6 AI Chatbots Predict Robinhood (HOOD) Stock Trend After Q4 2025 Earnings

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

At TheDayAfterAI News, we believe the best way to evaluate AI-driven market analysis is to put multiple leading chatbots to the same test — side by side. In this instalment of our AI Chatbot Stock Forecast Series, we tasked six of the most widely used AI chatbots with a single challenge: predict the price trend of Robinhood Markets, Inc. (NASDAQ: HOOD) over a five-trading-day window from 11 February to 18 February 2026.

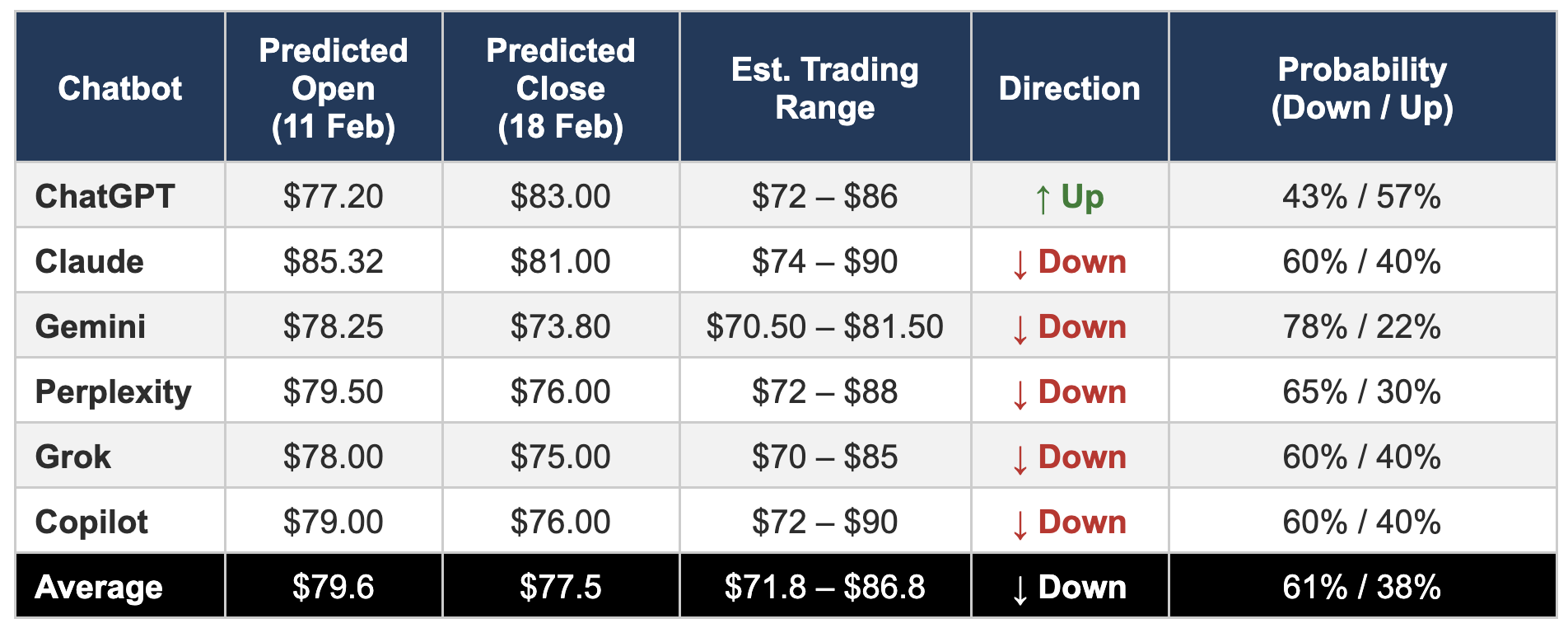

Each chatbot was given the same set of contextual data and asked to provide a predicted opening price on 11 February, a predicted closing price on 18 February, an estimated intra-period trading range, and a probability assessment of whether the stock would end the period higher or lower than its opening price. The six chatbots evaluated were ChatGPT, Claude, Gemini, Perplexity, Grok, and Copilot.

This article presents the consensus and divergences across these six forecasts, the key drivers each chatbot identified, and our editorial commentary on how AI chatbot predictions can serve as a research tool — rather than investment advice.

Why HOOD This Week?

The forecast period was deliberately chosen to coincide with one of the most event-rich weeks for Robinhood in recent memory. Several converging catalysts made this an ideal stress test for AI-driven analysis:

Post-Earnings Reaction: Robinhood released its Q4 and Full Year 2025 results after market close on Monday, 10 February 2026. While EPS of $0.66 beat the consensus estimate of $0.63, total revenue of $1.28 billion missed the $1.34–$1.37 billion consensus range. Critically, cryptocurrency transaction revenue plunged 38% year-over-year to $221 million, triggering a 7–8% after-hours selloff.

Dense Macro Calendar: The week featured the delayed January Jobs Report (11 February), the January CPI release (13 February), and FOMC Minutes (18 February) — any of which could swing risk sentiment dramatically for high-beta stocks like HOOD.

Presidents’ Day Holiday: Markets were closed on Monday, 16 February, compressing the trading week to just five sessions and creating liquidity constraints around options expiry on 13 February.

Crypto Sensitivity: With Bitcoin trading around $67,000 (down 47% from its October 2025 all-time high of $126,080) and the Crypto Fear & Greed Index at historically depressed levels, HOOD’s high correlation with crypto markets added an additional layer of volatility.

All Six Chatbots at a Glance

The table below consolidates the headline predictions from each of the six AI chatbots. All figures are in US dollars unless otherwise stated.

Five Bears, One Cautious Bull

The most striking finding from this exercise is the near-unanimous bearish consensus. Five out of six chatbots predicted that HOOD would close below its opening price on 18 February, with the probability of a decline ranging from 60% to 78%. Only ChatGPT predicted a net gain over the period, forecasting a +7.5% move from $77.20 to $83.00 — driven by its emphasis on oversold conditions and dip-buying potential.

The consensus predicted opening price clustered around $78–$79, which closely tracked the pre-market indications on the morning of 11 February (pre-market prints were in the $77–$80 range). The notable outlier was Claude, which used the actual confirmed opening price of $85.32 rather than the pre-market estimate, resulting in a higher reference point but still predicting a decline.

Key Drivers Identified Across Chatbots

1. Post-Earnings Sentiment (Universally Cited)

All six chatbots identified the Q4 2025 earnings miss as the dominant near-term catalyst. The revenue shortfall of approximately $60–$90 million versus consensus, concentrated in cryptocurrency transaction revenue, was flagged as the primary driver of the gap-down open. Gemini offered the most detailed analysis, noting the “trapped long” dynamic and the quality of the EPS beat (driven by net interest income rather than core transactional growth).

2. Cryptocurrency Market Correlation (Cited by All)

Every chatbot highlighted HOOD’s significant correlation with Bitcoin and the broader crypto market. Claude provided particularly granular data, noting Bitcoin’s 47% decline from its October 2025 ATH, the Crypto Fear & Greed Index at 6 (near record lows), and Robinhood’s roughly 50% price correlation with crypto markets. The structural question — whether Bitcoin ETF adoption has permanently cannibalized HOOD’s crypto trading revenue — was raised by Gemini and Claude.

3. Technical Breakdown (Cited by All)

All chatbots agreed the technical picture was decisively bearish: the stock was trading well below its 20-day, 50-day, and 200-day moving averages. RSI readings clustered around 34–45 (near oversold but not extreme), and MACD was firmly negative across the board. Perplexity stood out for its detailed quantitative approach, citing specific ATR figures (~$6/day, ~7% of price) and using them to derive statistically grounded trading ranges.

4. Macro Event Risk (Cited by All)

The dense economic calendar — Jobs Report, CPI, and FOMC Minutes — was universally flagged as a source of binary risk. Gemini was notably the most detailed here, modelling specific CPI scenarios and their implications for HOOD’s valuation through the lens of discount rates and margin competitiveness. ChatGPT took a more constructive view, suggesting that benign macro data could facilitate a mean-reversion bounce.

5. Options Positioning and Market Microstructure (Cited by 5 of 6)

Five chatbots analysed options flow and expiry dynamics. Notable observations included a put/call open interest ratio of just 0.3 (cited by Claude as contrarian bullish), significant put positioning at the $71 strike expiring 13 February (cited by Perplexity and Gemini), and gamma squeeze mechanics that could amplify moves in either direction. Grok’s analysis was the most concise on this point, focusing on the hedging-versus-conviction distinction in options flow.

6. Seasonal and Structural Headwinds (Cited by 4 of 6)

Claude, Gemini, Perplexity, and Copilot all noted the negative seasonal backdrop: Presidents’ Day is historically the weakest market holiday, February is HOOD’s worst calendar month (20% historical probability of positive returns), and shortened trading weeks tend to amplify the prevailing trend direction. The pre-holiday liquidity drain ahead of the three-day weekend was flagged as a risk amplifier.

Day-by-Day Forecast Comparison

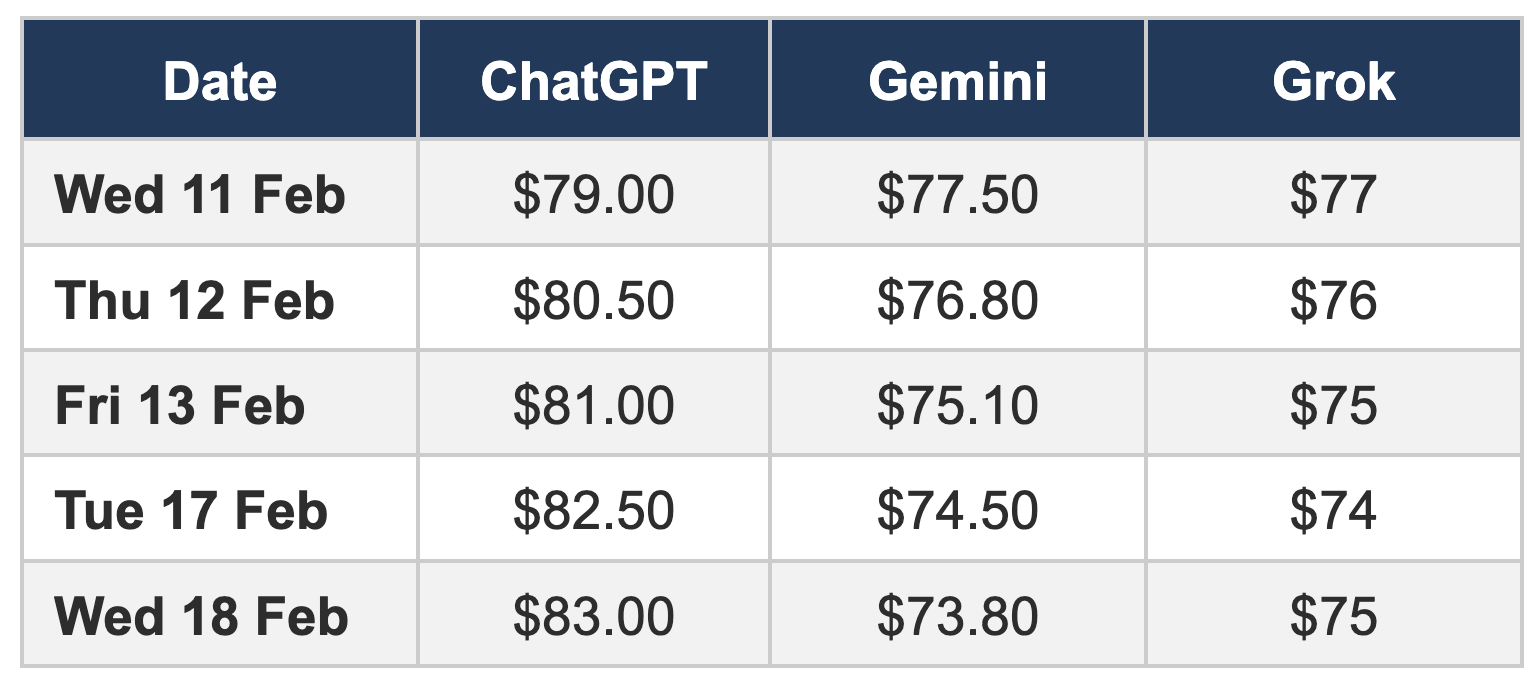

Three chatbots — ChatGPT, Gemini, and Grok — provided detailed day-by-day price estimates. The table below compares their daily projected closing prices:

The divergence is stark. ChatGPT envisioned a steady recovery from the gap-down open, with each subsequent session closing higher as oversold conditions attracted dip buyers. Gemini, by contrast, modelled a “lower highs, lower lows” trajectory, with the CPI release on Friday 13 February acting as an inflection point that accelerated selling into the long weekend. Grok projected a similar declining pattern with a modest bounce on the final day.

Notable Differences in Analytical Approach

Depth and Sourcing: The chatbots varied enormously in analytical depth. Gemini produced the most comprehensive report — a 13-page equity research-style document with 33 cited sources covering everything from gamma squeeze mechanics to Bitcoin ETF cannibalization theory. Claude also delivered an extensive, well-sourced analysis with 60+ references and detailed options flow data. By contrast, Grok and Copilot offered more concise but still substantive analyses, each under 6 pages.

Opening Price Reference: A significant methodological difference emerged in how chatbots defined the opening price. Claude used the confirmed actual opening price of $85.32 (which included intraday recovery from the pre-market lows), while the other five chatbots anchored to pre-market prices ranging from $77.20 to $79.50. This distinction materially affects the directional probability calculation: Claude’s higher reference point makes it easier to predict a decline, while ChatGPT’s lower reference point facilitated its bullish call.

Structural vs. Cyclical Analysis: Gemini was unique in raising the structural question of whether Bitcoin ETF adoption had permanently impaired Robinhood’s crypto revenue model (the “Cannibalization Theory”). This deeper strategic analysis went beyond the cyclical considerations that dominated the other forecasts and suggests that HOOD’s valuation multiple may need to re-rate even after the current crypto downturn passes.

The Contrarian Bull Case: ChatGPT’s bullish outlook stood alone but was not without logic. It emphasised the oversold technical conditions, the potential for mean-reversion after a large gap-down, and the observation that short interest was not extreme enough to suppress a sustained bounce. This contrarian framework is a legitimate analytical lens, even if the majority of chatbots disagreed with its conclusion.

Editorial Commentary

This comparative exercise reinforces several important observations about the current state of AI-driven market analysis:

Convergence on fundamentals, divergence on interpretation. All six chatbots identified the same core drivers — the earnings miss, crypto weakness, macro risk, and technical breakdown. Where they differed was in how they weighted these factors against potential catalysts for recovery. This mirrors how human analysts can look at the same data and reach different conclusions.

AI chatbots as a research aggregation tool. The real value of this exercise is not in any single prediction, but in the rapid synthesis of fundamental, technical, and macro data across multiple analytical frameworks. A human analyst reviewing all six reports gets a more complete picture of the risk landscape than any single chatbot provides alone.

Confidence calibration varies widely. Gemini expressed 78% conviction in a decline, while Claude and Copilot were at 60%. These differences in calibration are important — higher conviction does not necessarily mean higher accuracy. Investors should pay attention not just to the direction of the prediction, but to the reasoning behind the confidence level.

None of these predictions constitute investment advice. AI chatbots cannot account for sudden news events, geopolitical shocks, or the reflexive dynamics of market sentiment. They are, at best, sophisticated tools for organising publicly available information — not crystal balls.

Conclusion

The overwhelming consensus from six leading AI chatbots is that HOOD faces continued near-term pressure during the 11–18 February 2026 trading window, with a predicted decline probability averaging approximately 61% across all models. The expected closing price on 18 February clusters around $75–$81, representing a modest decline from the opening price.

The key risk events to watch are the January CPI report on 13 February and any developments in the cryptocurrency market over the Presidents’ Day long weekend. A soft CPI print combined with crypto stabilisation represents the most credible path to the bullish scenario, while a hot CPI reading and further Bitcoin weakness would validate the bearish consensus.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.