INTC Price Prediction: 6 AI Chatbots Forecast Intel Stock Jan 8–14, 2026

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In this analysis, TheDayAfterAI News presents a comprehensive comparison of stock price predictions from six leading AI chatbots—Grok, Gemini, ChatGPT, Perplexity, Copilot, and Claude — for Intel Corporation (NASDAQ: INTC) covering the five trading days from January 8 to January 14, 2026.

Intel has been making headlines following its CES 2026 unveiling of the Panther Lake Core Ultra Series 3 processors built on the company's 18A process node. The stock surged 6.52% on January 7, closing at $42.63 and reaching a 52-week high of $44.57. With this momentum as the backdrop, we asked each AI platform to provide their price predictions and probability assessments for the upcoming trading week.

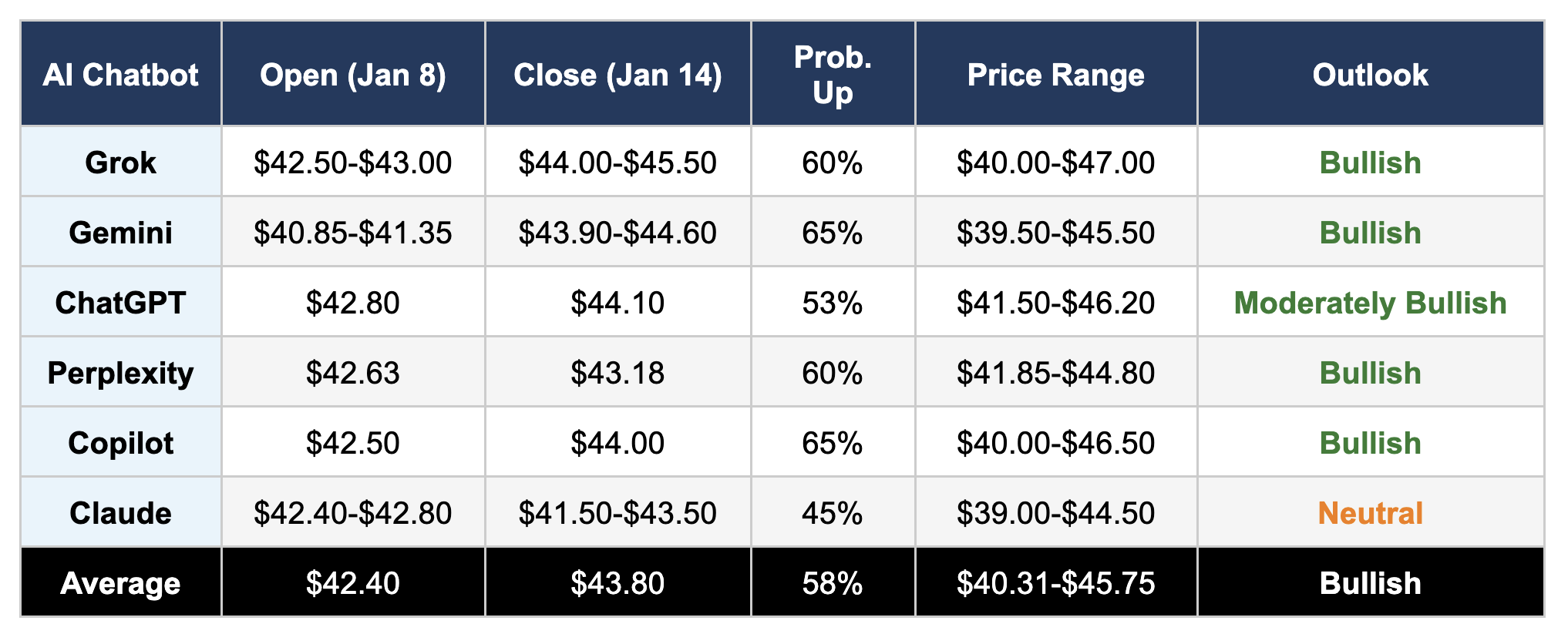

Key Finding: Five out of six AI chatbots express a bullish outlook, with predicted closing prices ranging from $43.18 to $45.50. The consensus probability of a price increase stands at approximately 58%, reflecting cautious optimism tempered by concerns about overbought technical conditions and upcoming macroeconomic data releases.

Prediction Summary at a Glance

Recent Performance

Intel closed January 7, 2026 at $42.63, marking a remarkable 6.52% single-day gain. The surge was catalyzed by the company's CES 2026 unveiling of the Core Ultra Series 3 "Panther Lake" processors, built on Intel's much-anticipated 18A process node. Trading volume exploded to 165.6 million shares, more than double the 20-day average of approximately 74 million shares.

Key Catalysts Identified by AI Chatbots

18A Process Node Validation: Intel's demonstration of functional silicon confirms the viability of its manufacturing roadmap, with yields reportedly improving at 7% per month.

Nvidia Strategic Investment: The completion of Nvidia's $5 billion investment in Intel provides validation of the foundry business and creates a strategic partnership for advanced packaging.

Semiconductor Sector Tailwinds: The broader semiconductor sector continues to benefit from AI-driven demand, with the industry forecast to reach $1 trillion in 2026.

Options Market Sentiment: All six chatbots noted bullish options positioning, with put/call ratios well below 1.0 indicating strong call buying activity.

Individual Chatbot Analyses

Grok

Grok presents a moderately bullish outlook, projecting a closing price of $44.00-$45.50 with a 60% probability of gains. The analysis emphasizes positive momentum from the Panther Lake launch and broader semiconductor sector strength. Grok highlights key support at $40 and resistance at the 52-week high of $44.57, noting that options expiration on January 9 could introduce short-term volatility. The estimated price range of $40.00-$47.00 reflects both upside potential and downside risk from macroeconomic data releases.

Gemini

Gemini delivers the most detailed technical analysis, assigning a 65% probability to the bullish scenario with a target closing price of $43.90-$44.60. The analysis introduces the concept of "Max Pain" at $39.00 for the January 9 options expiration, predicting short-term price suppression before a post-CPI relief rally on January 13. Gemini uniquely provides a day-by-day price roadmap, expecting the stock to dip toward $40 on January 8-9 before recovering to $44.25 by January 14. The analysis frames Intel's recovery as part of a broader "Silicon Renaissance" theme.

ChatGPT

ChatGPT offers a balanced perspective with a 53% probability of increase, projecting a closing price of $44.10. The analysis provides day-by-day estimates showing gradual appreciation from $42.80 (January 8) to $44.10 (January 14). ChatGPT emphasizes the importance of monitoring the January 9 employment report and the Federal Reserve Beige Book release on January 14 as key volatility catalysts. The analysis identifies $44.60 as the critical resistance level that would trigger acceleration toward $46-$47 in a bull scenario.

Perplexity

Perplexity provides the most conservative bullish forecast, predicting a closing price of $43.18 with a 60% probability of increase. The analysis stands out for its detailed scenario modeling, assigning 45% probability to a bullish continuation ($44.50-$45.00 close), 40% to consolidation ($43.50-$44.00 close), and 15% to a bearish pullback ($40.50-$41.50 close). Perplexity raises significant concerns about Intel's valuation metrics, including a trailing P/E of 710.5x and negative free cash flow of -$4.42 billion, describing these fundamentals as "alarming."

Copilot

Copilot expresses strong bullish conviction with a 65% probability of price increase, targeting $44.00 at close. The analysis highlights low short interest (approximately 2.7% of float) as reducing downside pressure and increasing potential for short-covering rallies. Copilot uniquely emphasizes the favorable VIX environment at 14-15, suggesting limited systemic fear. Key technical support is identified at $40.00 with resistance at $46.00-$46.50, and the analysis recommends using $40.00 as a tactical stop level for traders.

Claude

Claude emerges as the most cautious of the six chatbots, assigning only a 45% probability of price increase — essentially a coin flip. The predicted closing price range of $41.50-$43.50 (midpoint $42.50) suggests the stock may struggle to hold its gains. Claude's analysis emphasizes profit-taking risk following an 84% gain in 2025 and the gap between current prices and analyst consensus targets of $33-$39. The bearish case (25% probability) envisions a correction back toward $39.00-$41.00, while the bull case sees potential for $44.00-$45.00. Claude specifically warns that "Wall Street analysts recommend caution in playing INTC shares at current levels, since they may be due a correction following the surge."

Key Risk Factors

All six AI chatbots identified similar risk factors that could derail the bullish thesis:

Macroeconomic Data Releases: The January 9 Non-Farm Payrolls report and January 13 CPI release could trigger significant volatility. A hotter-than-expected inflation print could spike Treasury yields and pressure growth stocks.

Overbought Technical Conditions: Multiple chatbots noted elevated RSI and Stochastic RSI readings, suggesting the stock may be due for consolidation or mean reversion.

Options Expiration Effects: The January 9 weekly options expiration could create artificial price suppression toward the Max Pain level around $39-$40.

Profit-Taking Pressure: Following the substantial 2025 rally and hitting 52-week highs, institutional investors may lock in gains ahead of the January 22 earnings report.

Execution Risk: While the 18A process node has been validated, any negative news regarding yield improvements or manufacturing delays could rapidly reverse sentiment.

Conclusion

The consensus among six leading AI chatbots points to a moderately bullish outlook for Intel stock over the January 8-14, 2026 trading period. Five of six platforms predict higher closing prices, with the average expected gain of approximately 2-4% from the January 7 close of $42.63. However, the relatively modest probability spreads (45-65% for upside) and wide predicted price ranges ($39-$47) reflect genuine uncertainty in the face of multiple macro catalysts and technical crosscurrents.

The most bullish platforms (Gemini and Copilot at 65%) emphasize Intel's structural turnaround narrative and favorable options positioning. The most cautious platform (Claude at 45%) highlights valuation concerns and profit-taking risks. This divergence suggests that while the near-term momentum remains positive, investors should maintain disciplined risk management, particularly around the January 9 employment report and January 13 CPI release.

Key Levels to Watch: Support at $40.00 (psychological and technical floor), resistance at $44.57 (52-week high). A decisive break above $45 would signal continuation of the bullish trend, while a close below $40 would invalidate the bullish thesis and suggest a deeper correction toward $38.

For the complete breakdown — including day-by-day price targets, specific option strikes to watch, and detailed institutional flow analysis — please refer to the Full Report.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.