AI Chatbot Showdown: 6 Models Predict CoreWeave Stock After NVIDIA Deal

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In an unprecedented experiment, TheDayAfterAI News tasked six leading AI chatbots with the same challenge: predict CoreWeave (NASDAQ: CRWV) stock price movements for the trading week of January 26-30, 2026. The timing proved especially significant, as NVIDIA announced a landmark $2 billion strategic investment in CoreWeave on January 26, creating a real-time test of how different AI models interpret and respond to major market catalysts.

The models analysed include Gemini, Claude, Grok, ChatGPT, Perplexity, and Copilot. Each was provided with identical prompts and access to real-time market data, technical indicators, and fundamental analysis frameworks. The results reveal fascinating divergences in methodology, risk assessment, and price targets that offer valuable insights into how AI approaches financial forecasting.

Key Finding: All six AI models predicted a bullish outcome for CRWV, with probability estimates ranging from 56% to 72%. However, price targets varied significantly, with predicted Friday closes spanning from $95 to $108.

The Catalyst: NVIDIA's $2 Billion Investment

On January 26, 2026, NVIDIA announced a $2 billion strategic investment in CoreWeave at $87.20 per share, aimed at accelerating the buildout of over 5 gigawatts of AI factories by 2030. This announcement fundamentally altered the investment thesis for CRWV, providing what several AI models described as a "valuation floor" and validating CoreWeave's position in the AI infrastructure ecosystem.

The investment carries multiple implications: strategic validation from the world's leading AI chip manufacturer, reduced refinancing risk, and enhanced institutional confidence. Pre-market trading on January 26 saw CRWV surge approximately 10%, setting the stage for a volatile and potentially transformative trading week.

Comparative Results: The Predictions

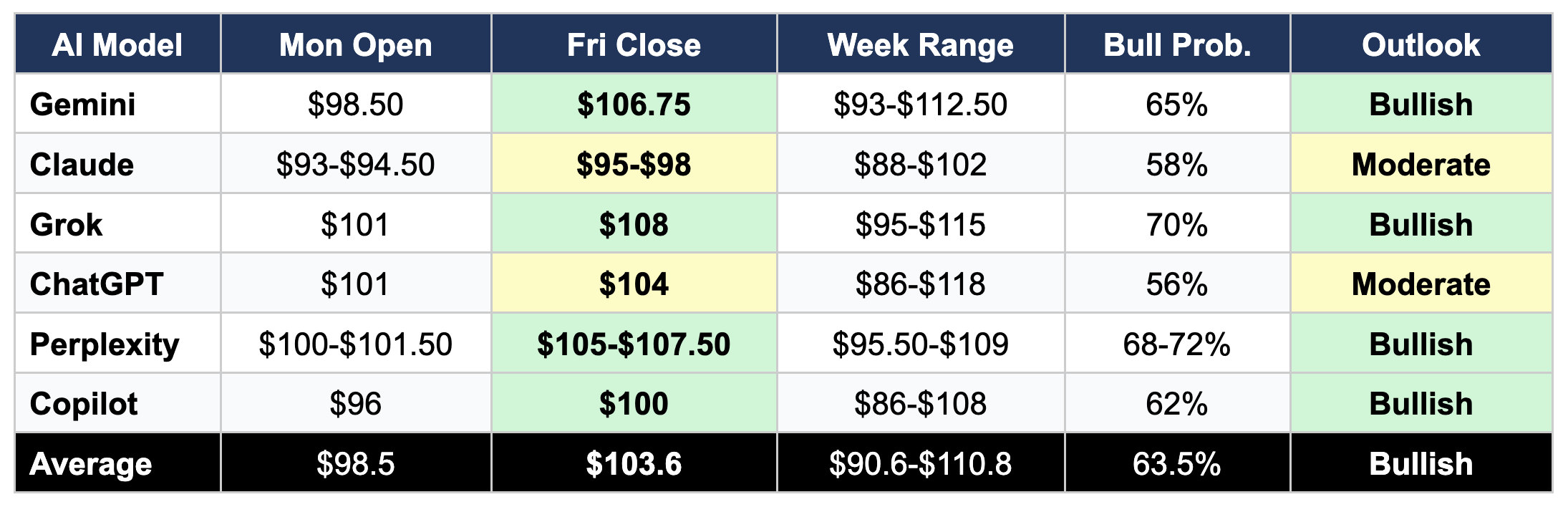

The following table summarises the key predictions from each AI model:

Individual Model Analysis

Gemini: The Strategic Equity Thesis

Gemini produced the most comprehensive institutional-style research report, framing the NVIDIA investment as a "valuation anchor" that fundamentally alters CRWV's risk profile. The model emphasised three converging forces: the $87.20 price floor established by NVIDIA, short squeeze potential from 20.76% short interest, and derivative catalysts from Microsoft and Meta earnings.

Unique to Gemini's analysis was its detailed day-by-day price path projection, predicting distinct phases of "Price Discovery," "Macro-Volatility Integration," and "Earnings-Derived Alpha." The model showed particular sophistication in analysing gamma exposure and options market mechanics, suggesting that market makers' hedging activities would act as a "magnet" pulling prices toward and through key strike levels.

Claude: The Cautious Contrarian

Claude emerged as the most conservative of the six models, with the lowest predicted Friday close ($95-$98) and the most tempered bullish probability (58%). This cautious stance was notable given the strong bullish catalyst of the NVIDIA investment.

Claude placed significant weight on headwinds that other models acknowledged but gave less emphasis: the $95-$100 overhead resistance zone, persistent insider selling totalling $1.91 billion over three months, and elevated short interest not as squeeze potential but as a signal of institutional scepticism. The model noted the inverse head-and-shoulders pattern forming but remained unconvinced of a definitive breakout.

Grok: The Squeeze Specialist

Grok delivered the highest bullish probability (70%) and one of the most aggressive price targets ($108 Friday close). The model's analysis centred heavily on the short squeeze mechanics, noting the 8.53% short float and 25.7% recent increase in short positions as creating significant "powder keg" potential.

Distinctive to Grok's approach was its integration of broader market sentiment indicators, including the VIX at 15.64 (indicating low volatility conducive to risk-on trades), put/call ratios showing bullish positioning, and institutional fund flows into AI-themed ETFs. The model provided a particularly useful indicator summary table correlating technical signals with trading interpretations.

ChatGPT: The Scenario Planner

ChatGPT took a distinctly scenario-based approach, explicitly modelling bull (30%), base (45%), and bear (25%) cases with corresponding price paths and outcomes. This probabilistic framework led to the lowest overall bullish probability among the aggressive models (56%) despite projecting a respectable $104 Friday close.

ChatGPT showed notable transparency about data limitations, explicitly acknowledging that true options flow data and institutional fund flows were largely paywalled. The model compensated by using publicly available proxies like put/call ratios and implied volatility, demonstrating intellectual honesty about the constraints of AI-based financial analysis.

Perplexity: The Research Synthesiser

Perplexity produced perhaps the most thoroughly sourced analysis, with 85 citations spanning financial data providers, news sources, and market analysis platforms. The model's 68-72% bullish probability range reflected this comprehensive approach, incorporating multiple data streams into a weighted probability framework.

Particularly valuable was Perplexity's detailed treatment of options expiration dynamics, explaining how gamma trading mechanics and open interest concentration at specific strike prices could amplify price movements into Friday's close. The model also provided the most extensive risk factor cataloguing, identifying both upside catalysts and downside risks with assigned probability weightings.

Copilot: The Concise Pragmatist

Copilot delivered the most concise analysis, focusing on actionable data points without extensive narrative elaboration. Its predictions ($96 open, $100 close, 62% bullish probability) positioned it in the moderate camp, acknowledging the NVIDIA catalyst while maintaining realistic expectations about resistance levels and macro risks.

The model's brevity belied its analytical rigour, correctly identifying the key technical levels ($87.20 support, $101-$105 resistance) and macro events (FOMC meeting, PPI data) that would drive price action. Copilot also provided specific trading guidance, recommending stops below $87 for long positions and reduced position sizing around Fed/PPI windows.

Key Themes Across All Models

The NVIDIA Valuation Floor: All six models identified the $87.20 NVIDIA investment price as establishing a psychological and potentially algorithmic "hard deck" for the stock. Several models noted that this price point would likely trigger aggressive buying algorithms whenever intraday volatility pushed prices toward this level, effectively compressing downside variance.

Short Squeeze Mechanics: Short interest data featured prominently in every analysis, though models interpreted the implications differently. While Grok and Gemini viewed elevated short interest as squeeze fuel, Claude treated it more as a reflection of legitimate institutional concerns. Short interest figures ranged from 8.53% to 20.76% across models, reflecting different data sources and calculation methodologies.

FOMC Risk Management: The January 27-28 FOMC meeting was universally identified as the week's primary macro risk event. All models expected rates to hold steady, but diverged on the implications of Chair Powell's press conference. Models generally agreed that dovish signals would accelerate the bullish case while hawkish surprises could cap upside or trigger pullbacks.

Earnings Correlation: Microsoft and Meta earnings (reporting January 28-29) were identified as crucial secondary catalysts. Multiple models noted that CoreWeave's revenue recognition is heavily dependent on hyperscaler capital expenditure, making their guidance effectively a proxy for CRWV's future revenue.

Observations on AI Financial Analysis

This comparative exercise reveals several important insights about the current state of AI-assisted financial analysis:

Methodological Diversity: Each model brought distinct analytical frameworks, from Gemini's institutional research style to ChatGPT's scenario-based planning. This diversity suggests that combining multiple AI perspectives may yield more robust analysis than relying on any single model.

Consensus with Variance: While all models predicted bullish outcomes, the range of predictions (56% to 72% bullish probability; $95 to $108 Friday close) demonstrates that AI models can reach similar directional conclusions while diverging significantly on magnitude.

Data Interpretation Differences: The same data points (short interest, insider selling, technical levels) were interpreted differently by different models. This highlights that AI analysis, like human analysis, involves subjective judgment about how to weight and interpret information.

Transparency Variations: Models differed notably in their acknowledgment of limitations and data gaps. This transparency is crucial for users to calibrate confidence in AI-generated predictions.

Conclusion

The AI chatbot showdown for CoreWeave's January 26-30 trading week demonstrates both the potential and limitations of artificial intelligence in financial forecasting. All six models correctly identified the bullish implications of NVIDIA's strategic investment while acknowledging the macro risks posed by the FOMC meeting and broader market dynamics.

The consensus view suggests a moderately bullish week for CRWV, with an average predicted gain of approximately 5% from Monday open to Friday close. However, the significant variance in predictions (from Claude's cautious $95-$98 to Grok's bullish $108) underscores the importance of viewing AI-generated forecasts as one input among many in the investment decision-making process.

We at TheDayAfterAI News will follow up with an accuracy assessment once the trading week concludes, providing transparency about how well these AI predictions matched actual market outcomes.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.