Battle of the AIs: 6 Chatbots Predict AMD Stock Price

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

At TheDayAfterAI News, we believe in putting AI to the test — not just reporting on it. In this instalment of our AI Chatbot Stock Prediction Series, we tasked six of the most widely used AI chatbots with the same challenge: analyse AMD (Advanced Micro Devices, NASDAQ: AMD) and predict its stock price movement over the next five trading days, from Wednesday, February 4 to Tuesday, February 10, 2026.

Each chatbot was given access to the same market context — AMD’s Q4 2025 earnings release on February 3, pre-market trading data, technical indicators, options positioning, macroeconomic factors, and analyst sentiment — and asked to deliver a structured prediction including opening price, closing price, probability assessments, price range, and scenario analysis.

The six AI chatbots evaluated are: Perplexity, Claude (Anthropic), Gemini (Google), Copilot (Microsoft), ChatGPT (OpenAI), and Grok (xAI). What follows is a comprehensive comparison of their predictions, methodologies, and where they agree — and diverge.

Market Context: Why AMD, Why Now?

AMD reported its Q4 2025 earnings after the market close on February 3, 2026, delivering results that beat Wall Street expectations on virtually every metric. Revenue came in at US$10.27 billion (up 34% year-over-year), EPS hit US$1.53 (versus the US$1.32 consensus), and the Data Centre segment posted record performance with 39% year-over-year growth. Free cash flow reached a record US$2.1 billion.

However, despite the strong beat, AMD’s stock suffered a dramatic after-hours sell-off of approximately 6–9%, with pre-market trading on February 4 indicating an opening around US$218–225. The sell-off was driven by several factors: Q1 2026 guidance implied a sequential revenue decline of approximately 5%, concerns over the quality of Q4 revenue (approximately US$390 million came from non-recurring China MI308 chip sales), and the broader market’s demand for exponential — not merely strong — growth from AI-exposed names.

This created a fascinating test case for AI prediction: a stock with stellar fundamentals experiencing intense short-term selling pressure, layered with options expiration dynamics, a partial US government shutdown delaying the jobs report, and major tech earnings (Alphabet, Amazon) landing mid-week.

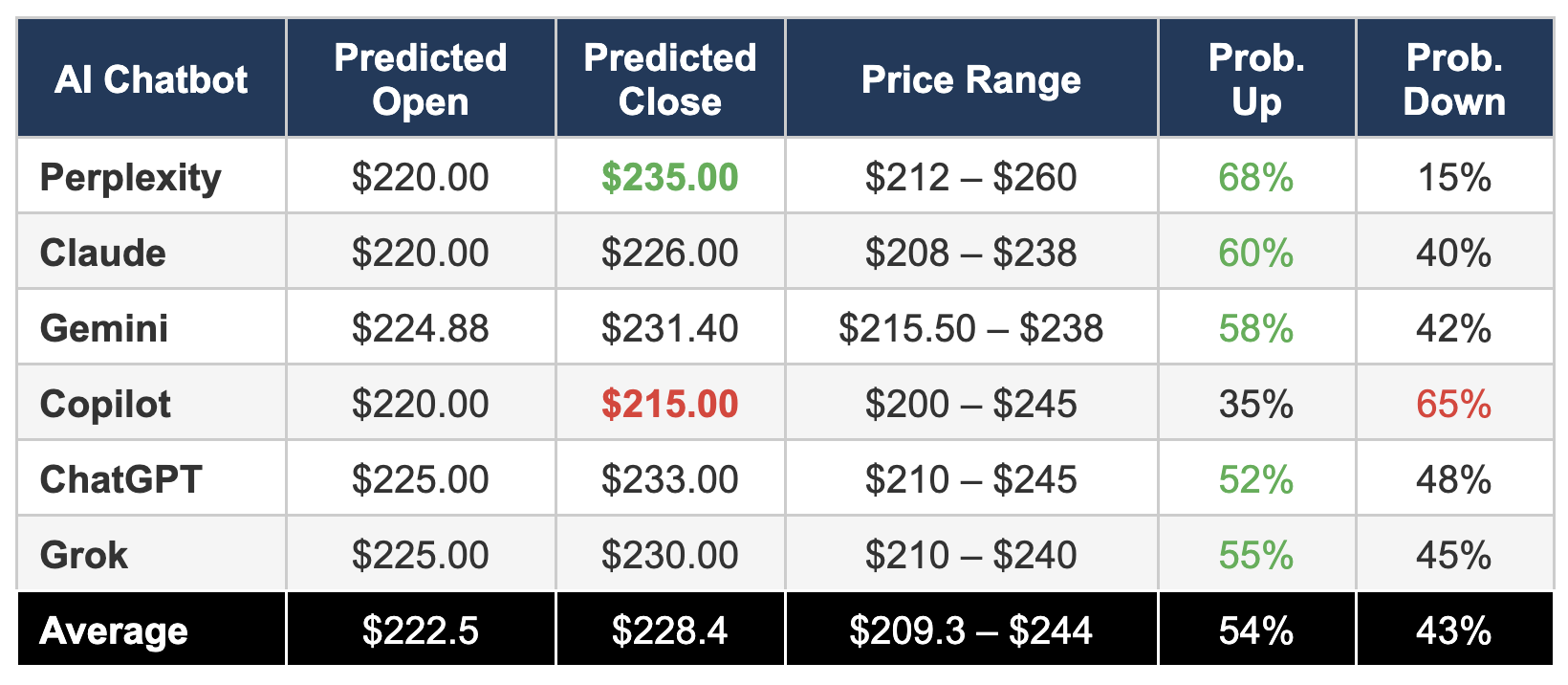

Head-to-Head: The Predictions at a Glance

The table below summarises the core predictions from all six AI chatbots. All figures are in US dollars unless otherwise noted.

Individual Chatbot Analysis

1. Perplexity — The Most Bullish Outlier

Prediction: Open US$220 → Close US$235 (+6.82%) | 68% probability of increase

Perplexity delivered the most optimistic forecast of the group, projecting a robust recovery to US$235 by February 10. Its analysis characterised the technical setup as “overwhelmingly bullish,” citing all seven key momentum indicators (RSI, MACD, Stochastics, ROC, put/call ratio, momentum score, and the Golden Cross trend confirmation) as supportive of upside.

The report emphasised bullish options flow with a put/call ratio of 0.39, strong call dominance near the US$217.50 strike, and a shift in whale activity from 62.4% bearish to 46% bullish. Perplexity assigned the widest price range of any chatbot (US$212–US$260) and provided a detailed three-scenario framework: Bear Case (20%, close US$212), Base Case (60%, close US$235), and Bull Case (20%, close US$258).

Perplexity’s day-by-day breakdown projected a gradual staircase recovery from US$221 on Wednesday to US$238 on Friday (driven by weekly options pinning at US$245), before settling at US$235 by Tuesday. The analysis also included specific trading strategy recommendations across conservative, moderate, and aggressive entry approaches.

Strengths: Comprehensive technical coverage, detailed scenario analysis with clear probability weightings, actionable trading strategies, and extensive source citations.

Weaknesses: Arguably the most aggressive outlook, potentially underweighting the significance of the post-earnings sell-off and the sequential revenue decline concerns. The wide price range (US$48 spread) may reduce actionability.

2. Claude (Anthropic) — The Measured Moderate

Prediction: Open US$220 → Close US$226 (+2.73%) | 60% probability of increase

Claude produced a notably cautious analysis relative to its directional call. While projecting a 60% probability of upside, the expected closing price of US$226 implies only a modest US$6 recovery — the second-smallest gain among the bullish predictions. This reflects Claude’s emphasis on the “quality of earnings” concern and the sequential revenue deceleration.

The analysis stood out for its granular earnings dissection, particularly highlighting that US$390 million of Q4 revenue came from non-recurring China MI308 sales (dropping to US$100 million in Q1), which materially reduced the organic beat when adjusted. Claude also provided detailed analyst price targets from six major firms, noting the consensus Strong Buy rating with an average target of US$286–289 (approximately 30% upside from the expected open).

Claude identified Alphabet and Amazon earnings as the most important external catalysts for the week, the delayed jobs report due to the government shutdown, and the Kevin Warsh Fed Chair nomination as additional sentiment factors. The day-by-day pathway showed a base case of gradual recovery from US$215–228 on Wednesday to US$216–234 by Tuesday.

Strengths: Excellent earnings quality analysis, strong catalyst identification (Alphabet/Amazon as key drivers), detailed analyst consensus data, and realistic probability assessment.

Weaknesses: Relatively conservative price target given the fundamental strength acknowledged in the report. Less technical depth compared to Perplexity or Gemini.

3. Gemini (Google) — The Academic Deep-Diver

Prediction: Open US$224.88 → Close US$231.40 (+2.90%) | 58% probability of increase

Gemini delivered the most academically rigorous analysis of the group, reading more like institutional equity research than a chatbot prediction. The report introduced sophisticated concepts including negative gamma exposure mechanics, the distinction between “linear versus exponential” growth expectations, and the “data blindness” risk created by the government shutdown’s suppression of the January jobs report.

Notably, Gemini was the only chatbot to explicitly identify the 200-day moving average (at US$228.81) as a critical reclaim level, framing it as the demarcation line between long-term bull and bear market structures. The analysis also uniquely highlighted the role of CTA (Commodity Trading Advisor) automated selling triggered by the MA breach, and the “trapped longs” phenomenon creating resistance at the US$228–230 zone.

The probability model was transparent, breaking down directional probability into component weightings: technical oversold condition (+20%), fundamental value support (+15%), macro/shutdown drag (−15%), and negative gamma volatility (−5%), yielding an adjusted 58% upside probability. Gemini predicted a U-shaped recovery pattern rather than a V-shaped bounce.

Strengths: Most sophisticated analytical framework, excellent options microstructure analysis, transparent probability model, and strong institutional-quality reasoning.

Weaknesses: The academic depth may sacrifice accessibility. The opening price prediction of US$224.88 proved slightly high relative to actual pre-market levels.

4. Copilot (Microsoft) — The Lone Bear

Prediction: Open US$220 → Close US$215 (−2.27%) | 35% probability of increase (65% decrease)

Copilot was the only chatbot to predict a net decline over the five-day period, making it the contrarian voice in this exercise. Its analysis was notably more concise than the others, focusing on the dominant short-term catalyst (the post-earnings sell-off and guidance disappointment) as the primary driver.

The report emphasised elevated put activity and weekly options expiration risk on February 6, the modest short interest (2.3% of float, limiting squeeze potential), and the sensitivity of the semiconductor sector to weak macro data prints. Copilot assigned the widest downside in its price range, with a low estimate of US$200 representing a potential 9% decline from the predicted open.

Copilot’s risk framework was straightforward: bullish reversal triggers would require strong analyst upgrades or better-than-expected macro data, while downside would be amplified by weak employment figures or heavy put accumulation into the February 6 expiry. The analysis was the shortest of the six, operating more as a concise trading note than a comprehensive research report.

Strengths: Provided a valuable contrarian perspective, concise and actionable format, realistic about near-term momentum challenges.

Weaknesses: Least detailed analysis of the group, limited technical and fundamental depth, and no day-by-day breakdown or scenario probabilities.

5. ChatGPT (OpenAI) — The Balanced Pragmatist

Prediction: Open US$225 → Close US$233 (+3.56%) | 52% probability of increase

ChatGPT struck the most balanced tone of any chatbot, with a near-coin-flip probability assessment (52% up vs 48% down) that reflected genuine uncertainty about the week’s outcome. The analysis provided a structured day-by-day path projecting an initial flush on Wednesday (low of US$216), stabilisation on Thursday, a volatile Friday driven by the jobs report and options expiry, and a gradual drift higher into Tuesday.

The report provided three clear scenarios: Base Case (50%, close US$228–236), Bull Case (20%, close US$240–248), and Bear Case (30%, close US$214–222). ChatGPT was notably specific about options mechanics, identifying the US$220–225 strike concentration and the dealer hedging dynamics that could amplify intraday swings around the Friday expiry.

ChatGPT uniquely framed the forecast around the tension between gap-down momentum and mean-reversion tendencies, noting that AMD historically tends to see bounces within 1–3 sessions after large post-earnings gaps. The 90% confidence range (US$210–245) was among the wider bands, reflecting appropriate humility about prediction accuracy.

Strengths: Well-calibrated probability assessment, excellent scenario structure, strong day-by-day pathway with clear drivers, and appropriate epistemic humility.

Weaknesses: The near-50/50 probability call, while honest, may be less useful for readers seeking directional conviction.

6. Grok (xAI) — The Sector Contextualist

Prediction: Open US$225 → Close US$230 (+2.22%) | 55% probability of increase

Grok provided a well-rounded analysis that placed particular emphasis on sector dynamics and macroeconomic context. The report included a detailed economic calendar for the February 4–10 period, covering events from MBA mortgage rates to NFIB optimism, and assessed each event’s potential impact on AMD specifically.

Grok’s technical analysis was thorough, covering RSI, MACD, Stochastics, and moving averages, while also incorporating a useful recent price history table showing the intense volatility in AMD’s daily trading over the prior week. The report highlighted the new Section 232 tariffs on advanced logic chips (effective January 15) as potentially beneficial for domestic semiconductor players like AMD — a regulatory angle that other chatbots largely overlooked.

The sentiment analysis was multi-dimensional, incorporating VIX levels, equity put/call ratios, short interest data, social media sentiment from Stocktwits, and key analyst ratings. Grok’s predicted close of US$230 placed it in the middle of the pack, reflecting a cautiously optimistic but not aggressive stance.

Strengths: Excellent macroeconomic integration, comprehensive sentiment analysis, unique regulatory angle (tariffs), and well-structured data presentation.

Weaknesses: Probability assessment (55% up) was among the most non-committal. Some analysis sections felt more like data compilation than original insight.

Key Themes and Points of Agreement

Despite their differing conclusions, the six chatbots showed remarkable convergence on several critical points:

Opening Price Consensus: All six predicted an opening price between US$220 and US$225, reflecting the sharp pre-market decline from the prior close of US$242.11.

Fundamental Strength Acknowledged: Every chatbot recognised that AMD’s Q4 results were objectively strong, with record revenue, earnings beats, and robust Data Centre growth.

China Revenue Quality Concern: Five of six chatbots (all except Copilot, which did not discuss it in detail) identified the US$390 million non-recurring China MI308 sales as a key driver of the sell-off.

Options Expiry Significance: All six highlighted the February 6 weekly options expiration as a critical near-term volatility driver, with most identifying the US$220–225 strike zone as a key battleground.

Alphabet and Amazon as Catalysts: Claude, Gemini, and ChatGPT specifically identified the mid-week earnings reports from Alphabet and Amazon as potentially pivotal for AMD sentiment.

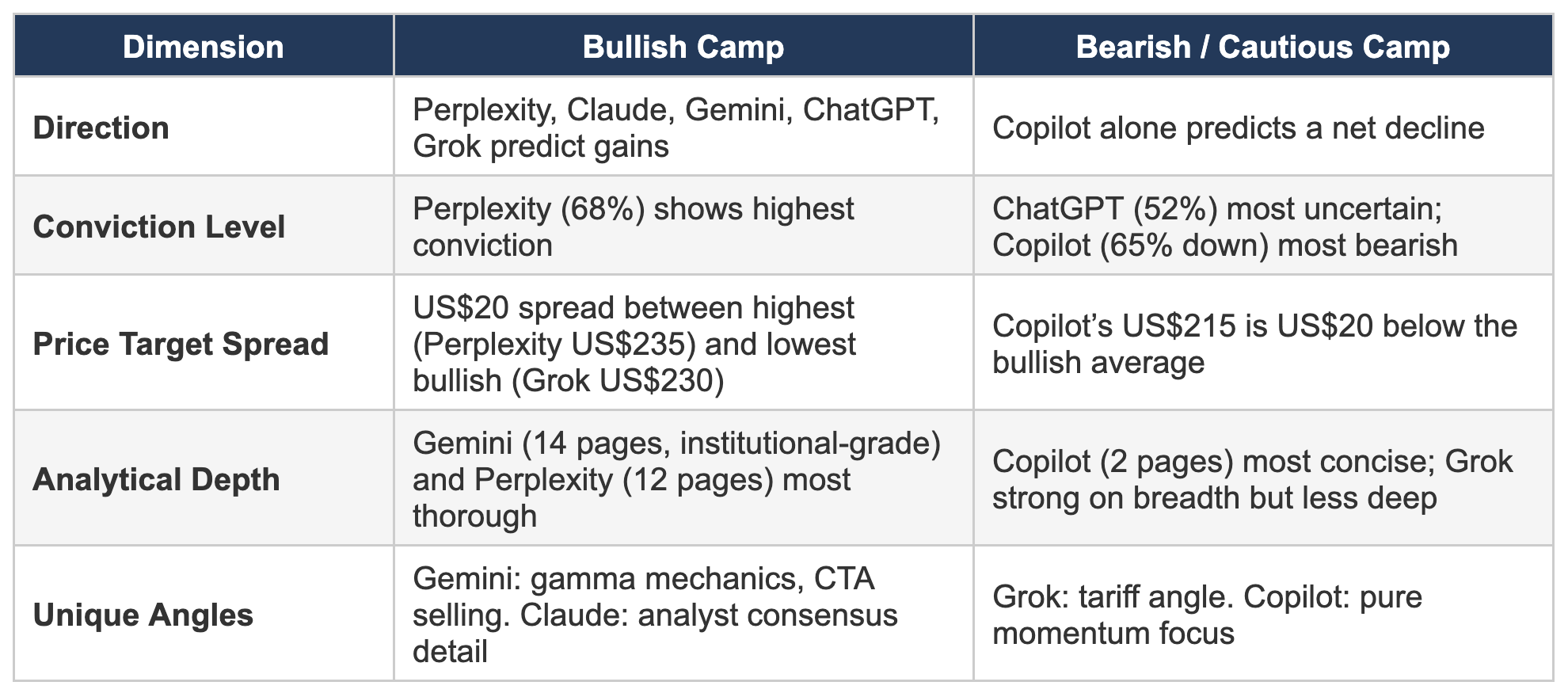

Where the Chatbots Diverge

Methodology Comparison

The analytical approaches varied significantly across the six chatbots, revealing different “personalities” in how each model tackles financial analysis:

Perplexity led with technical analysis and options flow, building its thesis primarily from momentum indicators and positioning data, supported by 71 cited sources.

Claude emphasised earnings quality and catalyst identification, combining fundamental analysis with detailed analyst consensus data to frame a moderate recovery thesis.

Gemini adopted an institutional research approach, integrating derivatives microstructure, macroeconomic overlays, and a transparent probability model with explicit weighting factors.

Copilot took a momentum-driven approach, focusing on the dominant short-term catalyst (the sell-off) and emphasising near-term risk factors over medium-term fundamental support.

ChatGPT balanced technical and fundamental factors with strong scenario planning, providing the most evenly weighted probability assessment and detailed day-by-day pathways.

Grok distinguished itself through sector and macro integration, offering the broadest contextual coverage including regulatory developments, commodity impacts, and geopolitical factors.

What Can We Learn?

This exercise reveals both the promise and the limitations of using AI chatbots for stock price prediction. On the promising side, all six models demonstrated sophisticated analytical capabilities — integrating real-time data, technical analysis, options mechanics, and macroeconomic factors into coherent forecasts. The consensus view (a modest recovery of 2–7% from the post-earnings gap-down) reflects a reasonable synthesis of the available information.

On the cautionary side, the spread between the most bullish (Perplexity at +6.82%) and most bearish (Copilot at −2.27%) predictions highlights the inherent uncertainty in short-term stock forecasting. Five of six chatbots predicted gains while one predicted a decline — a 5-to-1 bullish-to-bearish ratio that itself carries information about how these models tend to weigh strong fundamentals against adverse short-term price action.

Perhaps the most valuable insight is not any single chatbot’s prediction, but the collective picture they paint: AMD’s fundamental story remains intact, the post-earnings sell-off appears at least partially overdone relative to the quality of the results, but meaningful near-term risks (options dynamics, macro data, big tech earnings, and the government shutdown) create a wide range of possible outcomes.

As always, these AI-generated analyses are presented for informational and educational purposes only. They do not constitute investment advice. Past performance of AI predictions is not indicative of future accuracy. Readers should conduct their own due diligence and consult qualified financial advisors before making any investment decisions.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.