META Stock Forecast: 6 AI Chatbots Predict Prices After Q4 Earnings

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In an unprecedented experiment in AI-driven financial analysis, TheDayAfterAI News consulted six leading AI chatbots to forecast Meta Platforms (META) stock performance for the five trading days spanning January 29 to February 4, 2026. Following Meta’s blockbuster Q4 2025 earnings release on January 28 — which exceeded analyst expectations across virtually every metric — we sought to understand how different AI systems interpret the same market data and arrive at their predictions.

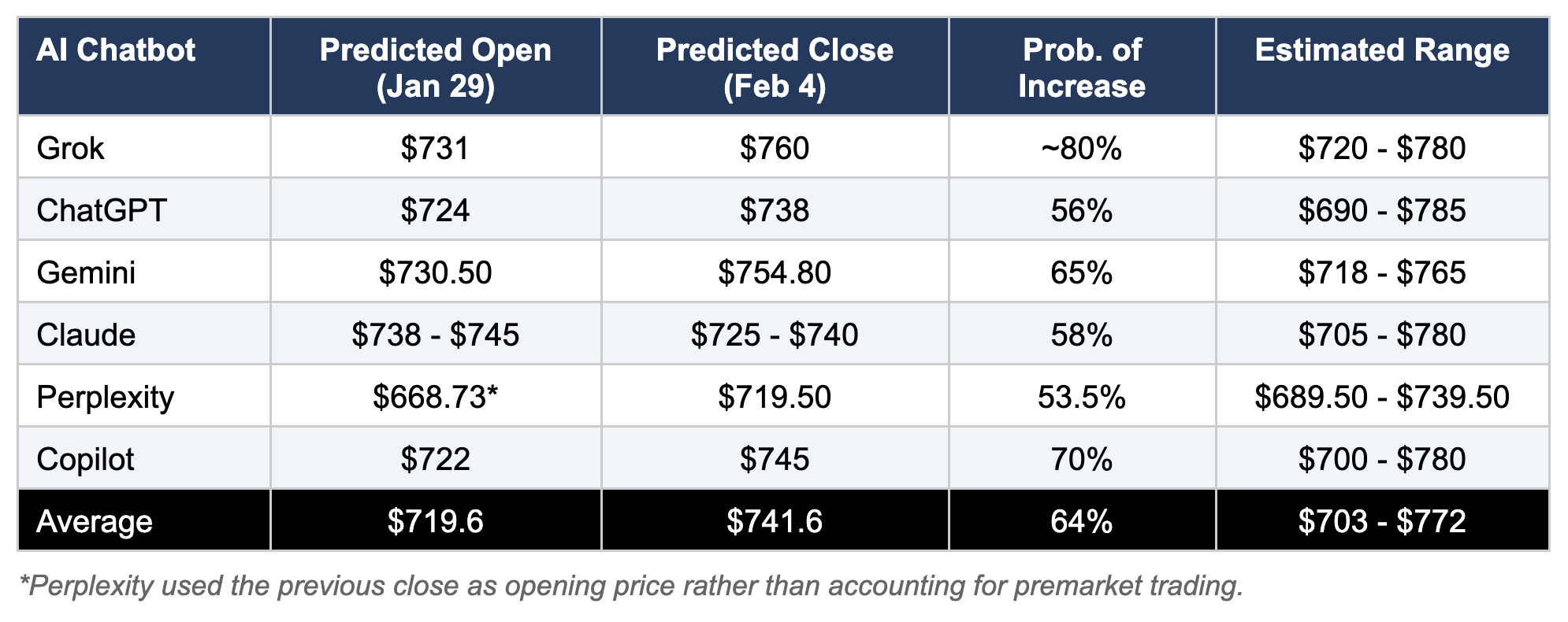

The results reveal a fascinating consensus: all six AI chatbots predict META will end the period higher than the pre-earnings close of $668.73, though they differ notably on magnitude, volatility expectations, and confidence levels. The average probability of a price increase across all models stands at approximately 64%, with predictions for the February 4 closing price ranging from $719.50 to $760.

The AI Participants

We tasked six widely-used AI chatbots with analyzing META’s near-term price trajectory: Grok (by xAI), ChatGPT (OpenAI), Gemini (Google), Claude (Anthropic), Perplexity, and Microsoft Copilot. Each AI was provided identical prompting requesting a comprehensive 5-day forecast incorporating fundamental analysis, technical indicators, market sentiment, options flow, macroeconomic factors, and probability assessments.

Comparative Predictions at a Glance

Key Market Drivers Identified by AI Models

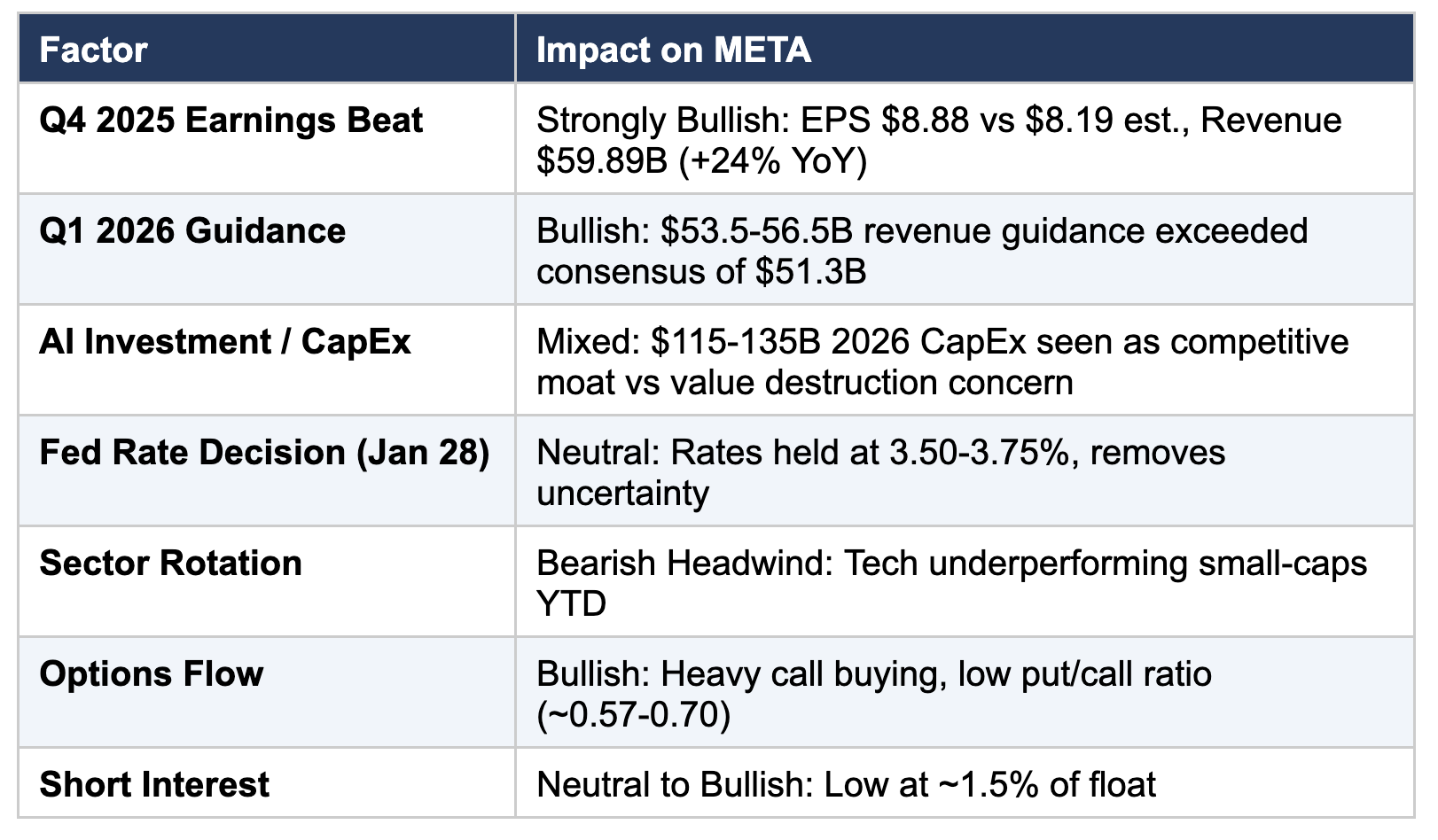

Despite using different analytical frameworks, all six AI chatbots converged on similar fundamental and technical factors driving META’s near-term price action:

Individual Chatbot Analysis Highlights

Grok (xAI) — Most Bullish

Grok delivered the most optimistic forecast, predicting a closing price of $760 with approximately 80% probability of increase. The analysis emphasized the “powerful positive momentum” from Meta’s earnings beat, highlighting the 24% revenue growth and EPS of $8.88 exceeding estimates. Grok noted that analyst consensus remains strongly bullish with a median price target around $840–$850, implying 25–27% upside. Technical indicators including RSI near 70 and bullish MACD crossover supported the upward trajectory, though Grok cautioned that overbought conditions could temper gains.

ChatGPT (OpenAI) — Cautiously Optimistic

ChatGPT took a more measured approach, projecting a $738 close with only 56% probability of increase. The model noted that while earnings and guidance were strong, the substantial capex guidance of $115–$135 billion could trigger “good news, sell the spend” profit-taking. ChatGPT provided a detailed daily path forecast, expecting initial gap consolidation around $700–$710, followed by gradual appreciation through the week. The analysis highlighted the January 30 weekly options expiration as a key volatility event.

Gemini (Google) — High Confidence Bullish

Gemini produced the most detailed institutional-style research report, forecasting a $754.80 close with 85% confidence and 65% probability of increase versus the opening price. The analysis introduced sophisticated concepts including “Fundamental Repricing Event,” “CapEx FOMO,” and Post-Earnings Announcement Drift (PEAD). Gemini emphasized the “Regime Change” in investor sentiment regarding AI spending, noting that the market now views massive capex as a competitive moat rather than value destruction.

Claude (Anthropic) — Balanced with Capex Concern

Claude’s analysis stood out for its detailed treatment of capex concerns as a potential upside limiter. The model predicted an opening range of $738–$745 but a closing range of $725–$740 — notably lower than the open, suggesting possible profit-taking. With 58% probability of increase, Claude emphasized that “history suggests elevated capex guidance triggers selling.” The analysis provided comprehensive risk factors including sector rotation, Reality Labs losses, and FTC antitrust concerns.

Perplexity — Most Conservative

Perplexity delivered the most conservative forecast with only 53.5% probability of increase. Notably, this was the only model that appeared to use the previous close ($668.73) rather than accounting for pre-market gains in its opening price assumption, which affects comparison with other models. The weighted scenario analysis assigned 40% probability to a bullish case ($745 close), 45% to a base case ($715), and 15% to a bearish scenario ($665). Perplexity emphasized sector rotation headwinds, noting tech stocks have lagged small-caps YTD.

Microsoft Copilot — Confidently Bullish

Copilot projected a $745 close with 70% probability of increase — the second-highest confidence level among the six models. The analysis highlighted heavy bullish options flow, including multi-million dollar call sweeps at $700+ strikes, as strong evidence of institutional bullish positioning. Copilot’s trading range of $700–$780 aligned closely with other models, and the analysis provided actionable risk management guidance for both long and short positions.

Where the AI Models Agree

Bullish Post-Earnings Sentiment: All six models interpreted Meta’s Q4 2025 earnings as a significant positive catalyst, with the revenue beat (+24% YoY), EPS surprise ($8.88 vs. $8.19), and strong Q1 2026 guidance driving initial momentum.

Technical Support Above $700: Every model identified the $700–$720 zone as key support, with the earnings gap expected to hold throughout the forecast period. Gap fill probability was universally assessed as low.

Capex as Double-Edged Sword: While interpretations varied in degree, all models acknowledged the $115–$135 billion capex guidance as a pivotal factor that could either cement META’s AI leadership or concern value-focused investors.

Options Flow Supports Upside: All models that analyzed options positioning noted bullish call activity and favorable put/call ratios, suggesting institutional positioning favors continued gains.

Where the AI Models Diverge

Probability Assessments: The range of increase probabilities spans from 53.5% (Perplexity) to approximately 80% (Grok) — a 27% point spread that reflects fundamental differences in how each model weighs bullish catalysts against risk factors.

Capex Interpretation: Gemini views the massive AI spending as triggering “CapEx FOMO” and a “Regime Change” in investor sentiment (bullish), while Claude and Perplexity emphasize historical patterns where elevated capex triggers selling (bearish).

Price Target Magnitude: Closing price predictions range from $719.50 (Perplexity) to $760 (Grok) — a 5.6% spread that has meaningful implications for trading strategies.

Conclusion

This comparative analysis demonstrates both the promise and limitations of AI-driven financial forecasting. While all six chatbots arrived at bullish conclusions — correctly interpreting Meta’s strong earnings as a positive catalyst — their probability assessments and price targets varied significantly. The consensus view suggests META will trade in a $700–$780 range during the forecast period, with a 64% average probability of closing higher than the January 29 open.

For investors, the key takeaway is not which AI “wins” but rather the collective intelligence these models provide: identifying consensus views, highlighting key risk factors, and quantifying uncertainty. We will publish a follow-up article after February 4 comparing actual META performance against these AI predictions.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.