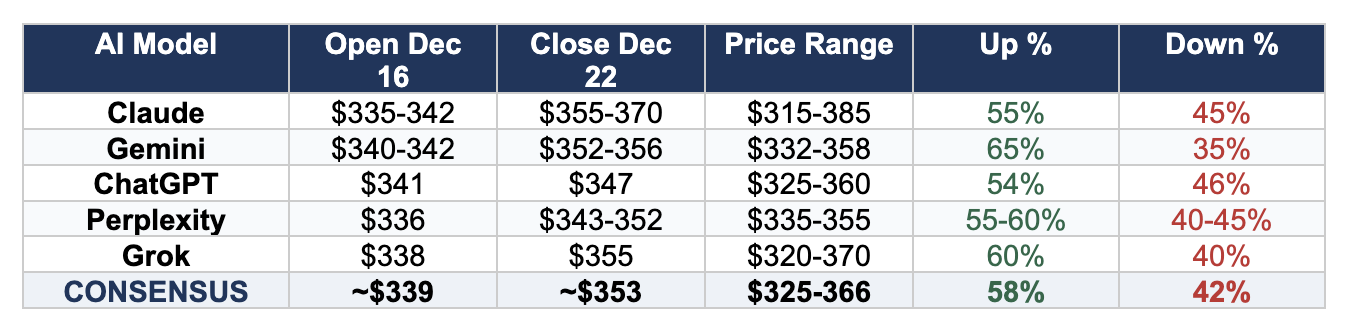

In an unprecedented experiment, TheDayAfterAI News commissioned five leading AI chatbots to independently analyze and forecast Broadcom Inc. (AVGO) stock performance for the upcoming trading week. The results reveal a remarkable consensus: all five models predict the stock will likely recover from its recent post-earnings selloff, with probabilities ranging from 54% to 65% for a net price increase by December 22, 2025.

Broadcom, a semiconductor giant that recently reached a $1.6 trillion market capitalization, experienced dramatic volatility following its Q4 FY2025 earnings release on December 11. Despite beating analyst expectations on both revenue ($18.02B vs. $17.49B expected) and earnings per share ($1.95 vs. $1.86 expected), the stock plummeted approximately 16-17% over three trading sessions, falling from an all-time high of $414.61 to close around $339.81 on December 15.

The Five AI Analysts

We tasked five of the most widely-used AI assistants with the same analytical framework, asking each to provide a comprehensive five-day forecast incorporating technical analysis, fundamental catalysts, market sentiment, macroeconomic factors, and structural considerations. The participating models were:

Claude (Anthropic)

Gemini (Google)

ChatGPT (OpenAI)

Perplexity (Perplexity AI)

Grok (xAI)

Consensus Forecast Summary

Key Findings

Universal Bullish Lean: All five AI models predict a greater-than-50% probability of AVGO finishing the week higher than where it started. The range spans from ChatGPT's conservative 54% to Gemini's optimistic 65%, with an average probability of approximately 58% for upside movement.

Tight Consensus on Opening Price: The models show remarkable agreement on where AVGO will open on December 16, with estimates clustering tightly between $335-$342. This reflects the after-hours trading data available at the time of analysis, with the stock showing modest weakness following December 15's close at $339.81.

Divergent Upside Expectations: While all models agree on the direction, they diverge significantly on magnitude. Claude projects the highest potential closing price at $355-$370 (base case), while ChatGPT takes a more conservative stance at $347. Perplexity splits the difference with $343-$352.

Technical Oversold Consensus: Every model highlighted AVGO's deeply oversold technical condition as a primary catalyst for potential recovery. RSI readings in the 20-37 range (depending on the data source) suggest the stock may be due for mean reversion. Claude specifically noted an RSI of 21.4, while Perplexity cited 33.3—both indicating oversold territory.

Common Catalysts Identified

The AI models converged on several key factors expected to influence AVGO's price action during the forecast period:

Bullish Factors

Oversold Technical Conditions: RSI readings below 30-40 historically precede mean-reversion bounces

$73 Billion AI Backlog: Massive order visibility provides fundamental support

Analyst Price Target Increases: Multiple firms raised targets post-earnings (JPMorgan to $475, UBS to $475)

Dividend Record Date (Dec 22): $0.65 quarterly dividend may attract buyers

Strong Q4 Results: Beat on both EPS ($1.95 vs $1.86) and revenue ($18.02B vs $17.49B)

Bearish Factors

Triple/Quadruple Witching (Dec 19): Options expiration could amplify volatility in either direction

Margin Compression Concerns: AI revenue mix pressuring gross margins

High Valuation: P/E ratio of 70-100x leaves limited room for disappointment

Holiday Liquidity: Thin trading volumes could exaggerate moves

Macroeconomic Data: CPI release (Dec 18) and Fed policy signals remain wildcards

Claude (Anthropic)

Claude provided the most detailed technical analysis, citing specific support ($330-$340) and resistance ($360-$365) levels. The model emphasized the significance of the RSI at 21.4 as 'severely oversold' and offered three probability-weighted scenarios: Bull Case (25% probability, $375-$395), Base Case (50% probability, $350-$375), and Bear Case (25% probability, $310-$340). Claude's analysis was notably comprehensive in addressing risk factors, including customer concentration on hyperscalers and the stock's high beta (2.24).

Gemini (Google)

Gemini emerged as the most bullish model with a 65% probability of price increase. The analysis emphasized the 'capitulation' nature of the recent selloff and the potential for options expiration dynamics to drive a 'dead-cat bounce.' Gemini provided a detailed day-by-day narrative, predicting stabilization on Tuesday, volatility around the Fed decision on Wednesday, and potential 'pinning action' near $350 on Friday due to options expiration.

ChatGPT (OpenAI)

ChatGPT offered the most conservative forecast with a 54% upside probability and a modest closing target of $347. The model uniquely highlighted the ex-dividend adjustment on December 22, noting that price comparisons should account for the ~$0.65 mechanical reduction. ChatGPT's analysis was distinguished by its emphasis on macroeconomic calendar events and their potential to override technical factors.

Perplexity (Perplexity AI)

Perplexity provided the most citation-heavy analysis, referencing 59 external sources ranging from Forbes to SEC filings. The model offered a nuanced 55-60% probability range and emphasized the CPI release on December 18 as the week's most critical event. Perplexity's day-by-day breakdown labeled Thursday as 'CPI Day' with high 'data dependent' volatility potential. The model also included a unique chart visualization showing the stock's recent price trajectory.

Grok (xAI)

Grok balanced optimism with caution, projecting a 60% probability of upside and a closing target of $355. The analysis stood out for its attention to sector dynamics, noting that peers like NVIDIA were oversold +50% YTD while AMD and TSM showed strength. Grok also uniquely addressed global market influences, noting Asian indices were down (Nikkei -1.36%, Hang Seng -1.86%) while European markets showed modest gains.

Limitations and Considerations

This comparative analysis comes with important caveats. AI models, regardless of sophistication, cannot predict stock prices with certainty. The consensus presented here reflects pattern recognition and probabilistic reasoning based on historical data, not prescient knowledge of future events.

Additionally, each model may have accessed different data sources and timestamps, leading to slight variations in the baseline figures used for analysis. The 'consensus' figures presented are simple averages and should not be interpreted as a refined ensemble prediction.

Conclusion

The five AI chatbots demonstrate notable agreement that Broadcom stock is more likely to rise than fall during the week of December 16-22, 2025. With an average probability of 58% for upside movement and a consensus closing price around $353, the models collectively suggest a modest recovery from recent oversold conditions.

However, the wide price ranges (spanning nearly $70 in some forecasts) underscore the significant uncertainty surrounding short-term stock movements, particularly for a high-beta stock like AVGO during a week featuring options expiration and macroeconomic data releases.

This experiment illustrates both the promise and limitations of AI-assisted financial analysis. While the models can synthesize vast amounts of data and identify relevant patterns, their forecasts should be viewed as one input among many in any investment decision-making process.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.