UNH Stock Crash: 6 Top AI Models Predict What Happens Next

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

At TheDayAfterAI News, we believe in the power of collective AI intelligence. Rather than relying on a single artificial intelligence model for financial insights, we harness the analytical capabilities of six leading AI chatbots to provide our readers with a comprehensive, multi-perspective view of stock price predictions.

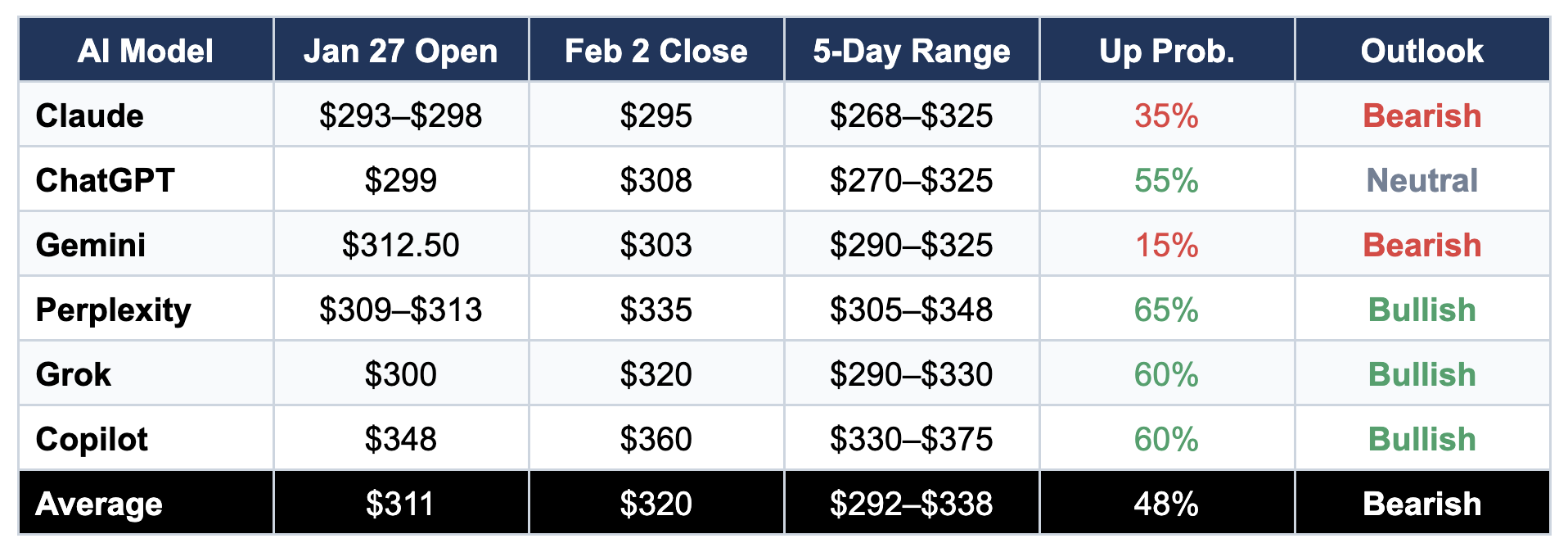

This week, we tasked Claude (Anthropic), ChatGPT (OpenAI), Gemini (Google), Perplexity, Grok (xAI), and Copilot (Microsoft) with analyzing UnitedHealth Group (NYSE: UNH) for the five-day trading period from January 27 to February 2, 2026. What emerged was a fascinating divergence of opinion that perfectly illustrates both the potential and limitations of AI-driven financial analysis.

The Perfect Storm: What Triggered This Analysis

UnitedHealth Group found itself at the epicentre of a market storm in late January 2026, making it an ideal candidate for our AI prediction experiment. Two major catalysts converged within 24 hours:

CMS Medicare Advantage Rate Shock: The Centers for Medicare & Medicaid Services proposed a mere 0.09% increase in 2027 Medicare Advantage reimbursement rates — dramatically below the 4–6% industry consensus expectations.

Q4 2025 Earnings & Disappointing Guidance: While UNH delivered a modest EPS beat ($2.11 vs $2.10 consensus), the company shocked markets with 2026 revenue guidance of $439 billion — approximately $15 billion below analyst expectations and representing the company's first projected annual revenue decline in over a decade.

The stock, which closed at $351.64 on January 26, plunged 12–16% in pre-market trading, creating exactly the type of high-volatility, news-driven scenario that tests the mettle of predictive models — human and artificial alike.

The Six AI Predictions: A Tale of Divergence

Each AI was provided with the same base information and asked to predict the opening price on January 27, the closing price on February 2, the expected trading range, and the probability of price increase versus decrease. Their responses revealed strikingly different interpretations of identical data.

The Bears: Gemini and Claude

Gemini (Google) – Most Bearish

Gemini delivered the most comprehensive and decidedly bearish analysis, characterising the situation as a "perfect storm of negative catalysts." With an 85% probability assigned to price decrease, Gemini's analysis was exhaustive, spanning 16 pages that covered fundamental valuation models, technical chart dynamics, derivatives market sentiment, and macroeconomic contextualisation.

Key thesis: The CMS rate proposal represents a "structural reset" in Medicare Advantage profitability. Gemini calculated that the 0.09% rate increase, when adjusted for medical cost inflation trending at 4–6%, constitutes a de facto reimbursement cut. The analysis predicted the stock would close the week at $303, representing a further decline from its predicted $312.50 opening.

Notable insight: Gemini highlighted the "gamma trap" in options positioning, noting that market makers who sold puts at higher strikes would need to short additional stock as the price fell, potentially exacerbating the downward spiral.

Claude (Anthropic) – Cautiously Bearish

Claude adopted a similarly bearish stance but with slightly more nuance, assigning a 65% probability of price decrease. The analysis emphasised the unprecedented nature of the revenue guidance miss — UNH's first projected annual revenue decline in over a decade.

Key thesis: The convergence of disappointing guidance, a hostile Medicare Advantage rate environment, and the ongoing DOJ investigation creates an "asymmetric risk profile favouring continued weakness." Claude predicted a base case close of $295, with downside risk to $268 in a bear scenario.

Notable insight: Claude flagged the potential government shutdown risk (January 30 funding deadline) as an additional volatility catalyst that other models largely overlooked.

The Bulls: Perplexity, Copilot, and Grok

Perplexity – Technical Rebound Thesis

Perplexity emerged as the most detailed bullish voice, assigning a 65% probability of price increase. The analysis focused heavily on technical indicators and mean-reversion dynamics following the sharp selloff.

Key thesis: The gap-down opening would compress the RSI into severely oversold territory (20–35 range), creating conditions that "typically trigger mean-reversion buying on days 2–4 of the selloff." Perplexity predicted a recovery to $335 by February 2, representing approximately 8% upside from the opening.

Notable insight: Perplexity emphasised UNH's diversification advantage — unlike Humana (92% Medicare Advantage-dependent), UNH derives only ~65% of revenue from MA, with Optum providing meaningful insulation.

Copilot (Microsoft) – The Outlier Bull

Copilot delivered the most optimistic forecast, predicting an opening at $348 and a close at $360 — numbers that would actually represent a gain from the pre-announcement close of $351.64. This positioned Copilot as a significant outlier among the six models.

Key thesis: The market reaction would be "modestly mixed/neutral," with the earnings beat providing fundamental support. Copilot appeared to heavily weight the positive aspects (EPS beat, Optum cash flows) while somewhat discounting the regulatory shock.

Notable caveat: Copilot's predictions appeared least aligned with the pre-market trading data available to all models, which showed the stock trading in the $295–$310 range before the market opened.

Grok (xAI) – Moderate Recovery

Grok took a balanced approach, predicting an opening at $300 and a close at $320, representing a 60% probability of price increase. The analysis was notably concise but focused on key technical support levels and sector rotation dynamics.

Key thesis: Healthcare inflows remain positive ($33M weekly, $1.1B YTD), suggesting institutional appetite for the sector despite the near-term turbulence. Grok emphasised the valuation reset creating a potential entry opportunity for rotation traders.

The Neutral: ChatGPT

ChatGPT occupied the middle ground, assigning a 55% probability of price increase—essentially a coin flip with slight bullish tilt. The analysis provided the widest trading range ($270–$325) among all models, reflecting high uncertainty.

Key insight: "After a ~15% earnings gap, the base case often includes at least a partial stabilisation/bounce, but the bear case remains very live because the move is fundamentally driven." ChatGPT's framework explicitly acknowledged the tension between technical rebound potential and fundamental deterioration.

Key Observations

Opening Price Convergence (ex-Copilot): Five of six models predicted an opening range of $293–$313, clustering around the $300–$310 zone that pre-market trading confirmed. This suggests the AI models effectively processed the available pre-market data.

Week-End Divergence: Closing predictions ranged from $295 (Claude) to $360 (Copilot)—a $65 spread representing nearly 20% of the stock price. This extreme divergence reflects genuine uncertainty about whether the selloff represents a buying opportunity or the beginning of a deeper correction.

Technical vs. Fundamental Split: The bulls (Perplexity, Grok, Copilot) generally emphasised technical oversold conditions and mean-reversion potential, while the bears (Gemini, Claude) focused on fundamental deterioration and regulatory risk. This mirrors the classic debate in financial analysis.

FOMC Sensitivity: All six models acknowledged the January 28 FOMC meeting as a key volatility catalyst, but interpreted its impact differently. Bulls saw potential for a "defensive rotation" into healthcare; bears saw "hawkish pause" risks.

What This Experiment Reveals About AI Financial Analysis

This multi-AI prediction exercise offers several insights into the current state of AI-assisted financial analysis:

Strengths Demonstrated

Comprehensive Data Synthesis: Each AI effectively processed multiple data streams—earnings releases, regulatory announcements, technical indicators, macroeconomic calendars, and options market data—into coherent narratives.

Transparent Reasoning: All models clearly articulated their analytical frameworks, allowing readers to understand not just the "what" but the "why" behind each prediction.

Risk Acknowledgment: Every model provided probability ranges and scenario analyses rather than single-point predictions, reflecting appropriate humility about forecast uncertainty.

Limitations Observed

Information Weighting Inconsistency: Given identical inputs, the models weighted information very differently—Copilot's apparent dismissal of pre-market pricing data led to a significant outlier prediction.

Recency Bias: Models may have overweighted the immediate news shock relative to longer-term fundamental considerations.

Confidence Calibration: The wide range of probability estimates (35%–65% for upside) suggests that these models may not be well-calibrated for probability estimation in novel, high-uncertainty scenarios.

Conclusion: The Wisdom of Crowds or the Confusion of Committees?

Our six-AI experiment on UNH reveals both the promise and limitations of AI-assisted financial forecasting. The models demonstrated impressive analytical depth and transparent reasoning, but their divergent conclusions underscore that even sophisticated AI cannot eliminate the fundamental uncertainty inherent in short-term stock price prediction.

Perhaps the most valuable takeaway is not any single prediction, but the range of scenarios and the quality of reasoning each AI provided. Investors who read all six analyses would emerge with a more nuanced understanding of UNH's risk/reward profile than those who relied on any single source—human or artificial.

At TheDayAfterAI News, we will continue to track how these predictions play out against reality, providing our readers with accountability data on AI forecasting performance. In an era of increasing AI influence on financial markets, such transparency is more important than ever.

Final thought: Whether you're bullish like Perplexity, bearish like Gemini, or somewhere in between, the unanimous agreement across all six models on one point is worth noting: expect significant volatility. In uncertain markets, that consensus may be the most reliable prediction of all.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.