CRCL Stock Forecast: 5 Top AIs Predict Prices (Dec 17–23)

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

At TheDayAfterAI News, we continue our commitment to transparency in AI-powered financial analysis. Today, we tasked five leading AI chatbots with the same challenge: predict Circle Internet Group's (NYSE: CRCL) stock performance over a 5-day trading window from December 17 to December 23, 2025.

Each AI platform received identical parameters and was asked to provide opening and closing price estimates, a projected trading range, and probability assessments for price movement. The results reveal fascinating differences in how each AI interprets market data, technical indicators, and fundamental catalysts.

Market Context

CRCL entered this analysis period following a significant catalyst: on December 16, 2025, Visa announced the launch of a stablecoin settlement service using Circle's USDC. This integration into traditional finance payment rails triggered a sharp rally, with the stock closing at approximately $83.00 after gaining nearly 10% in a single session.

Key factors influencing the analysis period include options expiration on December 19, ongoing concerns about insider selling by CEO Jeremy Allaire, and broader macroeconomic conditions including recent Federal Reserve rate decisions.

Prediction Summary

The following table summarizes each AI chatbot's key predictions for the 5-day trading period:

*Claude also assigned 30% probability to sideways movement (-5% to +5%)

Gemini (Google)

Outlook: Bullish Reversal / Continuation

Gemini presented the most optimistic forecast, projecting a close of approximately $89.50 by December 23. The analysis emphasized the Visa partnership as a "massive confidence booster" that validates USDC's integration into traditional finance. Gemini identified a "V-Shape Recovery" pattern on the daily chart and noted that RSI indicators suggest room for continued upside before reaching overbought territory.

Key risks flagged include potential "sell the news" profit-taking after the 10% spike and options expiration volatility on December 19.

OpenAI (ChatGPT)

Outlook: Moderately Bullish

OpenAI offered a balanced analysis with a center-point close estimate of $86.50. The model provided detailed day-by-day bias assessments and noted the price is above short-term moving averages (5, 10, and 20-day) but remains below the 50-day and 200-day averages, indicating a "choppy, range-bound rebound rather than a strong trend."

The analysis highlighted options positioning with a call-leaning put/call ratio of approximately 0.49, suggesting bullish sentiment among options traders.

Perplexity

Outlook: Modestly Positive with Wide Risk

Perplexity provided the most extensively sourced analysis with 40 citations. The model characterized the situation as "volatile post-selloff consolidation with mildly bullish short-term momentum." While acknowledging the positive catalyst, Perplexity emphasized that CRCL remains down 33% over three months and 72% below its 52-week high.

The analysis provided detailed day-by-day opening and closing ranges, with particular attention to "max pain" levels around the low-$80s for options expiration.

Claude (Anthropic)

Outlook: Slightly Bullish with Caution

Claude offered the most conservative price targets, with an opening estimate of $74.35 and closing range of $78–$82. Uniquely, Claude incorporated a three-way probability assessment including a 30% chance of sideways movement. The analysis noted deeply oversold RSI readings (25-30) as a potential bounce signal but emphasized concerns about lock-up expiration selling pressure.

Claude provided the most detailed breakdown of fundamental catalysts, including the OCC conditional approval, Abu Dhabi ADGM license, and Interop Labs acquisition.

Grok (xAI)

Outlook: Bullish with Technical Caution

Grok projected an opening of $74 and closing of $80, noting an ABC corrective pattern with a key low at $74.74. The analysis identified resistance at $88 (options strike) and $105 (triangle high), with support at $74.50 and extended downside at $64-65.

Grok highlighted elevated short interest at 12.46M shares (5.29% of float) with a low days-to-cover ratio, suggesting potential for a squeeze on positive catalysts.

Key Observations

Consensus Direction: All five AI platforms projected a net positive outcome for the upcoming 5 days, with upward probabilities ranging from 45% to 65%.

Price Divergence: Opening price estimates showed significant divergence, with Gemini and OpenAI expecting continuation near $83, while Claude and Grok projected a gap down to the $74 range.

Catalyst Agreement: All platforms identified the Visa USDC settlement announcement as the primary driver, with unanimous recognition of the December 19 options expiration as a key volatility event.

Risk Assessment: Common risks cited included post-rally profit-taking, insider selling concerns, and holiday-thinned liquidity toward the end of the period.

Methodology Differences: Perplexity provided the most citation-heavy approach, while Gemini offered the most decisive directional call. Claude was unique in providing a three-outcome probability framework.

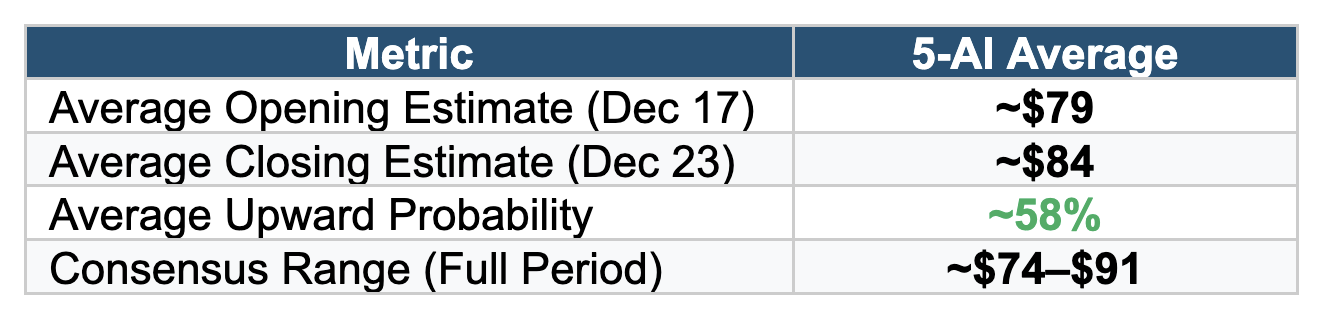

Consensus Metrics

Conclusion

This comparison demonstrates both the capabilities and limitations of AI-powered stock analysis. While all five platforms agreed on the general bullish sentiment driven by the Visa partnership, their specific price targets varied significantly—a reminder that AI predictions should be viewed as one input among many in investment decision-making.

The divergence in opening price estimates is particularly noteworthy: Gemini and OpenAI appear to have incorporated the December 16 close of $83 as their baseline, while Claude and Grok may have been working with slightly earlier data showing a lower price point. This highlights the importance of data recency in AI analysis.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.