AI vs. Market: 6 Models Predict Micron (MU) Stock Trends for Jan 2026

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In this comprehensive analysis, TheDayAfterAI News deployed six leading AI chatbots to forecast the price movement of Micron Technology (NASDAQ: MU) over a critical 5-day trading window. Each AI model was provided identical market data and asked to generate predictions for opening price, closing price, trading range, and probability of price increase.

The consensus among all six AI models is moderately bullish, with upside probabilities ranging from 55% to 70%. This alignment reflects the powerful combination of AI infrastructure demand, memory pricing tailwinds, and strong technical momentum driving Micron's stock to all-time highs.

The AI Models Tested

We selected six of the most capable and widely-used AI chatbots currently available, each bringing different training data, reasoning approaches, and analytical frameworks to the task:

Claude: Anthropic's advanced AI assistant, known for nuanced analysis and balanced perspectives

ChatGPT: OpenAI's flagship conversational AI with comprehensive financial analysis capabilities

Grok: xAI's real-time AI with access to current X (Twitter) data and market sentiment

Perplexity: AI-powered search engine with real-time web access and citation-backed analysis

Copilot: Microsoft's AI assistant integrated with Bing search and financial data services

Gemini: Google's multimodal AI with deep integration to Google Search and financial databases

Prediction Comparison

The following table presents a side-by-side comparison of all six AI models' predictions for Micron Technology stock from January 28 to February 3, 2026:

Points of Agreement

Despite using different analytical frameworks and data sources, the six AI models demonstrated remarkable consensus on several key points:

Bullish Bias: All six models predict a positive return over the 5-day period, with probability of upside ranging from 55% (Claude) to 70% (Gemini). This unanimous bullish stance reflects the powerful tailwinds from AI infrastructure spending.

Overbought Conditions: Every model flagged technical overbought signals (RSI above 70-80) but concluded these conditions do not negate the bullish trend in momentum-driven semiconductor rallies.

Support at $400: All models identified the $400 psychological level as critical support, with most noting it as an options gamma wall that would provide buying pressure on any dips.

FOMC as Key Catalyst: All models highlighted the January 28 Federal Reserve decision as the dominant macro catalyst, with consensus expecting a rate hold and focus on Powell's forward guidance.

AI/Memory Supercycle: Every model cited Micron's exposure to AI-driven memory demand (particularly HBM) as the fundamental driver justifying elevated valuations and continued price appreciation.

Points of Divergence

While agreeing on direction, the models showed notable differences in magnitude and confidence:

Price Targets: Closing price predictions ranged from $423 (Perplexity) to $440 (Grok), a spread of $17 or approximately 4%. This reflects differing views on how quickly the market will digest overbought conditions.

Confidence Levels: Claude expressed the most caution with 55% upside probability, while Gemini was most bullish at 70%. This 15-point spread suggests different weighting of technical versus fundamental factors.

Trading Range Width: Perplexity projected the tightest range ($407-$432, 6% width) while Copilot expected the widest ($400-$465, 16% width), reflecting different volatility assumptions.

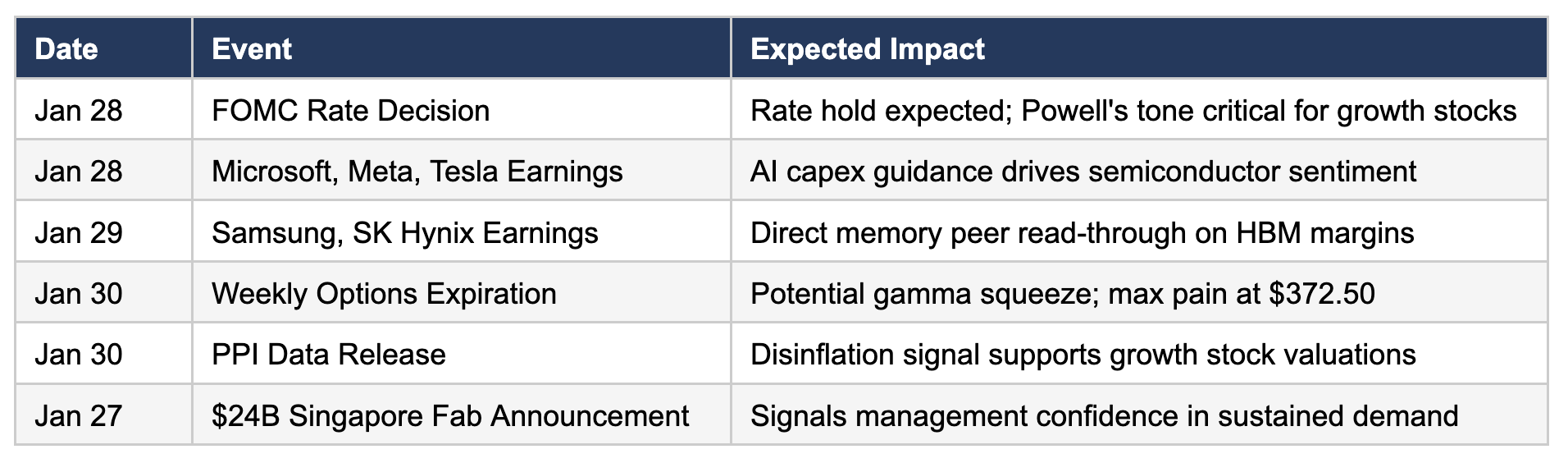

Key Catalysts Identified

The AI models collectively identified several critical events and factors that would drive price action during the forecast period:

Risk Factors

The AI models collectively identified several scenarios that could derail the bullish forecast:

Hawkish Fed Surprise: If Powell signals rates need to stay higher for longer, growth stocks would face immediate selling pressure.

Sell-the-News Reaction: The Singapore fab announcement may already be priced in; profit-taking could emerge after the initial gap up.

Technical Exhaustion: Extreme overbought conditions (RSI near 80) increase the probability of a sharp pullback, particularly if macro catalysts disappoint.

Broader Market Correction: Month-end rebalancing flows and any rotation out of high-beta tech could drag MU lower regardless of company-specific factors.

Conclusion

The convergence of six independent AI models on a moderately bullish outlook for Micron Technology demonstrates the power of consensus analysis in navigating uncertain markets. While individual predictions varied in magnitude and confidence, the unanimous agreement on direction—supported by compelling fundamental tailwinds from the AI infrastructure boom—provides valuable insight into market sentiment.

As TheDayAfterAI News continues this experimental series, we will track the accuracy of these predictions against actual market outcomes. The goal is not to provide trading recommendations but to explore the capabilities and limitations of AI-powered financial analysis in real-world conditions.

Stay tuned for our follow-up article comparing these predictions to actual results after February 3, 2026.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.