HIMS Stock Forecast: 6 AI Chatbots Predict Market Trajectory Amid FDA and Legal Crisis

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

At TheDayAfterAI News, we believe one of the most compelling applications of generative AI lies in its ability to synthesise vast quantities of financial data, news, and market signals into coherent forward-looking assessments. To test this premise in a high-stakes, real-world scenario, we presented the same analytical challenge to six of the most widely used AI chatbots: Google Gemini, xAI Grok, OpenAI ChatGPT, Perplexity, Microsoft Copilot, and Anthropic Claude.

The challenge was straightforward: given all available information as of pre-market Monday, February 9, 2026, forecast the stock price trajectory of Hims & Hers Health, Inc. (NYSE: HIMS) for the five trading days from February 9 to February 13, 2026. Each chatbot was asked to provide a predicted opening price for Monday, a predicted closing price for Friday, an estimated weekly trading range, and a probability assessment of whether the stock would close the week higher or lower than it opened.

The timing was far from arbitrary. HIMS entered this week amid arguably the most acute crisis in its corporate history: a regulatory crackdown by the FDA, a patent infringement lawsuit from Novo Nordisk, the forced withdrawal of its compounded oral semaglutide pill, and a DOJ referral — all converging against a backdrop of delayed macroeconomic data releases (Non-Farm Payrolls and CPI) that threatened to amplify volatility across the entire market.

This article presents a side-by-side comparison of all six forecasts, examines the areas of consensus and divergence, and reflects on what this experiment reveals about the current state of AI-assisted financial analysis.

The Crisis Context: What Hit HIMS

Before comparing the forecasts, it is essential to understand the catalysts that created this extraordinary situation. All six chatbots identified the same core set of events, though they varied in how they weighted their impact:

The Compounding Crisis: On February 5, 2026, Hims & Hers launched a compounded oral semaglutide pill at $49/month, dramatically undercutting branded Wegovy. By February 7, the company halted sales following intense FDA regulatory pressure. This reversal eliminated what many analysts had modelled as a multi-hundred-million-dollar revenue opportunity.

The Novo Nordisk Lawsuit: On February 9, Novo Nordisk filed a patent infringement lawsuit (US Patent 8,129,343) targeting HIMS’s injectable compounded semaglutide products, seeking both a permanent injunction and monetary damages. This introduced binary legal risk into the stock’s valuation.

Regulatory and Legal Escalation: The HHS General Counsel referred HIMS to the DOJ for investigation, and the FDA signalled its intent to take “decisive steps” to restrict GLP-1 APIs in non-approved compounded drugs. Class-action securities fraud investigations were also underway.

Macroeconomic Headwinds: The week featured delayed releases of both the January Non-Farm Payrolls report (Wednesday, February 11) and the CPI report (Friday, February 13), creating a “double-event” risk environment that concentrated volatility into a narrow window.

The net result: HIMS shares, which closed at $23.02 on Friday, February 6, were trading in the $18–19 range pre-market on Monday — a decline of approximately 18–22%.

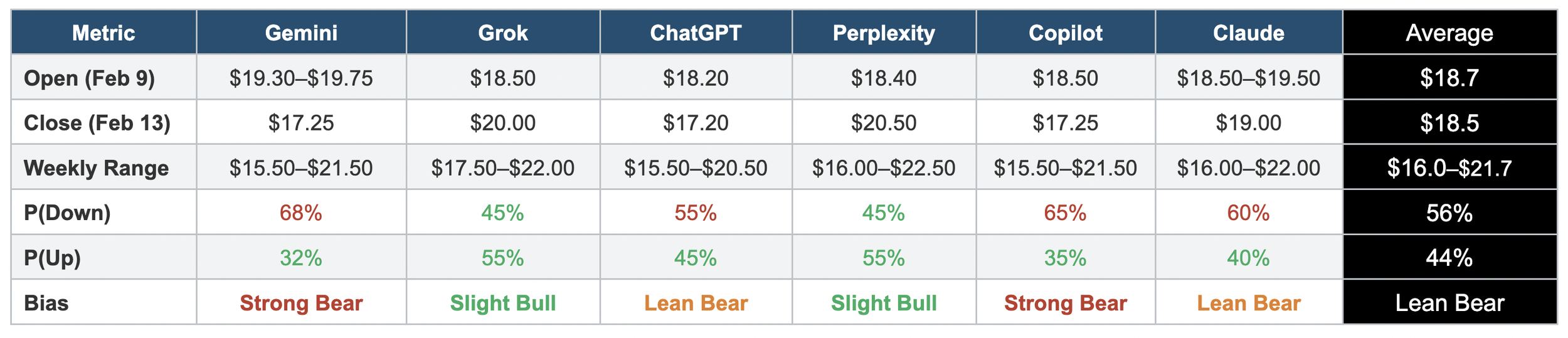

The Forecasts at a Glance

The table below summarises the key numerical predictions from each chatbot. All figures are in US dollars.

Note: Grok’s predicted closing price of $20.00 and Perplexity’s $20.50 represent the most optimistic forecasts, while Gemini, ChatGPT, and Copilot converged on approximately $17.20–$17.25 on the bearish side. Claude split the difference at ~$19.00.

Individual Chatbot Analysis Summaries

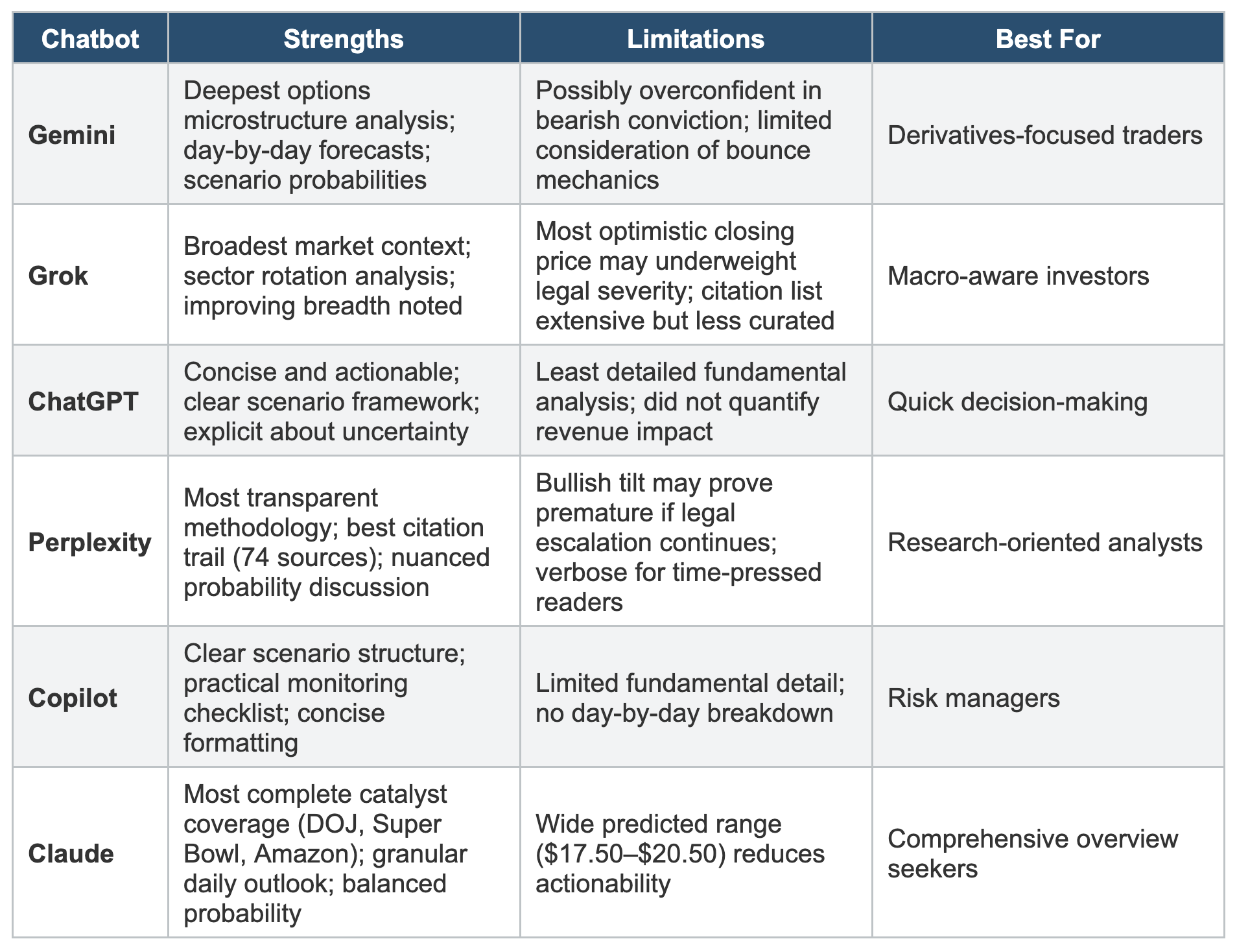

Google Gemini — “Strong Bearish Continuation”

Gemini produced the most extensive and aggressively bearish analysis of the six. It framed the situation as an “existential threat” to HIMS’s business model, arguing that the company was being re-rated from a “high-growth telehealth disruptor to a distressed asset facing potential regulatory obsolescence.”

Key distinguishing features of Gemini’s analysis included a detailed day-by-day price forecast predicting a steady decline from $18.80 on Monday to $17.25 by Friday, an in-depth treatment of options market microstructure including gamma exposure and the “gamma trap” mechanism, and explicit scenario probabilities (Bull 15%, Bear 55%, Base 30%). Gemini assigned the highest bearish probability of any chatbot at 68% and was the only one to provide specific daily closing price predictions for each trading session. Its treatment of the TrumpRx competitive threat and the “flight to quality” sector dynamics was also uniquely detailed.

xAI Grok — “Oversold but Vulnerable”

Grok took the most balanced approach, acknowledging the severity of the regulatory crisis while giving significant weight to oversold technical conditions and improving market breadth. Its predicted closing price of $20.00 reflected a belief in a “modest recovery on oversold bounce and short covering.”

Grok was notably the only chatbot to assign a greater than 50% probability to the stock closing above its opening price (55%), suggesting it weighted the technical rebound thesis more heavily than the fundamental deterioration. It also provided broader market context, noting that small-cap and value stocks had been outperforming, which could benefit a beaten-down mid-cap name like HIMS. Its analysis included a comprehensive list of over 100 citations, reflecting a wide data-gathering approach.

OpenAI ChatGPT — “Gap-and-Go Risk”

ChatGPT delivered a concise but focused analysis that emphasised the “gap-and-go” risk — the possibility that Monday’s gap down would not find a floor and would continue lower throughout the week. Its base-case path predicted a decline from $18.20 at Monday’s open to $17.20 by Friday’s close, with a particularly notable intraday low estimate of $16.00 on Friday.

ChatGPT distinguished itself through its explicit acknowledgement of the wide distribution of outcomes, noting that the implied volatility of ~111% mechanically implied large daily swings. It provided a clear framework for what would change the outcome: further legal escalation (bearish) versus “no new bad news” plus short covering (bullish). Its probability split of 55% down / 45% up was moderate.

Perplexity — “Modest Rebound from Depressed Open”

Perplexity produced the most methodologically transparent analysis, with the most extensive citation trail (74 sources) and the clearest separation of data, interpretation, and judgement. Its predicted Friday close of $20.50 was the most bullish of all six chatbots.

The core of Perplexity’s contrarian thesis rested on three pillars: extreme oversold technicals (RSI ~23–24), exceptionally high short interest (~35% of float creating squeeze potential), and the statistical observation that after major one-off gaps, a reflexive bounce is historically more probable than a second waterfall decline of identical magnitude. Perplexity was careful to note that this was “not a high-confidence bullish call” and that the distribution was “wide and skewed by legal headline risk.” Its treatment of institutional ownership (63–73%) and its implications for tape behaviour was uniquely detailed.

Microsoft Copilot — “Legal/Regulatory Overhang Dominates”

Copilot delivered a structured, scenario-based analysis with a clear emphasis on the legal and regulatory overhang as the dominant driver. Its probability split of 65% bearish / 35% bullish aligned closely with Gemini, making it the second-most bearish forecaster.

Copilot’s three-scenario framework (Base Negative 65%, Stabilisation/Squeeze 30%, Tail Risk 5%) was clearly presented with specific price targets for each. Its treatment of gamma exposure and options pinning mechanics was concise but effective, and its “monitoring checklist” — listing specific items to watch in real time — was a practical addition not found in other analyses. The predicted closing price of $17.25 matched Gemini exactly, suggesting similar weighting of the fundamental impairment.

Anthropic Claude — “Crisis Mode, High Volatility with Slight Bearish Bias”

Claude’s analysis was the most comprehensive in terms of company-specific catalysts, uniquely highlighting the DOJ referral under the Federal Food, Drug, and Cosmetic Act and Title 18, the Super Bowl LX advertisement (a mixed catalyst), and Amazon Pharmacy’s competitive pricing threat. Its midpoint closing prediction of ~$19.00 placed it in the centre of the forecast range.

Claude provided the most granular day-by-day outlook with specific catalysts for each session (CPI on Wednesday in its calendar, PPI on Thursday), and was the only chatbot to explicitly flag the upcoming Q4 earnings on February 23 as a source of positioning uncertainty. Its probability assessment of 60% bearish / 40% bullish represented a moderate stance, and its identification of $20.00 as the critical level to watch was a clear, actionable call.

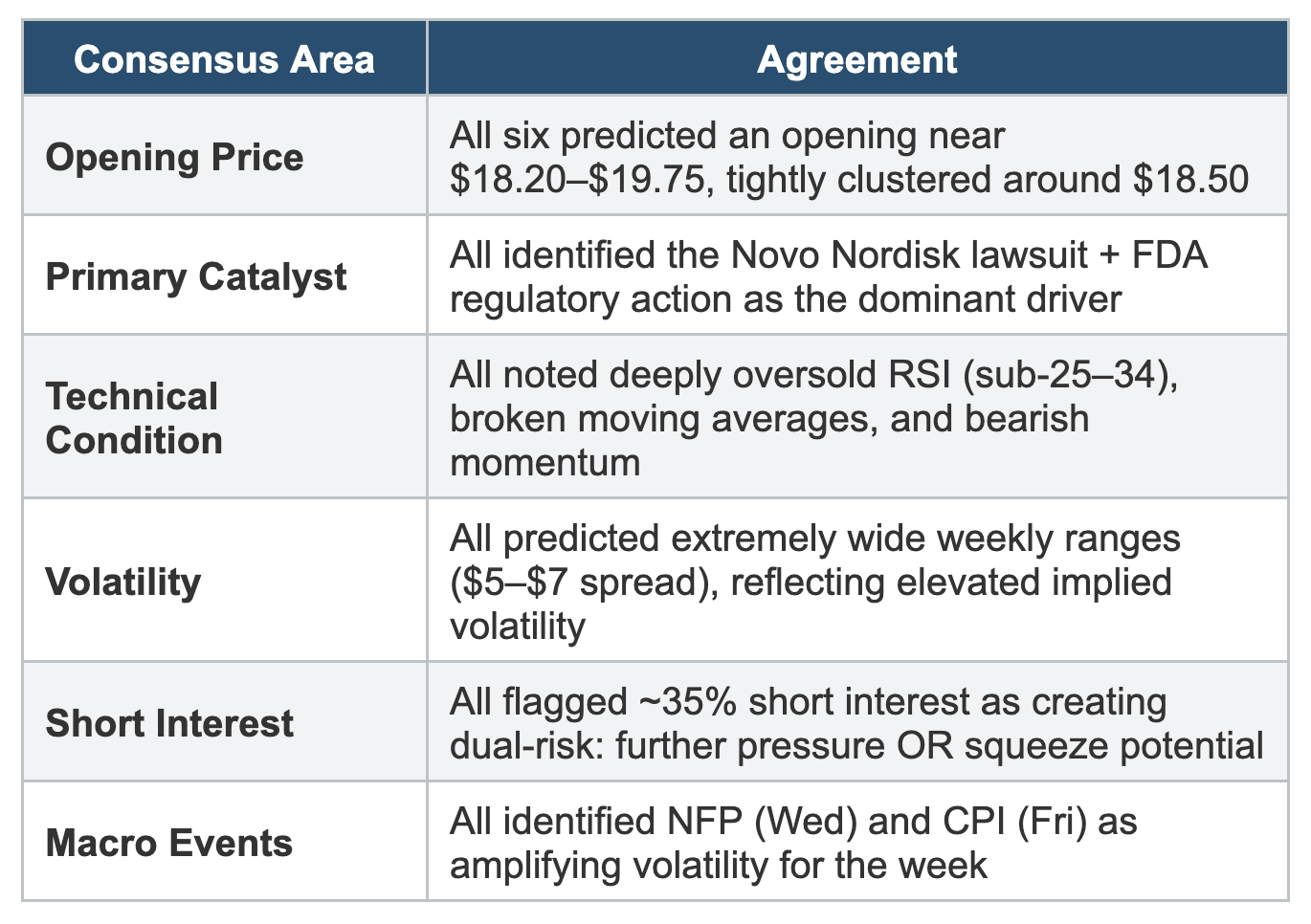

Areas of Strong Consensus

Despite their different approaches and conclusions, the six chatbots showed remarkable agreement on several key points:

Key Points of Divergence

The most significant split was on the question of whether the stock would close the week higher or lower than it opened. This created two distinct camps:

The Bear Camp (Gemini, Copilot, ChatGPT, Claude)

These four chatbots assigned 55–68% probability to a net weekly decline, with Gemini and Copilot being the most bearish. Their thesis centred on the severity of the fundamental impairment: the loss of GLP-1 revenue, the existential nature of the patent lawsuit, and the expectation that institutional investors would de-risk. They argued that “oversold” conditions in the context of genuine structural damage do not reliably produce bounces.

The (Cautious) Bull Camp (Grok, Perplexity)

Grok and Perplexity assigned 55% probability to a net weekly gain, though both emphasised this was not a high-conviction call. Their thesis rested on mean-reversion mechanics: the combination of extreme oversold technicals, very high short interest, and a major gap-down creating conditions where reflexive bounces are statistically more probable than continued waterfall declines. Perplexity in particular argued that “for a 5-day forecast, this combination argues against extrapolating another straight-line 20–30% drop.”

Comparative Assessment of Analytical Quality

Each chatbot brought distinct strengths to this exercise. The following table summarises our editorial assessment:

What This Experiment Tells Us About AI-Assisted Financial Analysis

This exercise reveals several important insights about the current capabilities and limitations of AI chatbots in financial forecasting:

Convergence on Inputs, Divergence on Interpretation

All six chatbots had access to essentially the same information and identified the same key catalysts. The divergence in their conclusions—a $3.30 spread between the most bearish and most bullish closing price predictions—demonstrates that even with identical inputs, the weighting and interpretation of factors can produce materially different outcomes. This mirrors the reality of human equity research, where analysts with the same Bloomberg terminal can reach opposing conclusions.

The Oversold Debate

The central analytical disagreement—whether oversold technicals in the context of genuine fundamental impairment signal a buying opportunity or a “falling knife”—is precisely the kind of question that separates profitable from unprofitable trading. None of the chatbots resolved this question definitively, and in fairness, neither can human analysts. The chatbots that performed best were those that explicitly acknowledged the tension and quantified their uncertainty.

Citation and Transparency

There was a striking variance in methodological transparency. Perplexity’s 74 numbered citations and Gemini’s detailed endnotes stood in contrast to some other analyses that made claims without clear sourcing. For investors relying on AI-generated analysis, the ability to verify underlying data is crucial.

No Chatbot Provided Investment Advice

Appropriately, all six chatbots included disclaimers noting that their outputs do not constitute investment advice. This is particularly important given the speculative nature of short-term stock price forecasting.

Conclusion

The collective verdict of six AI chatbots on HIMS for the week of February 9–13, 2026, can be summarised as follows: high volatility is virtually certain, the downside risks are severe and well-understood, but the magnitude of the selloff has created technical conditions where a reflexive bounce cannot be ruled out.

License This Article

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.