AI Chatbot Showdown: Predicting Micron’s Stock Move After Q1 2026 Earnings

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

At TheDayAfterAI News, we conducted a unique experiment: we asked six leading AI chatbots to predict Micron Technology's (NASDAQ: MU) stock price movement for the upcoming five trading days of December 17–23, 2025. This period was particularly significant as it encompassed Micron's highly anticipated Q1 FY2026 earnings release on December 17th.

The results reveal fascinating insights into how different AI systems analyze market data, weigh various factors, and arrive at probabilistic forecasts. While all chatbots had access to similar market information, their predictions varied significantly—highlighting both the promise and limitations of AI-driven financial analysis.

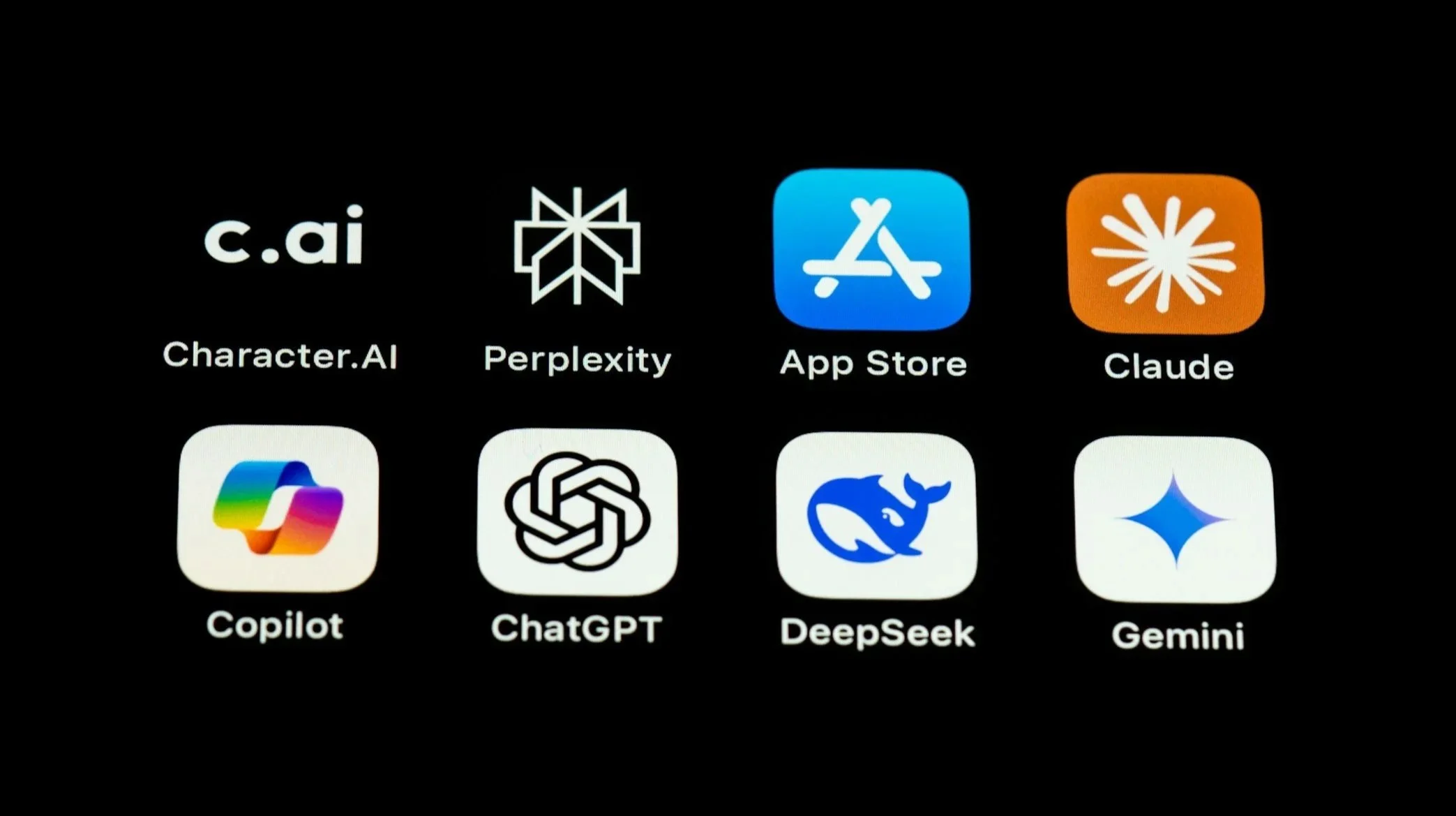

The Contenders

We tested six prominent AI chatbots, each with their own analytical approaches and underlying models:

ChatGPT (OpenAI) – The market leader in conversational AI

Claude (Anthropic) – Known for nuanced analysis and reasoning

Gemini (Google) – Google's multimodal AI assistant

Copilot (Microsoft) – Integrated with Bing search capabilities

Grok (xAI) – Elon Musk's AI with real-time X integration

Perplexity (Perplexity AI) – Search-focused AI with real-time data

Market Context

The week in question was dominated by Micron's Q1 FY2026 earnings announcement, which occurred after market close on December 17, 2025. The results exceeded expectations significantly:

EPS: $4.78 adjusted (vs. $3.91–$3.95 expected)

Revenue: $13.64 billion (vs. $12.84 billion expected)

Q2 Guidance: ~$18.70 billion revenue and ~$8.42 EPS (dramatically above consensus)

Key Driver: Surging AI/HBM (High Bandwidth Memory) demand from data center expansion

Additional factors included December 19th quadruple witching options expiration, thin holiday liquidity, and the Federal Reserve's December meeting with a 25 basis-point rate cut.

Prediction Summary

The following table summarizes each chatbot's key predictions for the December 17–23 trading period:

ChatGPT – The Contrarian

ChatGPT stood out as the only chatbot predicting a net price decrease for the period. With only a 35% probability of the stock finishing higher than its opening price of $236.56, ChatGPT projected a close around $228 (range: $218–$238).

Key reasoning: ChatGPT emphasized that the period opened at a relative high before the sell-off, making a full recovery above $236.56 by December 23rd challenging. It also highlighted sector weakness (SOXX and SPY both red) and the need for a quick snap-back while broader risk appetite cooperates.

Claude – The Balanced Analyst

Claude provided one of the most comprehensive analyses, assigning a 72% probability of price increase with a base case close of $248–$252. The analysis incorporated real-time post-earnings data showing the stock at $244.32 in overnight trading.

Standout features: Claude's analysis included detailed probability breakdowns (+20% from earnings beat, +15% from AI narrative, +10% from expected analyst upgrades, offset by -8% options expiration risk, -8% holiday unpredictability, -7% profit-taking).

Gemini – The Optimistic Technician

Gemini was tied for the most bullish outlook at 75% probability of increase. The analysis emphasized the December 17 price action as a "bear trap" where the stock tested support at $221 and held firmly before the earnings beat.

Unique insight: Gemini specifically called out the December 19 quadruple witching options expiration and identified "Call Walls" at $240 and $250 as key levels that could pin or amplify price movements.

Copilot – The Wide-Range Forecaster

Copilot provided the widest price range of all chatbots ($200–$285), reflecting high uncertainty around the earnings event. With a 62% bullish probability, it offered a more conservative outlook than peers.

Framework highlight: Copilot explicitly shared its weighting methodology: Earnings/guidance (40%), Technical/flow (25%), Sentiment/positioning (15%), Macro/sector (10%), and Market microstructure (10%).

Grok – The Most Bullish

Grok matched Gemini's 75% bullish probability and projected the highest closing price at $265—approaching Micron's all-time high of $264.75. The analysis emphasized the post-earnings rally potential and positive analyst sentiment.

Notable detail: Grok cited specific analyst price targets, including JPMorgan at $350 (Overweight) and Morgan Stanley at $325–$338, suggesting significant upside remained even at elevated levels.

Perplexity – The Data-Driven Moderate

Perplexity took a measured approach with a 60–65% probability of increase and the narrowest predicted close range ($230–$255). The analysis was heavily sourced, citing over 40 references including real-time options data and historical price movements.

Distinctive approach: Perplexity explicitly acknowledged the inherent uncertainty, stating that daily opens and closes are "not observable" and providing probabilistic ranges rather than point estimates.

Key Observations

Consensus Direction: Five of six chatbots (83%) predicted a bullish outcome, with only ChatGPT forecasting a net decline.

Probability Spread: Bullish probabilities ranged from 35% (ChatGPT) to 75% (Gemini/Grok), a 40-percentage-point spread reflecting genuine analytical divergence.

Price Target Variance: Projected closing prices ranged from $228 (ChatGPT) to $265 (Grok)—a $37 difference representing nearly 16% of the stock price.

Common Factors: All chatbots cited the earnings beat, AI/HBM demand strength, options expiration effects, and holiday liquidity concerns as key drivers.

Reference Point Sensitivity: ChatGPT's bearish stance appears driven by measuring from the opening price ($236.56) rather than the post-selloff close ($225.52), demonstrating how framing affects conclusions.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.