NVDA Stock Forecast: 6 AI Chatbots Predict Year-End 2025 Price

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

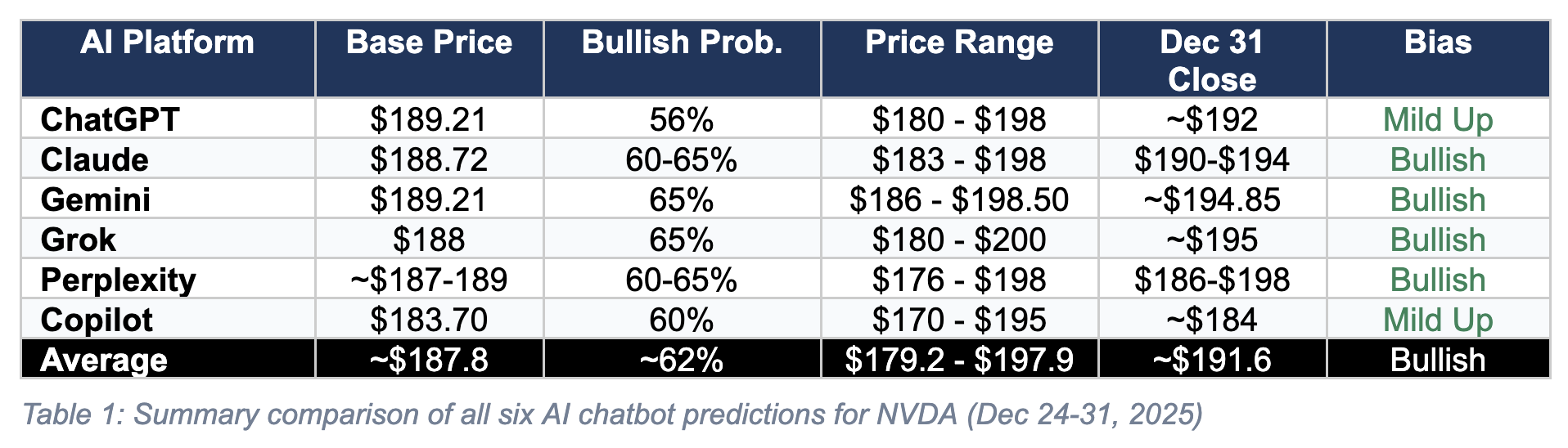

In an unprecedented comparison study, TheDayAfterAI News tasked six leading AI chatbots with the same challenge: predict NVIDIA Corporation's (NVDA) stock price movement over the next five trading days (December 24-31, 2025). Each platform received identical parameters and was asked to provide probability assessments, price ranges, and day-by-day estimates.

The results reveal a remarkable consensus among AI platforms, with all six predicting a bullish bias ranging from 56% to 65% probability of price increase. However, the specific price targets and analytical approaches varied significantly, highlighting both the convergent thinking patterns and unique capabilities of each AI system.

At a Glance: Prediction Summary

Key Findings

Unanimous Bullish Consensus: All six AI platforms predicted a higher probability of price increase than decrease, with bullish probabilities ranging from 56% (ChatGPT) to 65% (Gemini, Grok).

Price Range Convergence: The predicted trading ranges clustered around $176-$200, with most platforms identifying $180-$198 as the most likely band.

Year-End Target Spread: December 31 closing price estimates ranged from $184 (Copilot, most conservative) to $195 (Grok, most bullish), a spread of approximately 6%.

Consistent Catalysts Identified: All platforms cited the Santa Claus rally seasonality, low VIX environment, and holiday liquidity concerns as key factors.

ChatGPT (OpenAI)

ChatGPT delivered the most conservative probability assessment at 56% bullish, citing the overbought RSI reading (~77.8) as a key concern that could limit upside. The platform provided detailed support/resistance levels and noted implied volatility of ~32.9%, translating to an expected daily move of approximately 2.1%.

Distinguishing Feature: Most granular options market analysis with specific IV-derived move calculations.

Claude (Anthropic)

Claude provided the most comprehensive fundamental analysis, highlighting specific catalysts including the H200 chip export opportunity to China and recent analyst price target upgrades from Truist ($275) and Tigress Financial ($350). The platform assigned a 60-65% bullish probability with a base case target of $190-$194.

Distinguishing Feature: Most detailed catalyst breakdown with specific analyst price targets and policy developments.

Gemini (Google)

Gemini framed its analysis around the "Santa Claus Rally Setup," emphasizing the removal of near-term overhangs including tariff delays until 2027 and H200 chip sales approvals. The platform predicted the most specific year-end close at ~$194.85 with 65% bullish probability.

Distinguishing Feature: Strongest emphasis on institutional "window dressing" dynamics and year-end portfolio positioning.

Grok (xAI)

Grok provided the most bullish year-end target at $195, citing 65% probability of increase. The analysis included unique X (Twitter) sentiment data showing 60% bullish posts predicting rebounds to $200+, while 40% warned of further drops to $164. The platform also incorporated real-time social media coordination risks.

Distinguishing Feature: Unique integration of X platform sentiment analysis and retail trader coordination monitoring.

Perplexity

Perplexity delivered the most extensively sourced analysis, citing 60 references across financial data providers, technical analysis platforms, and market commentary. The platform provided probabilistic ranges for each trading day rather than point estimates, reflecting higher uncertainty acknowledgment.

Distinguishing Feature: Most comprehensive citation network and transparent source attribution.

Copilot (Microsoft)

Copilot used the lowest base price ($183.7) and delivered the most conservative year-end estimate at ~$184. The analysis emphasized options gamma risk around the December 26 weekly expiration and identified this as the most volatile day in the forecast period.

Distinguishing Feature: Strongest focus on options market microstructure and gamma-driven volatility.

Consensus View

Averaging across all six platforms yields a consensus bullish probability of approximately 62%, with an expected trading range of $179-$198 and a year-end closing target of approximately $192. This consensus reflects moderate optimism tempered by holiday liquidity concerns and technical overbought conditions.

Common Bullish and Bearish Factors

Santa Claus rally seasonality

Low VIX environment (~13-16)

Strong analyst consensus (avg PT $259)

China H200 export catalyst

Price above key moving averages

Low short interest (~1% of float)

Bearish Factors

RSI approaching overbought (67-78)

Thin holiday liquidity

Options expiration volatility risk

China policy uncertainty

~11% off all-time highs

AI spending ROI scrutiny

Conclusion

The remarkable consensus among six leading AI platforms suggests a moderately bullish outlook for NVDA through year-end 2025. While the specific predictions vary, the convergence around 62% bullish probability and a $184-$198 year-end target provides an interesting data point for market observers.

TheDayAfterAI News will track actual NVDA performance against these predictions and publish a follow-up accuracy assessment in early January 2026. This ongoing evaluation will help establish benchmarks for AI prediction reliability and inform future comparative studies.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.