Baidu Stock Forecast: 6 AI Chatbots Predict Jan 2026 Trends

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In a groundbreaking experiment, TheDayAfterAI News tasked six of the world's leading AI chatbots with predicting the stock price movement of Baidu Inc. (NASDAQ: BIDU) for the first trading week of 2026. This analysis comes at a pivotal moment: on January 1, 2026, Baidu announced the proposed spin-off and Hong Kong IPO of its AI chip subsidiary, Kunlunxin—a development that sent shockwaves through the market.

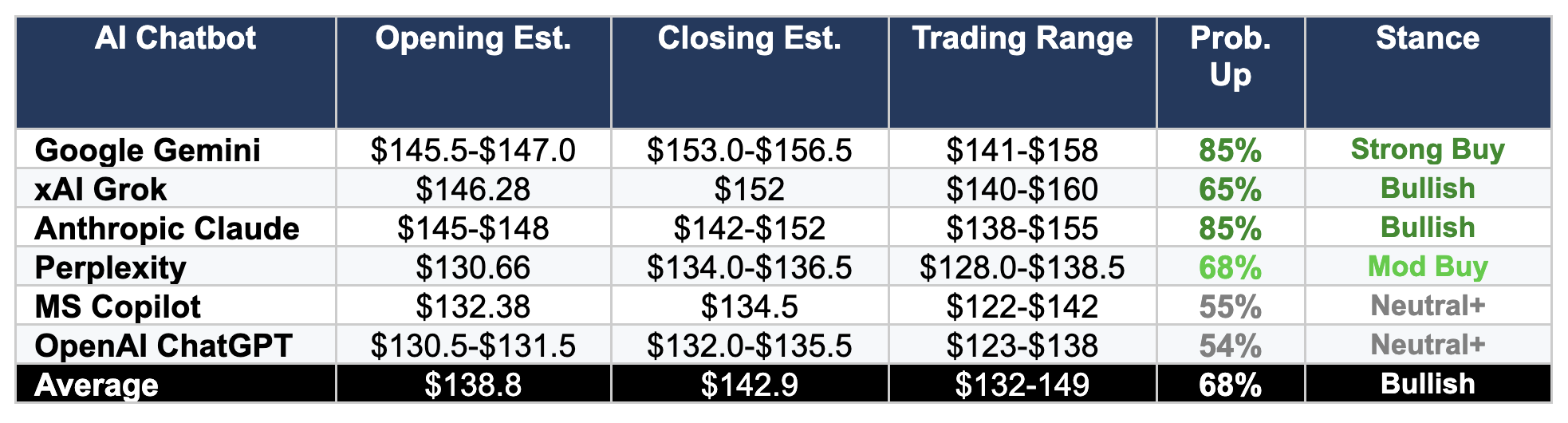

The results reveal fascinating divergences in how different AI systems interpret identical market data, catalyst events, and technical indicators. While all six chatbots agreed on a bullish outlook, their price targets and confidence levels varied dramatically—from conservative estimates of 54% probability of gains to aggressive 85% confidence calls.

The Catalyst: Kunlunxin IPO Announcement

On January 1, 2026, Baidu announced that its AI chip subsidiary Kunlunxin had confidentially filed for a Hong Kong IPO. This transformative corporate action serves as the primary catalyst driving the analysis period. Key implications include:

Value Unlock: Kunlunxin was valued at approximately $3 billion in recent funding rounds, but analysts estimate the public market valuation could reach $16-23 billion

Strategic Positioning: The spin-off positions Baidu as a key player in China's semiconductor self-reliance initiative amid US export restrictions

Market Response: Hong Kong-listed shares surged 7.5% on January 1, signaling strong institutional appetite

Head-to-Head Comparison: Key Predictions

The following table summarizes each chatbot's key predictions for BIDU during the January 2-8, 2026 forecast period:

Google Gemini: The Most Bullish

Gemini delivered the most aggressive forecast, recommending a Strong Buy / Overweight position with 85% confidence in price appreciation. The analysis centered on three pillars: fundamental re-rating through the Kunlunxin spinoff, a technical breakout from an inverse head-and-shoulders pattern, and favorable macro-sector rotation into Chinese equities.

Gemini's sum-of-the-parts (SOTP) analysis was particularly detailed, calculating a fair value of approximately $184 per share—representing over 40% upside from current levels. The model argued that the market was assigning 'near-zero value' to Baidu's Kunlunxin stake, treating it as a 'free option.' The chatbot also incorporated options market dynamics, noting that the stock trading $20 above the 'Max Pain' level of $126 would trigger aggressive delta-hedging by market makers.

"The discrepancy between the current share price (~$130) and the sum-of-the-parts value (~$184), combined with the immediate gamma squeeze potential, creates a highly asymmetric upside opportunity."

xAI Grok: The Technical Analyst

Grok provided a technically-focused analysis with 65% probability of gains, emphasizing the 11.95% gap-up from December 31 as confirmation of strong buying interest. The analysis highlighted a multi-year basing pattern since 2022 lows near $74 and identified the January 2 move as the resolution of a falling wedge breakout.

Notably, Grok paid significant attention to momentum indicators, noting that RSI had jumped to approximately 75 (overbought) following the news—a level it described as indicating 'strong momentum but risk of a pullback.' The analysis also incorporated unusual options activity, citing a $3 million bet on $160 strike calls as evidence of institutional confidence.

Anthropic Claude: The Balanced Bull

Claude matched Gemini's 85% probability assessment but offered a more measured price range, estimating a closing price between $142 and $152. The analysis emphasized catalyst quality, noting that the Kunlunxin IPO represents 'a concrete corporate action, not rumors.'

Claude's technical framework identified key resistance at the 52-week high of $149.51 and psychological resistance at $155, while noting that RSI had room to run before becoming overbought. The analysis cautioned about gap-up risk, acknowledging that a 12% pre-market surge 'may invite profit-taking and consolidation.'

Perplexity: The Methodical Moderate

Perplexity took a more conservative stance with 68% probability of gains, using the December 31 close of $130.66 as its opening reference rather than incorporating pre-market activity. This methodological choice resulted in significantly lower price targets.

The analysis provided detailed day-by-day forecasts and probability breakdowns, estimating a 45% chance of reaching primary resistance at $136.10 and only 15% probability of breaking through $140. Perplexity emphasized the 57.7% year-to-date rally as a potential headwind, noting 'valuation concerns exist' that could trigger profit-taking.

Microsoft Copilot: The Cautious Optimist

Copilot delivered the most conservative forecast among the group, with just 55% probability of gains and a modest $134.50 closing estimate. Uniquely, Copilot did not appear to incorporate the Kunlunxin IPO announcement into its primary analysis, instead focusing on technical momentum and the absence of 'major company catalysts'.

The analysis provided a detailed scenario breakdown: 55% base case (modest continuation), 20% bull case ($139-$142), and 25% bear case ($122-$127). Copilot explicitly acknowledged the thin holiday-week liquidity as a volatility amplifier.

OpenAI ChatGPT: The Conservative Contrarian

ChatGPT produced the most conservative probability estimate at just 54%, barely above a coin flip. Like Perplexity, ChatGPT used the December 31 close as its opening reference, resulting in a narrow expected range of $123-$138.

The analysis acknowledged the Kunlunxin spinoff but appeared to weight the macro calendar more heavily, emphasizing ISM Manufacturing PMI (January 5), ADP Employment (January 7), and pre-positioning for the January 9 Non-Farm Payrolls report. ChatGPT characterized the directional edge as 'small because trend strength is moderate and the week contains multiple macro risk events'.

Key Divergences: Why the Chatbots Disagreed

Opening Price Methodology: The most significant divergence stemmed from how each chatbot handled the gap-up opening. Gemini, Grok, and Claude incorporated pre-market activity showing BIDU trading at $145-$147, while ChatGPT, Perplexity, and Copilot used the December 31 close of $130.66 as their reference point. This methodological difference alone accounts for approximately $15 in divergent base prices.

Catalyst Weighting: Gemini and Claude assigned transformative significance to the Kunlunxin IPO, treating it as a once-in-a-decade value crystallization event. ChatGPT and Copilot appeared to weight macro calendar risks (ISM, ADP, NFP) more heavily, resulting in more cautious assessments. Grok and Perplexity fell in between, acknowledging the catalyst but maintaining technical discipline.

Sum-of-the-Parts Valuation: Gemini was alone in providing a detailed SOTP framework, calculating $184 fair value and arguing the market was pricing Kunlunxin at 'near-zero'. Other chatbots either omitted this analysis or referenced analyst targets without independent calculation. This methodological choice drove Gemini's outlier bullishness.

Options Market Dynamics: Only Gemini and Grok incorporated detailed options flow analysis, including gamma squeeze mechanics and Max Pain theory. This additional layer of market microstructure analysis supported more aggressive upside targets. ChatGPT, Perplexity, and Copilot largely omitted this dimension.

What This Experiment Reveals

This head-to-head comparison demonstrates both the capabilities and limitations of AI-powered stock analysis. Several key observations emerge:

Directional Consensus: All six chatbots agreed on a bullish directional bias, though confidence levels ranged from 54% to 85%. This unanimous directional call suggests the Kunlunxin catalyst was genuinely significant.

Methodological Diversity: The wide range of price targets ($132-$157 closing estimates) reflects different analytical frameworks. Chatbots that incorporated pre-market data, SOTP valuation, and options dynamics produced more aggressive targets.

Risk Calibration: Conservative chatbots (ChatGPT, Copilot) weighted macro risks more heavily, while aggressive ones (Gemini, Claude) focused on the catalyst's transformative potential. Neither approach is inherently superior—they reflect different risk tolerances.

Information Processing: Gemini demonstrated the most comprehensive analytical framework, incorporating SOTP valuation, technical analysis, options mechanics, and macro factors. This holistic approach produced the most detailed (if aggressive) forecast.

For Investors

The consensus across six leading AI chatbots suggests that BIDU's risk-reward profile tilts bullish for the January 2-8 period. However, the wide range of price targets underscores the inherent uncertainty in short-term forecasting. Investors should note that:

The Kunlunxin IPO represents a genuine fundamental catalyst with potential for significant value crystallization

Technical indicators broadly support short-term momentum, though overbought conditions warrant caution

Macro calendar events (ISM, ADP, NFP positioning) could introduce volatility

AI chatbot predictions should complement—not replace—independent research and professional financial advice

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.