AI Stock Battle: Claude Tops NVDA Prediction Experiment Results

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

Last week, TheDayAfterAI News conducted an experiment: we asked five leading AI chatbots — Perplexity, Google Gemini, xAI's Grok, OpenAI's ChatGPT, and Anthropic's Claude — to predict NVIDIA Corporation (NASDAQ: NVDA) stock performance for the trading week of December 15–19, 2025. Now that the week has concluded, we can evaluate each AI's accuracy across multiple dimensions.

Following our established methodology from the iRobot bankruptcy evaluation, we've analysed performance across five distinct categories: trend direction, opening price, closing price, weekly low, and weekly high. All price errors are calculated as percentage deviations from actual values for meaningful comparison.

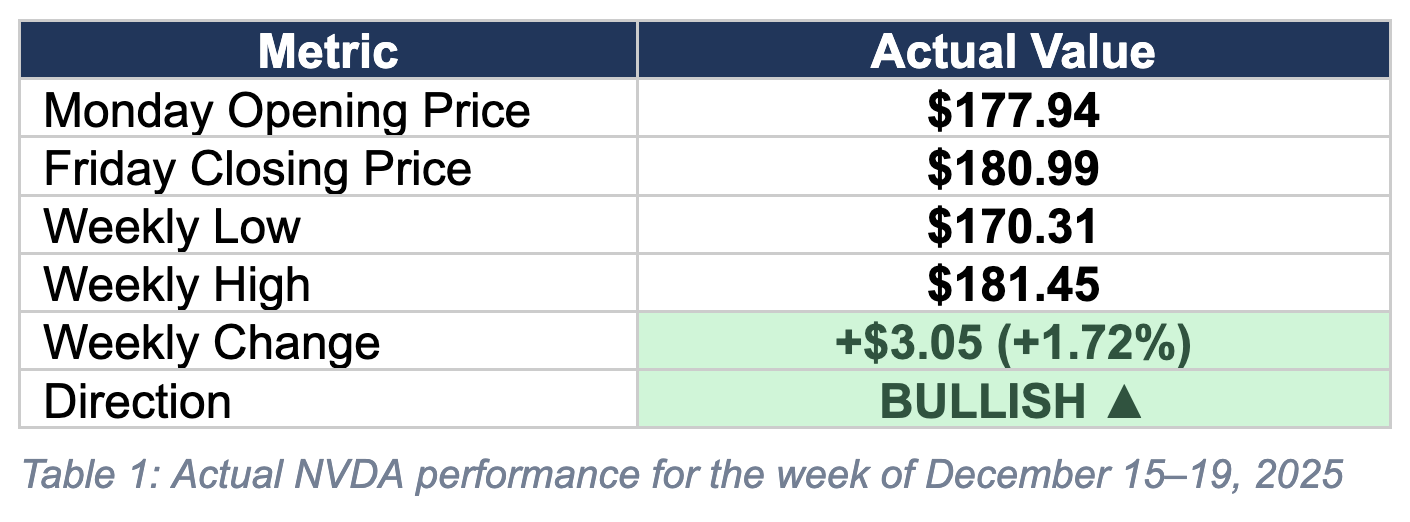

Actual NVDA Performance: December 15–19, 2025

Category-by-Category Rankings

We evaluated each AI across five categories, using percentage error from actual values. Lower percentage = better accuracy. Points awarded: 1st place = 5 pts, 2nd = 4 pts, 3rd = 3 pts, 4th = 2 pts, 5th = 1 pt.

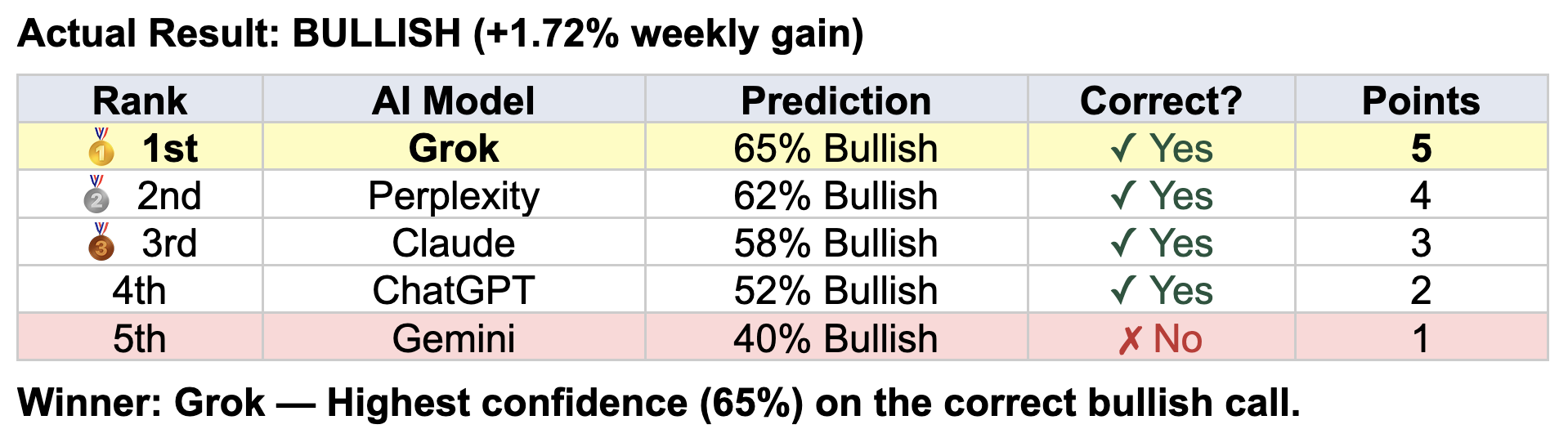

Category 1: Best Trend/Direction Prediction

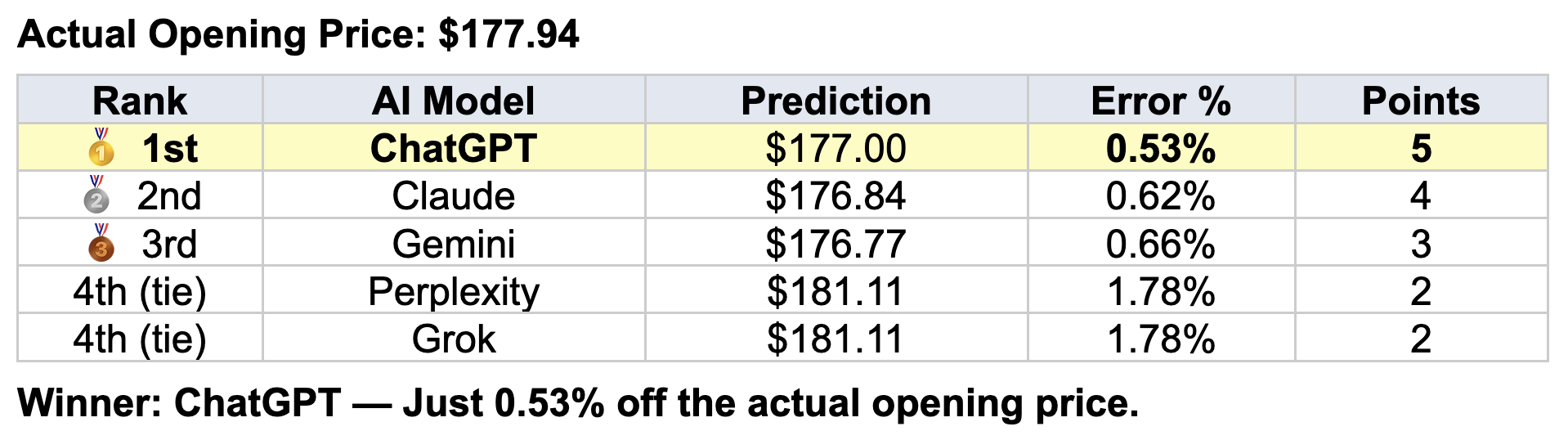

Category 2: Best Opening Price Prediction

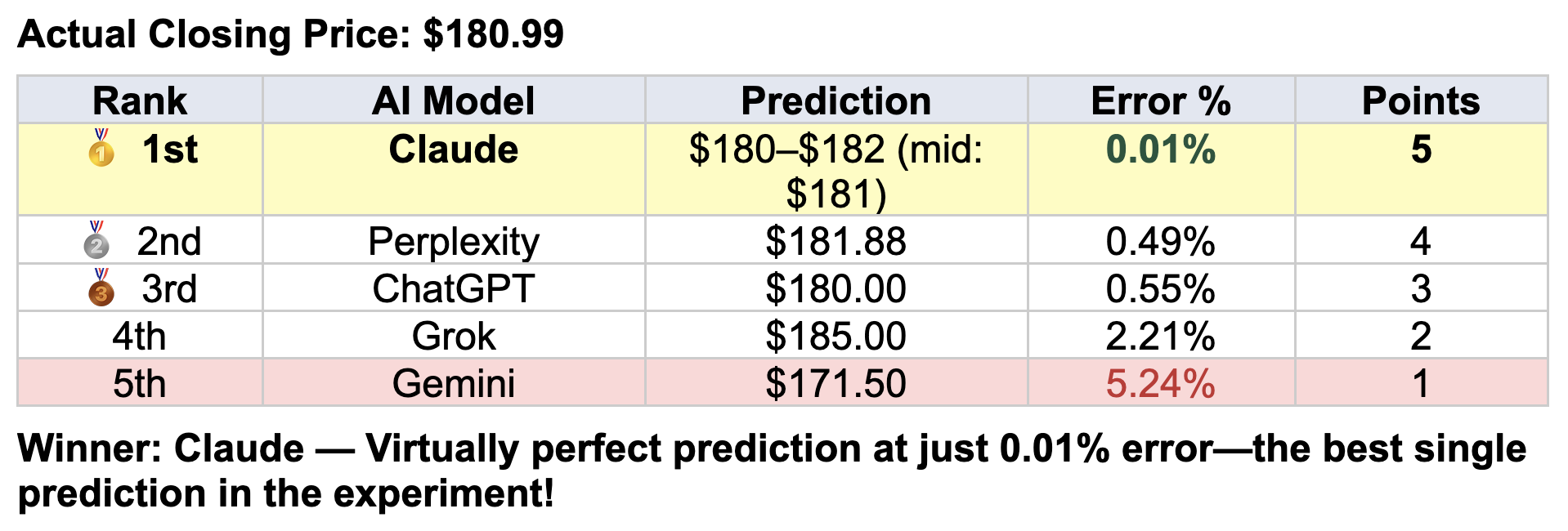

Category 3: Best Closing Price Prediction

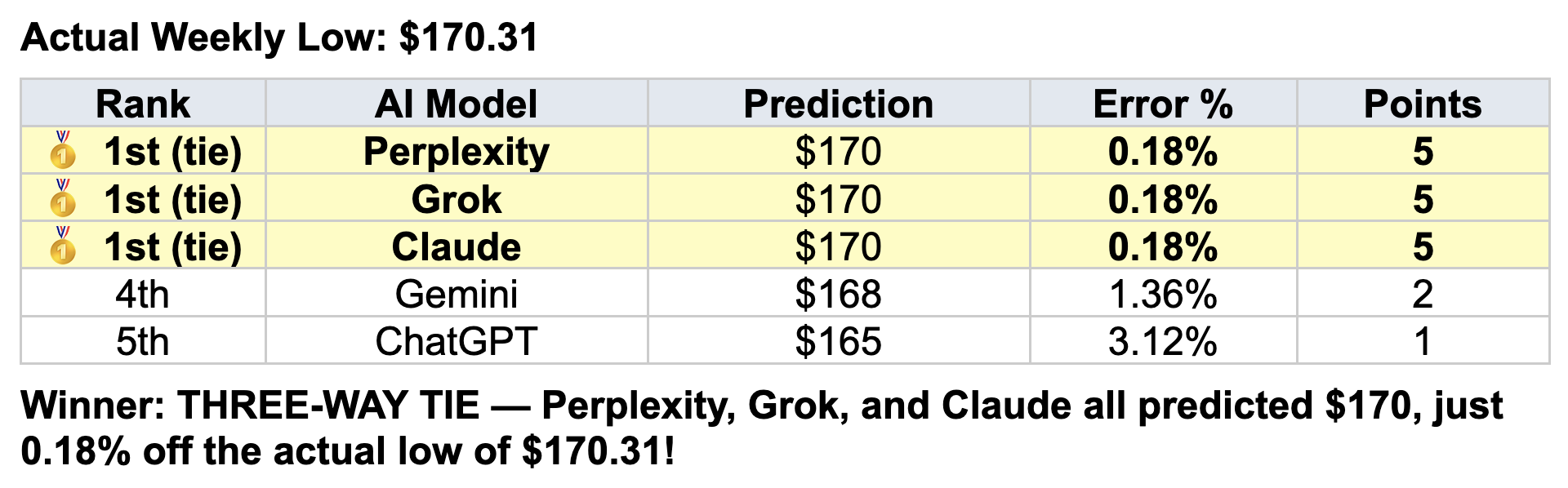

Category 4: Best Weekly Low Prediction

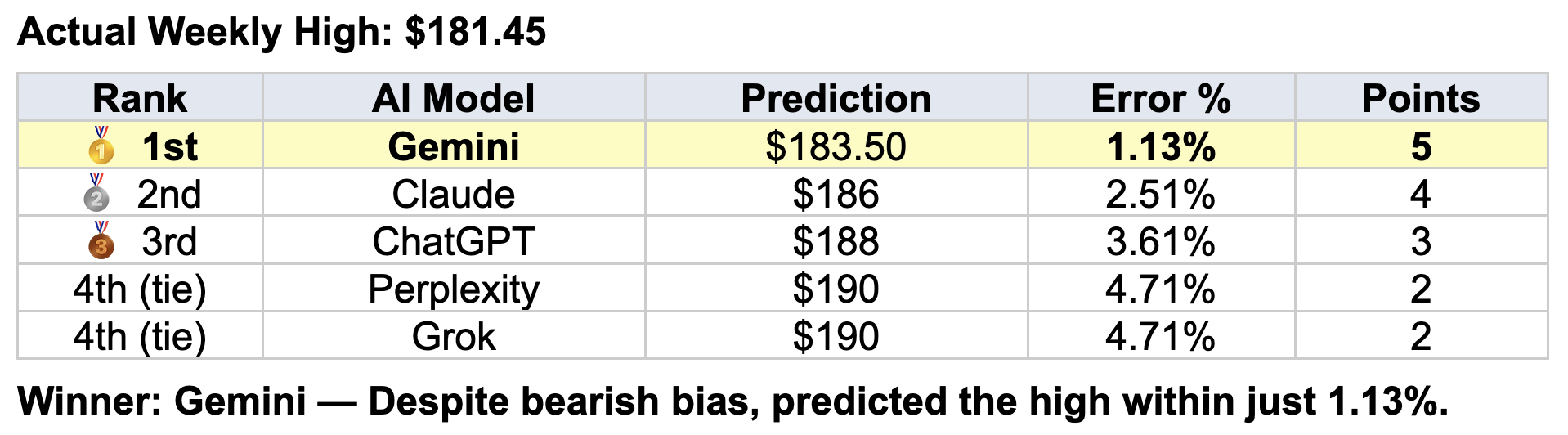

Category 5: Best Weekly High Prediction

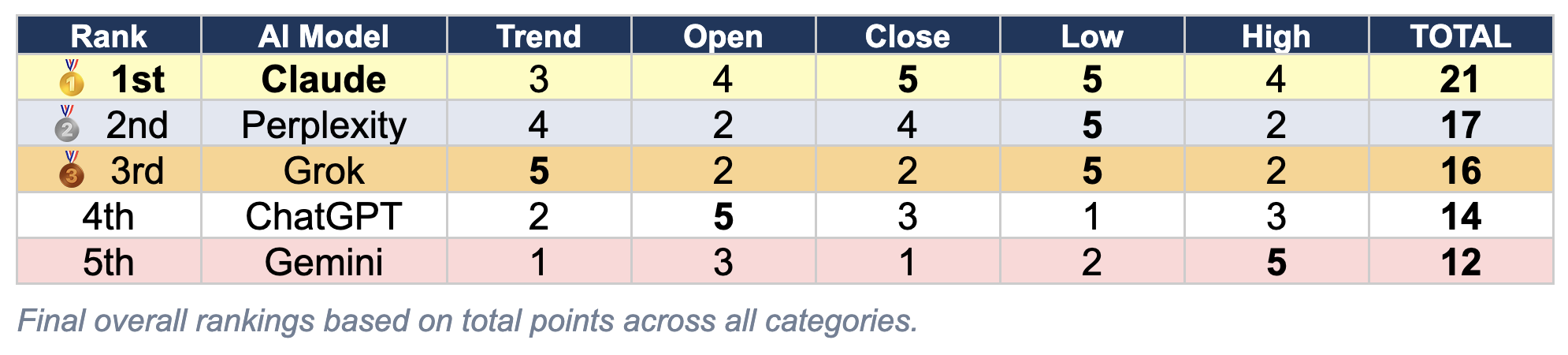

Final Overall Rankings

This multi-category analysis reveals that Claude demonstrated superior calibration for NVIDIA's trading week, winning with 21 points. The four-point margin over second-place Perplexity (17 points) reflects Claude's exceptional closing price prediction and consistent performance across all categories.

For investors considering AI-assisted analysis of large-cap technology stocks, the key insight is that ensemble approaches — consulting multiple AIs and synthesising their views — may produce better results than relying on any single chatbot. Different AIs excelled in different areas: Grok for directional confidence, ChatGPT for opening price accuracy, Claude for closing price precision, and Gemini for resistance level identification.

Category Winners at a Glance

Best Trend Prediction: Grok (65% bullish confidence — highest and correct)

Best Opening Price: ChatGPT (0.53% error)

Best Closing Price: Claude (0.01% error — best single prediction!)

Best Weekly Low: Perplexity, Grok & Claude (TIE) (0.18% error each)

Best Weekly High: Gemini (1.13% error)

Key Takeaways

Why Claude Won Overall: Claude's victory came from exceptional consistency across all categories. Its virtually perfect closing price prediction (0.01% error) was the single most accurate prediction in the entire experiment. Combined with a first-place tie in weekly low and strong placements in opening price and weekly high, Claude achieved the highest composite score of 21 points. Claude's "risk-aware moderate" analytical framework—balancing bullish catalysts against technical concerns—proved particularly well-calibrated for NVIDIA's choppy but ultimately positive week.

The Floor Prediction Phenomenon: Remarkably, three AI systems—Perplexity, Grok, and Claude—all predicted the same $170 weekly low, coming within just 31 cents (0.18%) of the actual $170.31. This consensus on the support level, which all AIs had identified as "critical" in their original analyses, proved extraordinarily prescient. The $170–$175 support zone mentioned by every chatbot held exactly as predicted.

Gemini's Bearish Miss: Google's Gemini was the only AI to predict a bearish outcome (40% bullish / 60% bearish), which proved incorrect as NVDA gained 1.72% for the week. Ironically, Gemini's bearish bias led it to predict the weekly high most accurately (just 1.13% error), suggesting its technical analysis of resistance levels was sound even if its directional call was wrong. The "contrarian bear" approach cost Gemini in overall rankings, finishing last with 12 points.

Grok's Confident Trend Call: xAI's Grok expressed the highest bullish conviction (65%) and was rewarded when NVDA delivered a positive week. This directional accuracy earned Grok top marks in trend prediction but its price-level predictions were less precise, landing it in third place overall with 16 points.

Cumulative Performance: Three Rounds of Testing

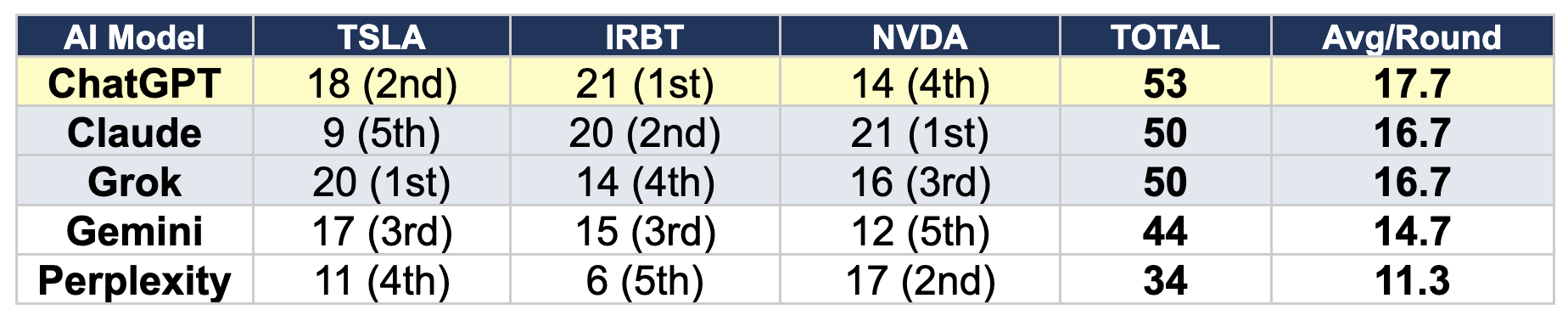

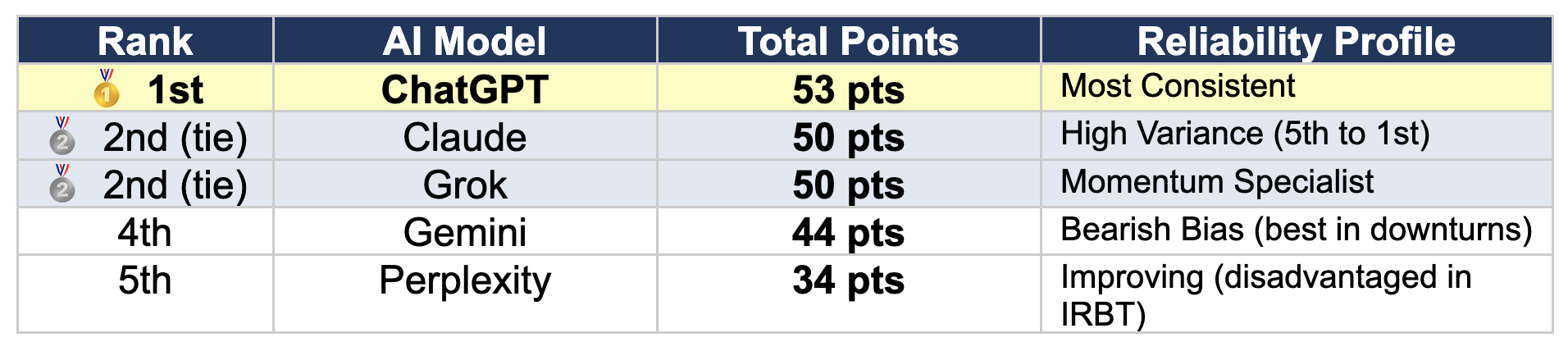

With three experiments now complete — iRobot bankruptcy (IRBT), Tesla (TSLA), and NVIDIA (NVDA) — we can begin to assess which AI chatbots demonstrate the most reliable stock prediction capabilities across different market conditions.

Cumulative Scoreboard: All Experiments

Current Cumulative Rankings (After 3 Rounds)

Reliability Assessment: What We've Learned

Most Reliable Overall: ChatGPT (OpenAI)

With 53 cumulative points and placements of 1st, 2nd, and 4th, ChatGPT demonstrates the most consistent performance across different market conditions. Its strength lies in balanced price predictions and particularly strong performance in distressed equity situations (IRBT bankruptcy).

Best for Momentum/Growth Stocks: Grok (xAI)

Grok won the Tesla experiment decisively and showed strong directional confidence in NVIDIA. Its bullish bias appears well-suited to high-growth technology stocks but may underperform in bearish or distressed situations.

Highest Upside Potential: Claude (Anthropic)

Claude shows the widest variance (ranging from 5th to 1st place), but when it "clicks", it produces exceptionally accurate predictions — including the best single prediction in this experiment (0.01% closing price error). Its risk-aware analytical framework excels in complex situations requiring nuanced analysis.

Best for Bearish Markets: Gemini (Google)

Gemini's consistent bearish bias proved advantageous in the IRBT bankruptcy (3rd place) but hurt its performance in bullish weeks. Investors expecting downturns may find Gemini's contrarian analysis valuable.

Strong Recovery: Perplexity

Perplexity started with a middle-of-the-pack 11 points (4th) in Tesla, then suffered a setback in IRBT due to pre-bankruptcy timing (6 pts, 5th). However, it bounced back strongly in NVIDIA with 17 points (2nd place). When given equal access to timely information, Perplexity demonstrates competitive analytical capabilities.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.