TSLA Forecast: 6 AI Chatbots Predict Feb 2-6 Price (5 Bears vs 1 Bull)

Image Credit: Austin Ramsey | Splash

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

At TheDayAfterAI News, we believe the best way to understand AI capabilities — and their limitations — is to put them to the test in real-world scenarios. For this inaugural experiment, we tasked six of the most widely used AI chatbots with the same challenge: produce a comprehensive, data-driven price forecast for Tesla (TSLA) stock for the trading week of February 2–6, 2026.

The six AI platforms we tested were ChatGPT (OpenAI), Claude (Anthropic), Gemini (Google), Perplexity AI, Grok (xAI), and Copilot (Microsoft). Each was given an identical prompt requesting a weekly forecast incorporating technical analysis, options positioning, sentiment indicators, fundamental catalysts, and macroeconomic factors. The results were striking — both in their areas of consensus and their divergences.

This article presents a side-by-side comparison of all six forecasts, highlights where the AIs agree and disagree, and draws conclusions about what these AI-powered analyses collectively suggest for Tesla’s near-term trajectory. As always, this is for informational and educational purposes only — not financial advice.

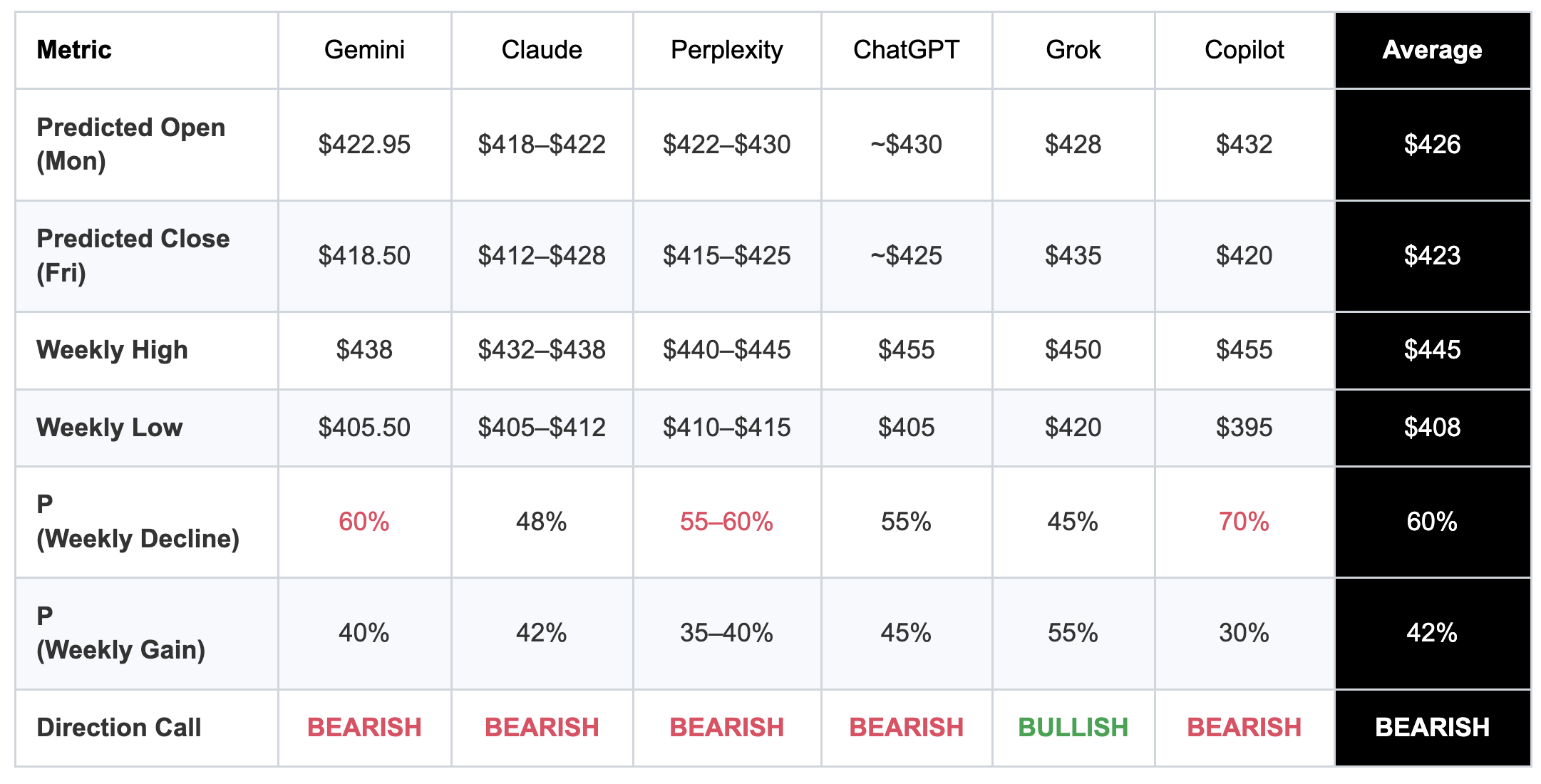

The Headline Numbers: All Six Forecasts at a Glance

Before diving into the nuances, let’s look at how each chatbot answered the core questions: Where does TSLA open? Where does it close? What’s the likely range? And does it go up or down for the week?

The Verdict: Five Bears and One Lone Bull

The most striking takeaway is the near-unanimous bearish consensus. Five out of six chatbots — Gemini, Claude, Perplexity, ChatGPT, and Copilot — predicted that TSLA would close the week lower than it opened. The sole dissenter was Grok (xAI), which projected a modest 1–2% gain and a Friday close near $435, assigning a 55% probability to a weekly increase.

On the bearish side, Copilot was the most aggressive, assigning a 70% probability of decline and projecting the widest downside range (as low as $395). Gemini came in as the most detailed bearish case, offering a day-by-day roadmap with a predicted close of $418.50 and a 60% probability of decline. Claude, Perplexity, and ChatGPT occupied a moderate bearish position, generally expecting the stock to settle in the $415–$428 range.

Where All Six AIs Agree

Despite their differences, all six chatbots converged on several critical themes:

1. Friday’s Jobs Report Is the Week’s Defining Event

Every single AI identified the January Non-Farm Payrolls (NFP) report, scheduled for Friday February 6 at 8:30 AM ET, as the most important catalyst of the week. Several noted the added significance of annual benchmark revisions that could dramatically reshape the labour market narrative. The consensus was that this data release would determine whether the week ends with a relief rally or an accelerated selloff.

2. Bearish Short-Term Technicals

All six noted that TSLA was trading below its key short-term moving averages (5-day, 10-day, 20-day, and 50-day), with RSI in neutral-to-slightly-bearish territory (44–55) and a negative MACD reading confirming weakening momentum. The technical picture was universally described as fragile, with the 200-day moving average serving as a critical longer-term support level.

3. The $405–$410 Support Zone Is Critical

Every chatbot identified the $405–$410 zone as a structural floor for the week. Gemini pinpointed $409.50 as the bottom of a multi-year rising channel. Claude and Perplexity flagged $405–$412 as the likely weekly low. A break below this level was universally viewed as a significant technical breakdown that could trigger accelerated selling toward $390–$400.

4. Elevated Volatility Expected

All six flagged a VIX in the high teens (~17–19) and elevated implied volatility on Tesla options, suggesting the market was pricing in significant moves. The consensus weekly range spanned roughly $30–$60 in width, reflecting expectations for large daily swings of $10–20.

5. Macro Calendar Dominance

All chatbots highlighted the same economic calendar: Monday’s ISM Manufacturing PMI, Wednesday’s ADP Employment and ISM Services, and Friday’s NFP. The consensus was that Tesla-specific catalysts were limited this week, making macro data the primary driver.

Where They Diverge: The Key Disagreements

Grok’s Contrarian Bullish Case

Grok stood out as the only bullish voice, projecting an open of $428 and close of $435 with a 55% probability of gain. Its analysis differed in several notable ways. First, it cited a lower VIX reading (~15 versus the ~17–19 cited by others), which it interpreted as favourable for risk assets. Second, it emphasised bullish MACD crossover signals and RSI at 55, reading the technicals as more constructive than bearish. Third, it focused on institutional accumulation (Vanguard, BlackRock net increases) and Cathie Wood’s reiterated $2,600 price target as supportive factors.

Whether Grok’s contrarian stance reflects a genuine difference in data interpretation or different underlying data sources is an important question. Notably, some of Grok’s technical readings (e.g., 5-day MA at $425, 20-day MA at $410) diverged significantly from the other five models, suggesting possible differences in data sourcing or calculation methodology.

The European Sales Collapse: Flagged or Missed?

Gemini devoted extensive analysis to Tesla’s devastating January European registration data (France down 42%, Norway down 88%), treating it as a primary catalyst for the week’s bearish setup. Claude mentioned European market weakness briefly. Perplexity and ChatGPT acknowledged the broader delivery challenges but did not isolate the January European data as a discrete catalyst. Grok and Copilot gave it less emphasis. This divergence suggests that AI models with stronger web search integration (Gemini used Google’s search infrastructure) may have had more timely access to this breaking news.

The SpaceX/xAI Merger Premium

Gemini uniquely identified the SpaceX–xAI merger rumours as a significant price-support mechanism, describing a “Merger Premium” that would arrest downside capitulation. Copilot also referenced corporate newsflow around the pivot (Model S/X discontinuation, Optimus reallocation). The other four AIs did not assign as much weight to this speculative narrative, focusing instead on near-term technicals and macro data.

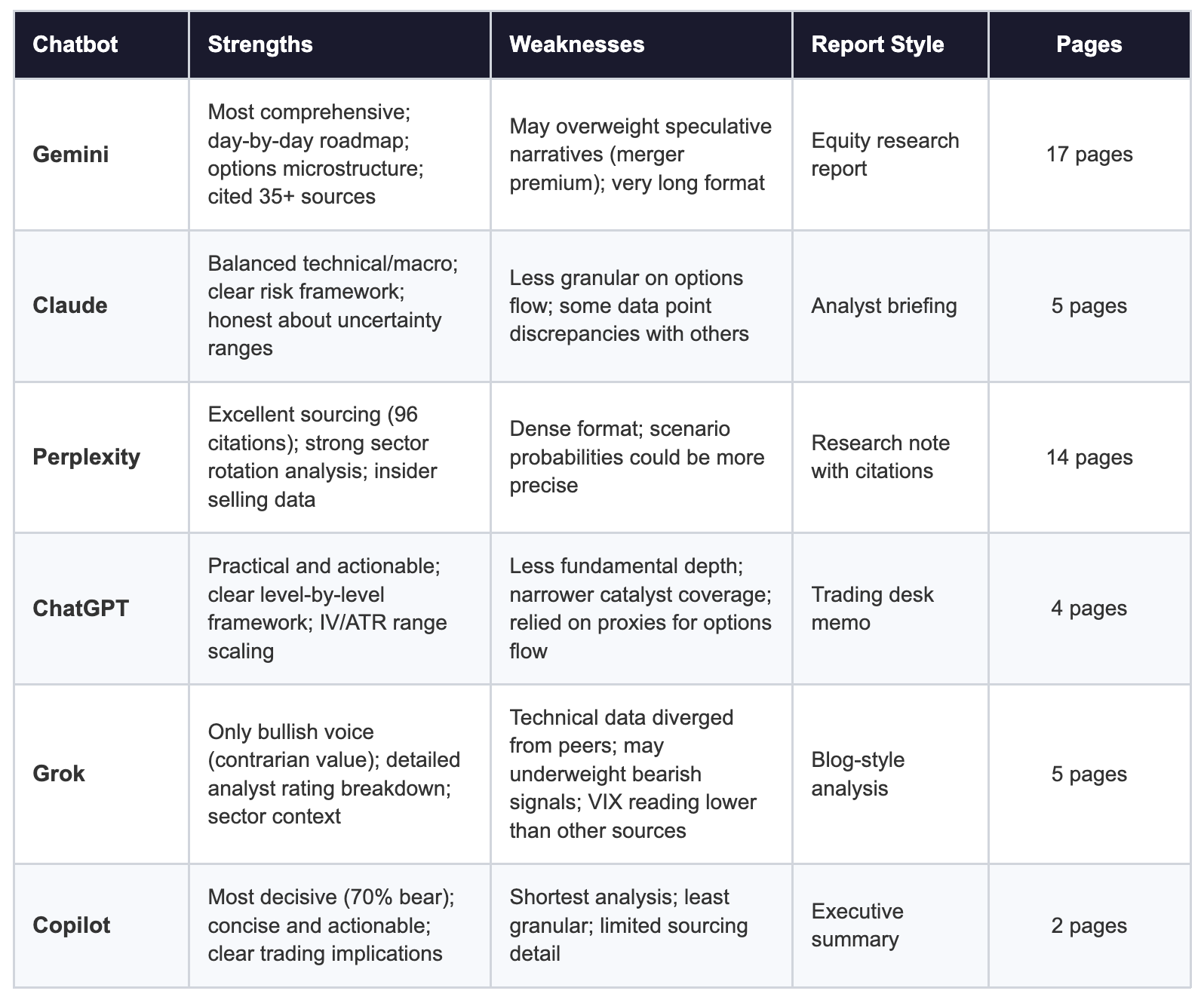

Comparative Assessment: Depth, Rigour, and Style

Beyond the headline numbers, the six reports varied dramatically in their depth, analytical rigour, and communication style. Here’s how they compared:

Key Observations and Takeaways

AI Models Are Not Created Equal

The depth of analysis varied enormously. Gemini produced a 17-page equity research report with 35+ cited sources, a day-by-day price roadmap, and detailed options microstructure analysis. Copilot, by contrast, delivered a concise 2-page executive summary. The quality of the underlying data also differed — some models appeared to have access to more recent and granular market data than others, which directly influenced their forecasts.

Data Freshness Matters Enormously

One of the most important findings was how much the forecasts depended on the timeliness of input data. Gemini’s detailed coverage of the European sales collapse (released over the weekend) clearly shaped its more aggressive bearish stance. Models that appeared to rely on slightly older data — or that lacked real-time pre-market pricing — produced forecasts that were notably different from those with current data access.

The Consensus Is Bearish, But Not Unanimously So

While the 5-to-1 bearish consensus is notable, it is worth emphasising that none of the models expressed extreme conviction. Even the most bearish forecast (Copilot at 70% probability of decline) still assigned a meaningful 30% chance of a weekly gain. The message is one of cautious bearishness with elevated uncertainty, not a confident directional call.

Options Positioning Tells a More Complex Story

An intriguing subplot emerged from the options analysis. While the price action was bearish, several AIs noted that options positioning (put/call ratios around 0.63–0.73) was surprisingly bullish, with more call open interest than puts. Claude specifically highlighted this tension, noting that “the extremely bullish options positioning combined with low IV could create positive gamma conditions.” This disconnect between bearish price action and bullish options positioning was identified as a potential source of surprise upside.

The Friday Jobs Report Creates Binary Risk

Every model agreed that the week’s outcome is heavily back-loaded. The first four days may see range-bound, choppy trading, but Friday’s NFP report introduces binary event risk that could move TSLA $15–20 in either direction. Gemini even modelled specific NFP scenarios: a “hot” print (>150K) would trigger valuation compression, a “cold” print (<0K) would spark recession fears, and a “Goldilocks” result (~70K) could produce a relief rally.

Conclusion: What This Experiment Tells Us About AI and Markets

This exercise was never about picking a “winner” — stock forecasting is inherently uncertain, and any single week’s outcome tells us little about forecasting accuracy. Rather, this experiment reveals something important about the state of AI-powered financial analysis in early 2026:

AI chatbots are remarkably capable financial analysts. All six produced structured, multi-factor analyses that incorporated technical, fundamental, sentiment, and macro data. The quality of reasoning was, in most cases, comparable to what you might receive from a junior equity analyst.

But they are not interchangeable. The differences in data access, analytical emphasis, and underlying model architecture produced meaningfully different forecasts—ranging from a bullish $435 close (Grok) to a bearish $418 close (Gemini) to a strongly bearish $420 with 70% downside probability (Copilot).

The wisdom-of-crowds principle applies. By aggregating all six forecasts, we arrive at a composite view (slightly bearish, range-bound $405–$445, with Friday as the swing factor) that is arguably more robust than any individual forecast.

At TheDayAfterAI News, we will continue to run these comparative AI forecast experiments each week, building a track record that will allow us to assess which models perform best over time — and whether the crowd composite outperforms any individual AI. Stay tuned.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.