Which AI Best Predicted Oracle's Weekly Performance?

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

Last week, TheDayAfterAI News asked five leading AI chatbots — Perplexity, Google Gemini, xAI's Grok, OpenAI's ChatGPT, and Anthropic's Claude — to predict Oracle Corporation (NYSE: ORCL) stock performance for the trading week of December 15–19, 2025. The predictions came at a critical moment: Oracle had just reported mixed Q2 fiscal 2026 earnings that triggered a sharp 13-14% selloff, leaving the stock technically oversold but fundamentally uncertain.

Now that the week has concluded, we evaluate each AI's accuracy across five distinct categories: trend direction, opening price, closing price, weekly low, and weekly high. Following our established methodology, all price errors are calculated as percentage deviations from actual values for meaningful comparison.

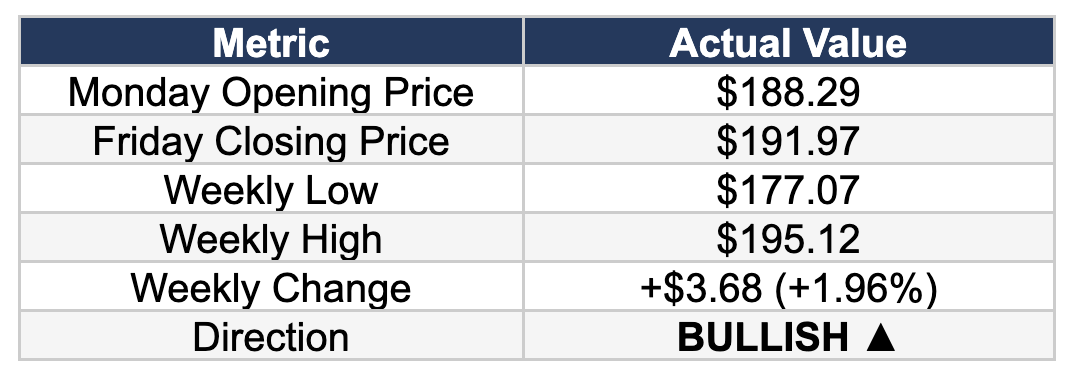

Actual NVDA Performance: December 15–19, 2025

Oracle delivered a surprising recovery week, bouncing from its post-earnings lows despite three of five AIs predicting continued weakness. The stock found support near $177 before rallying to close at $191.97, a gain of nearly 2% from Monday's open.

Category-by-Category Rankings

We evaluated each AI across five categories, using percentage error from actual values. Lower percentage = better accuracy. Points awarded: 1st place = 5 pts, 2nd = 4 pts, 3rd = 3 pts, 4th = 2 pts, 5th = 1 pt.

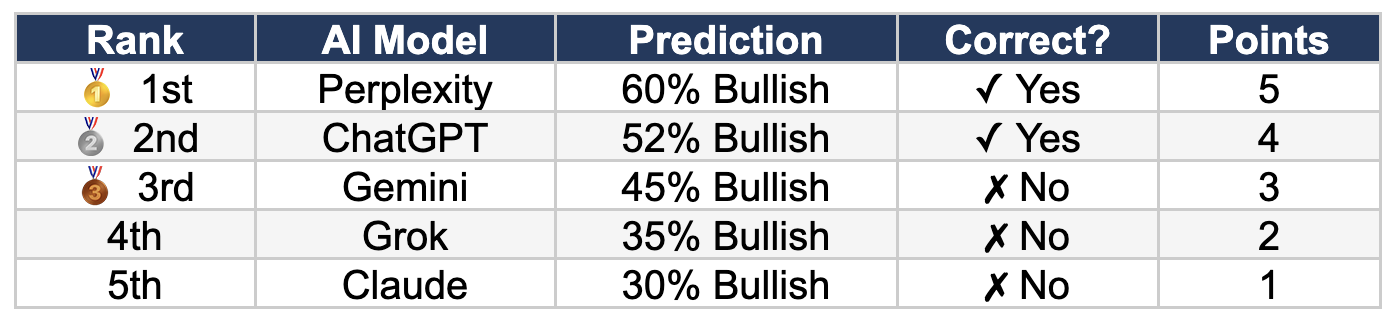

Category 1: Best Trend/Direction Prediction

Actual Result: BULLISH (+1.96% weekly gain)

Winner: Perplexity — Highest confidence (60%) on the correct bullish call.

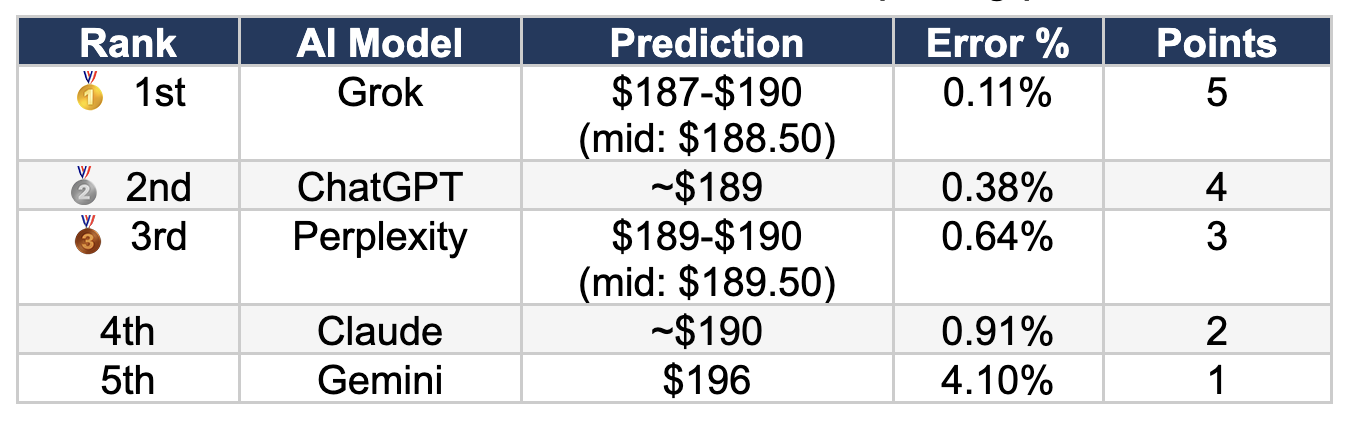

Category 2: Best Opening Price Prediction

Actual Opening Price: $188.29

Winner: Grok — Just 0.11% off the actual opening price.

Category 3: Best Closing Price Prediction

Actual Closing Price: $191.97

Winner: Gemini — Virtually perfect prediction at just 0.02% error—the best single prediction in the experiment!

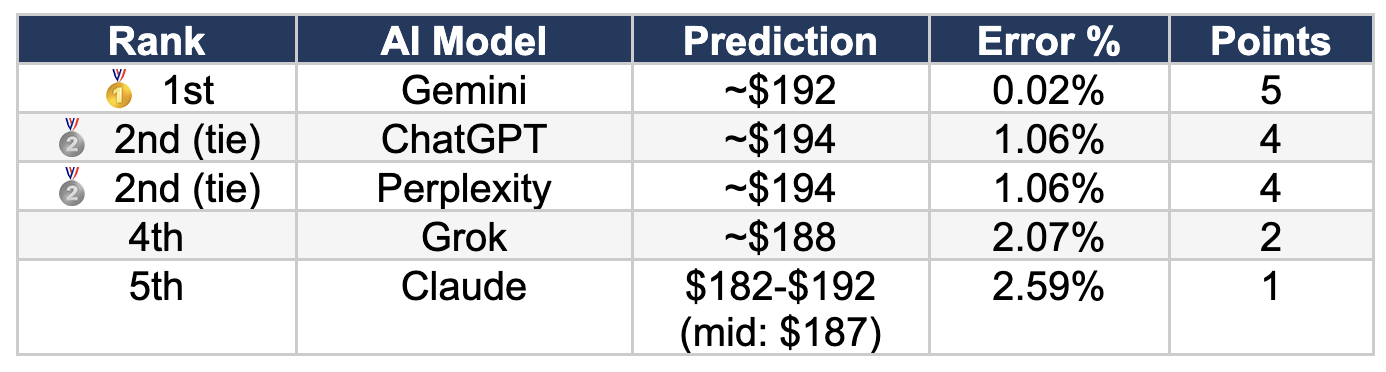

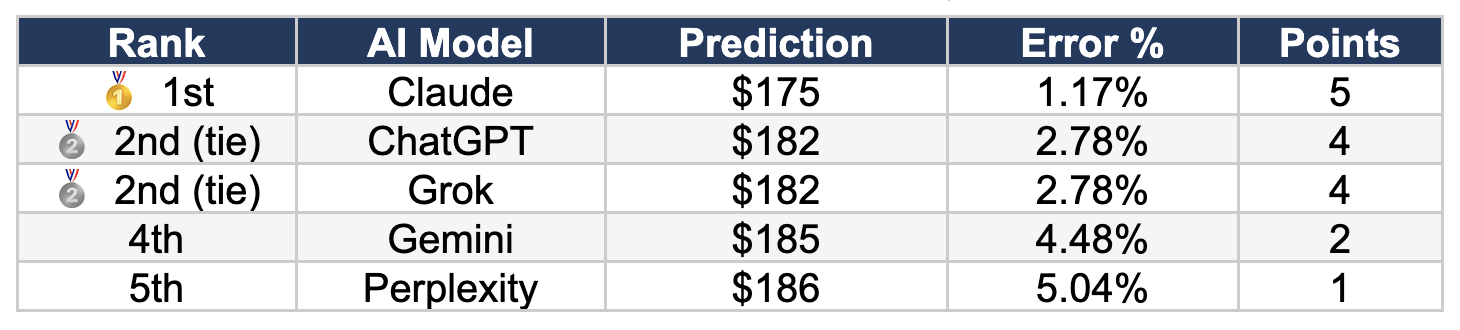

Category 4: Best Weekly Low Prediction

Actual Weekly Low: $177.07

Winner: Claude — Predicted the floor at $175, just 1.17% off the actual low of $177.07.

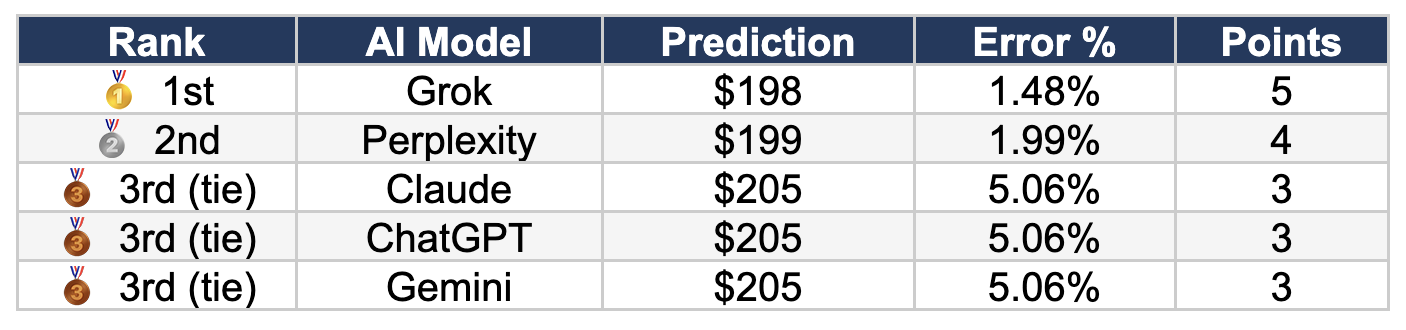

Category 5: Best Weekly High Prediction

Actual Weekly High: $195.12

Winner: Grok — Predicted the ceiling at $198, just 1.48% off the actual high.

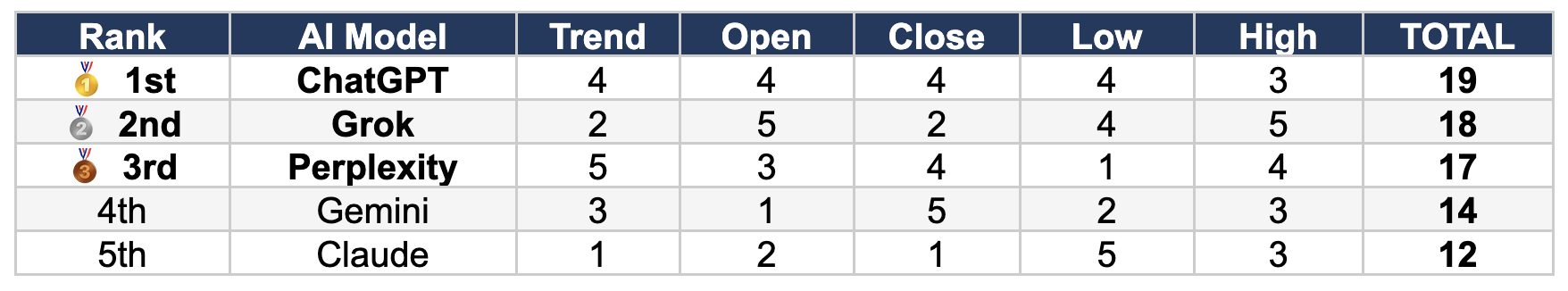

Final Overall Rankings

Based on total points earned across all five categories:

Category Winners at a Glance

Best Trend Prediction: Perplexity (60% bullish confidence — highest and correct)

Best Opening Price: Grok (0.11% error)

Best Closing Price: Gemini (0.02% error — best single prediction!)

Best Weekly Low: Claude (1.17% error)

Best Weekly High: Grok (1.48% error)

Key Takeaways

Why ChatGPT Won Overall: ChatGPT's victory came from exceptional consistency rather than category dominance. While it didn't win any individual category, it placed 2nd or better in four of five categories (Trend, Open, Close, Low). This balanced approach — never finishing worse than 4th place in any category — accumulated 19 points to edge out competitors who had higher highs but also lower lows. ChatGPT's "slight bullish" stance (52%) proved well-calibrated for Oracle's recovery week.

Gemini's Redemption Story: Despite a bearish directional call (45% bullish) that proved incorrect, Gemini produced the single most accurate prediction in the entire experiment: a closing price forecast of $192 that came within 0.02% of the actual $191.97. This remarkable precision demonstrates that even when an AI gets the direction wrong, its technical analysis of price levels can still be highly valuable. Gemini's strength in identifying resistance and support levels continues from previous experiments.

Claude's Downside Accuracy: Claude's widest trading range ($175-$205) proved prescient in one key dimension: its floor prediction of $175 came closest to the actual weekly low of $177.07. This "risk-aware" framework, which Claude has emphasized across multiple experiments, excels at identifying worst-case scenarios. However, Claude's most bearish stance (30% bullish) resulted in last place in the trend category, pulling down its overall score.

Grok's Technical Precision: Grok demonstrated exceptional technical analysis, winning both the opening price (0.11% error) and weekly high (1.48% error) categories. However, its bearish stance (35% bullish) cost it valuable points in trend prediction. Grok's detailed support/resistance analysis continues to produce accurate price level forecasts even when directional calls miss.

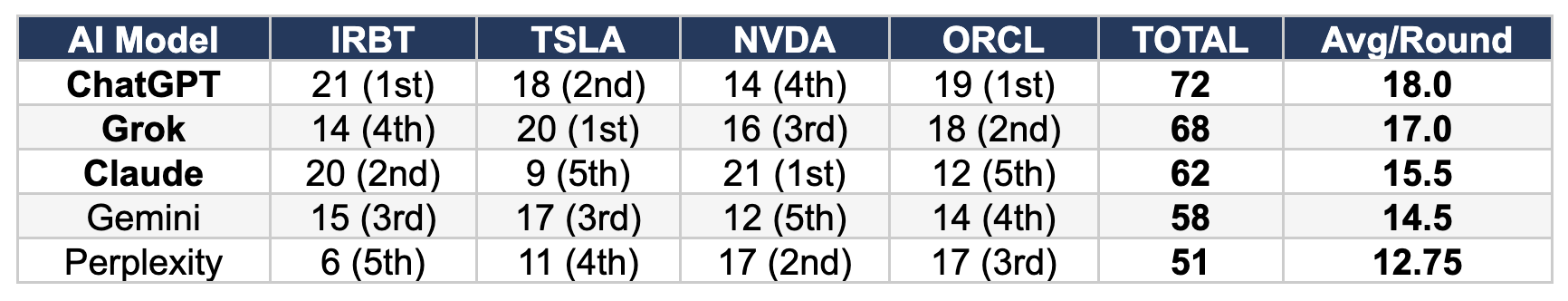

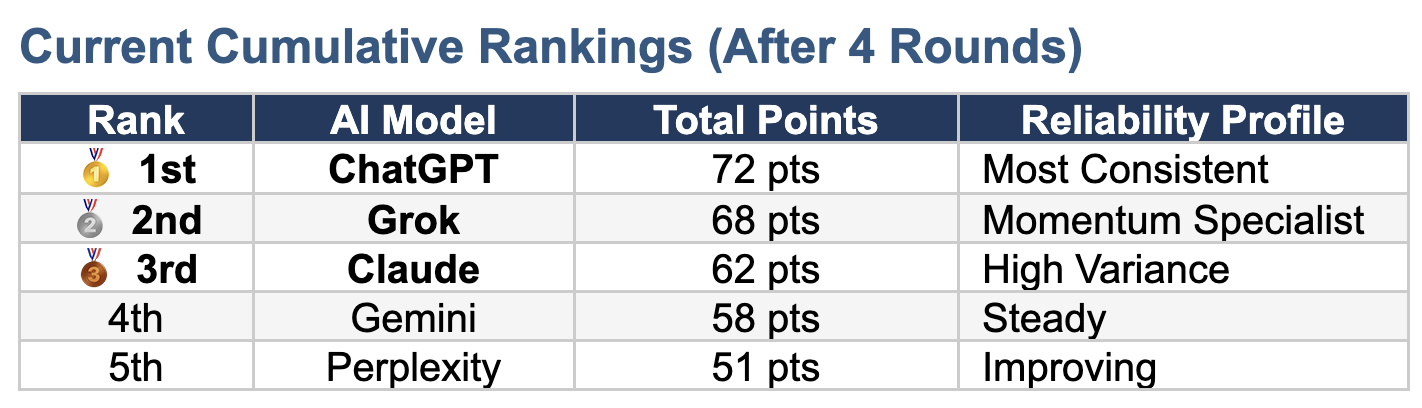

Cumulative Performance: Four Rounds of Testing

With four experiments now complete — iRobot bankruptcy (IRBT), Tesla (TSLA), NVIDIA (NVDA) and Oracle (ORCL) — we can assess which AI chatbots demonstrate the most reliable stock prediction capabilities across different market conditions.

Reliability Assessment: What We've Learned

Most Reliable Overall: ChatGPT (OpenAI)

With 72 cumulative points across four rounds, ChatGPT has established itself as the most dependable AI for stock prediction. Its two first-place finishes (IRBT and ORCL) combined with consistent top-half placements demonstrate an analytical framework that adapts well to different market conditions. ChatGPT's strength lies in balanced predictions that avoid extreme positions.

Best for Momentum Stocks: Grok (xAI)

Grok's win in Tesla and strong second-place finish in ORCL suggest its detailed technical analysis framework excels with high-momentum technology stocks. Its granular support/resistance analysis produces excellent price-level predictions even when directional calls miss.

Highest Upside Potential: Claude (Anthropic)

Claude shows the widest performance variance in our testing—ranging from first place (NVDA) to last place (TSLA, ORCL). When Claude's risk-aware analytical framework aligns with market conditions, it produces exceptional results. However, its conservative bias can result in poor directional calls during recovery rallies. Claude's particular strength lies in identifying downside risks and support levels.

Conclusion

This multi-category analysis reveals that ChatGPT demonstrated superior consistency for Oracle's trading week, winning with 19 points. The one-point margin over second-place Grok (18 points) reflects ChatGPT's balanced approach across all prediction categories.

The Oracle experiment highlighted an important lesson: directional confidence doesn't always translate to overall accuracy. Perplexity had the highest correct confidence (60% bullish) but finished third overall. Meanwhile, Gemini's incorrect bearish call didn't prevent it from producing the single best prediction (0.02% closing price error).

For investors considering AI-assisted analysis, the key insight remains consistent: ensemble approaches — consulting multiple AIs and synthesizing their views — produce better results than relying on any single chatbot. Different AIs continue to excel in different areas, and their collective wisdom often outperforms individual predictions.

TheDayAfterAI News will continue this experiment series with additional stocks to build a comprehensive reliability profile for each chatbot across diverse market conditions and asset types.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.