6 Leading AI Models Predict ONDS Stock Price for January 13-20, 2026

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In a groundbreaking experiment, TheDayAfterAI News tasked six of the most prominent AI chatbots with the same challenge: predict the stock price trajectory of Ondas Holdings Inc. (NASDAQ: ONDS) for the five trading days from January 13 to January 20, 2026. The results reveal fascinating divergences in how different AI systems interpret identical market data, fundamental catalysts, and technical indicators.

The AI models analyzed include ChatGPT (OpenAI), Claude (Anthropic), Copilot (Microsoft), Perplexity, Grok (xAI), and Gemini (Google). Each was given the same brief: analyze ONDS and provide opening price, closing price, price range, and probability forecasts for the trading period.

KEY FINDING

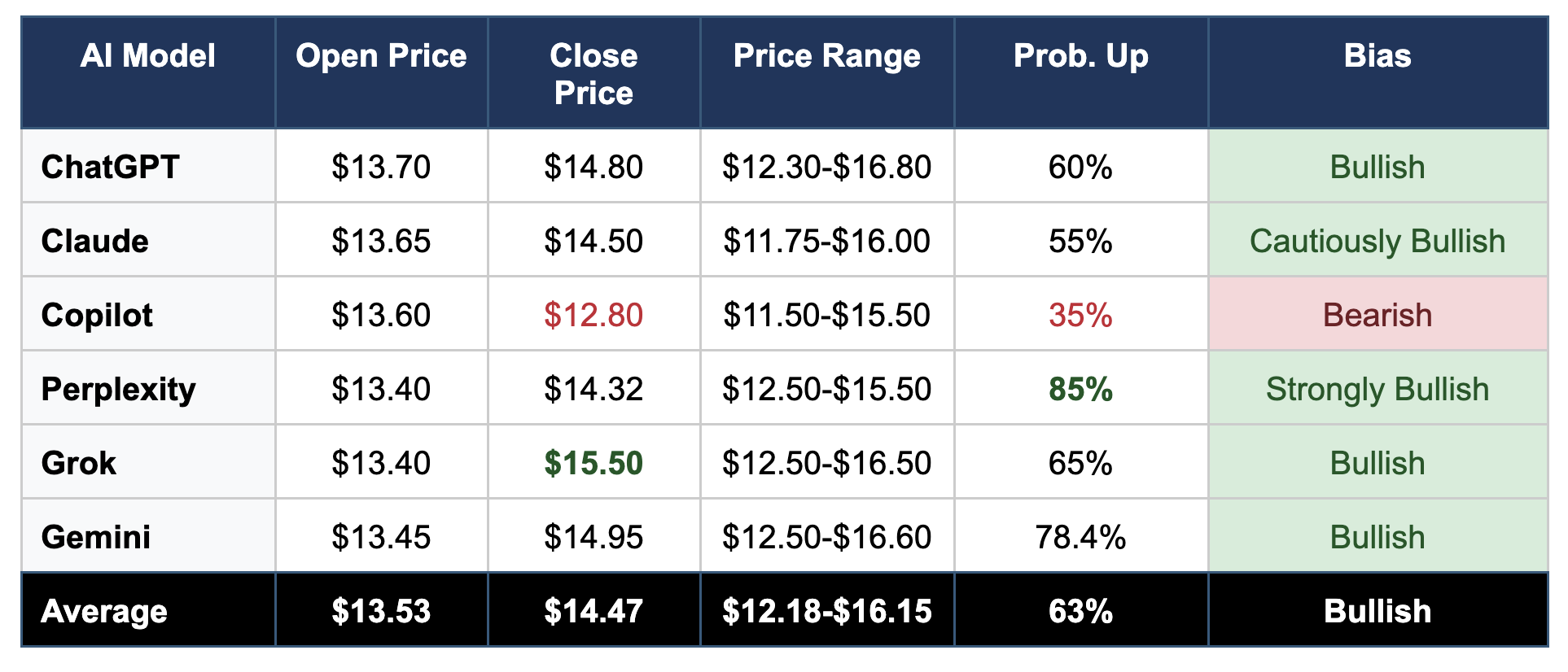

Five out of six AI models predicted ONDS would finish the week higher, with upside probabilities ranging from 55% to 85%. Only Microsoft Copilot bucked the trend, forecasting a 65% probability of decline. The consensus closing price target averages approximately $14.47, representing a potential 7.5% gain from the predicted opening.

About ONDS: The Stock in Focus

Ondas Holdings Inc. has been one of the most dramatic transformation stories of 2025. The company, which operates through its subsidiaries in private wireless networks (ONDAS Networks) and autonomous drone systems (Ondas Autonomous Systems), surged over 2,500% from its March 2025 low of $0.57 to recent highs near $15.28.

Several major catalysts converged in the forecast period: a $1 billion registered direct offering that closed January 12 (priced at a premium of $16.45 per share), the Needham Growth Conference presentation on January 14, and the highly anticipated OAS Investor Day on January 16. These events, combined with the company's recent selection as prime contractor for the Israeli Ministry of Defense's "Drone Hives" border protection project, made ONDS an ideal test case for AI prediction capabilities.

The Predictions Compared

The following table presents each AI model's core predictions side by side:

Individual Model Analysis

ChatGPT (OpenAI)

ChatGPT delivered a scenario-weighted forecast, assigning a 45% probability to a "bullish but choppy" base case where the stock grinds higher into Investor Day before consolidating. The model assigned 30% probability to a bull case with momentum squeeze potential, and 25% to a bearish "sell the news" scenario. ChatGPT emphasized the $16.45 offering price as a natural ceiling and the January 16 Investor Day as the biggest volatility driver. The model provided detailed day-by-day forecasts, predicting the stock would peak around $15.60 on Investor Day before settling back to $14.80 by January 20.

Claude (Anthropic)

Claude took a notably cautious stance, describing its confidence level as "LOW-MEDIUM (35-45%)," citing the extreme daily volatility (11%+), high beta (2.40), overbought RSI conditions, and binary event risk from Investor Day. The model highlighted several warning signals: the stock trading above analyst consensus price targets ($11.50 average), significant insider selling (CEO Eric Brock sold 475,000 shares on December 31), and the 21% short interest. Despite these cautions, Claude still concluded with a slight bullish bias due to the week's scheduled catalysts.

Copilot (Microsoft) - The Bearish Outlier

Microsoft's Copilot stood alone in predicting a net decline for the period. The model assigned 40% weighting to the "supply shock" from the $1 billion offering, viewing the large warrant overhang as the primary bearish driver. Copilot's analysis interpreted the same data differently: while other models saw the premium offering price ($16.45) as validation of institutional confidence, Copilot focused on the dilutive impact of 19 million shares plus 41.8 million pre-funded warrants. The model recommended reducing position size into Investor Day and setting stop-losses near $11.25.

Perplexity - The Most Bullish

Perplexity emerged as the most optimistic model with an 85% probability of price increase. The analysis emphasized seven factors favoring upside: Stifel's recent price target increase to $17, the capital raise at premium pricing demonstrating management confidence, $23.3 million backlog providing revenue visibility, the 280% annual return attracting momentum buyers, event-driven catalyst timing, bullish technical structure, and defense/drone sector tailwinds. Perplexity provided the most detailed day-by-day breakdown with specific price targets for each session, assigning 65% probability to a base case of moderately positive Investor Day guidance.

Grok (xAI)

Grok delivered the highest closing price target at $15.50, projecting approximately 15.7% upside from the predicted open. The model emphasized short squeeze dynamics, noting the 20-21% short interest and elevated cost to borrow. Grok's analysis uniquely highlighted the bullish options activity (212K calls traded on January 3, 81% above average) and the extremely bullish Stocktwits sentiment with ONDS trending among the top 5 most-discussed tickers. The model acknowledged overvaluation concerns but concluded that the "fundamental story is compelling" given FAA-certified drone technology and the $840M+ cash position.

Gemini (Google)

Gemini produced the most comprehensive institutional-style research report, framing its analysis around a "dislocation event" where market price ($13.19) had diverged from the "smart money" institutional valuation established by the $16.45 offering. Gemini's 78.4% upside probability was calculated using a weighted model (40% technical momentum, 40% near-term catalysts, 20% systematic market factors). The analysis included detailed gamma exposure mechanics, explaining how market maker hedging of high open interest at the $14-$15 strikes could create reflexive buy loops.

Key Points of Consensus

Opening Price Convergence: All six models predicted remarkably similar opening prices, ranging from $13.40 to $13.70, reflecting alignment on pre-market data and recent price action.

Investor Day as Pivot: Every model identified the January 16 OAS Investor Day as the critical binary event that would determine the week's direction.

Extreme Volatility Expected: All models projected wide price ranges (typically $4-$5 between high and low), acknowledging ONDS's 11%+ daily volatility profile.

$16.45 as Key Resistance: The offering price was universally identified as a significant psychological and technical resistance level.

Support Zone Around $12-$13: All models identified similar support levels, generally in the $11.50-$13.00 range, corresponding to recent swing lows and moving average support.

Key Points of Divergence

Offering Interpretation: The most significant divergence centered on interpretation of the $1 billion offering. Five models viewed the premium pricing as bullish validation of institutional confidence; Copilot viewed it as a dilutive supply shock creating downward pressure.

Probability Spreads: Upside probabilities ranged dramatically from 35% (Copilot) to 85% (Perplexity), a 50-percentage-point spread reflecting fundamentally different risk assessments.

Closing Price Targets: The $2.70 spread between the highest ($15.50, Grok) and lowest ($12.80, Copilot) closing price targets represents over 20% divergence on a 5-day forecast.

Observations on AI Prediction Methodology

This experiment reveals several insights about how different AI models approach financial forecasting. Perplexity and Gemini demonstrated the most structured, scenario-based methodologies with explicit probability weightings. Claude showed the greatest emphasis on uncertainty and risk factors, appropriately caveating its predictions. Grok appeared to weight sentiment and social media signals more heavily than other models. Copilot's contrarian view highlights how identical data can support opposing conclusions depending on analytical framework and factor weighting.

Notably, all models acknowledged significant uncertainty in their forecasts, with most explicitly stating that single-day moves of 10%+ were possible. This appropriate humility reflects the inherent unpredictability of short-term stock movements, particularly for high-volatility momentum stocks like ONDS.

Conclusion

The AI chatbot showdown on ONDS reveals both the promise and limitations of machine learning-assisted financial analysis. While five of six models reached bullish conclusions, the wide dispersion in probability estimates and price targets underscores the significant uncertainty inherent in short-term stock prediction. The consensus view suggests approximately $14.47 as the most likely closing price for January 20, representing a 7% gain from the opening, but with potential for much larger moves in either direction.

As AI continues to evolve, we at TheDayAfterAI News will continue tracking how these models perform against actual market outcomes. We encourage readers to view these predictions as one input among many in their investment research process, not as definitive forecasts. The true value of this exercise lies not in the specific numbers, but in understanding how different AI systems synthesize complex market data - and where they agree and disagree.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.