AI Stock Battle: 5 Chatbots Forecast NVIDIA’s Week

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

NVIDIA entered this pivotal week trading at $175.02 (closing price December 12, 2025), down 17.5% from its October all-time high of $212.19. The week featured an unusually dense concentration of market-moving events: quad witching options expiration, critical economic data releases, and central bank decisions from multiple jurisdictions. This complex environment provided an ideal testing ground for AI-powered market analysis.

This article presents the unfiltered predictions from Perplexity, Gemini, Grok, ChatGPT, and Claude—examining where they agreed, where they diverged, and what their collective wisdom suggests about the future of AI in financial forecasting.

Executive Summary: The Predictions at a Glance

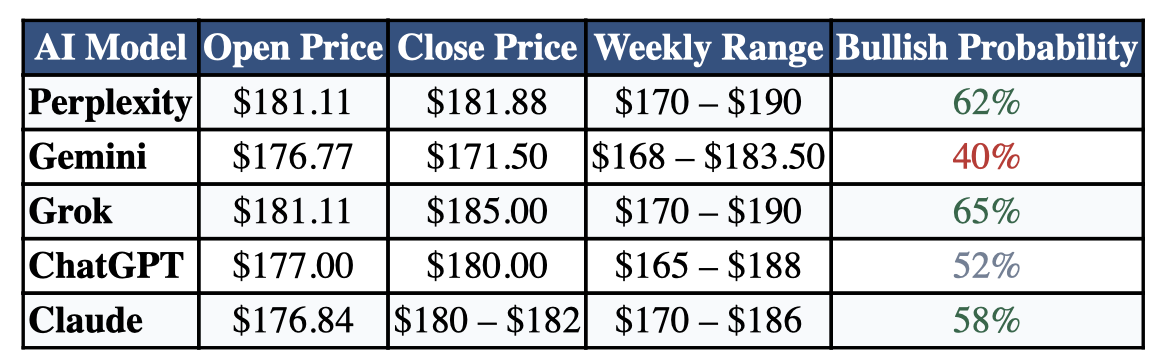

Before diving into the detailed analysis, here is what each AI predicted:

Summary of AI chatbot predictions for NVDA, December 15–19, 2025

Consensus Metrics

Average Predicted Close: $179.9

Average Bullish Probability: 55.4%

Average Range: $168.6 – $187.5

Overall Sentiment: Cautiously Bullish

Perplexity: The Probability Weighter

Perplexity delivered the most structured probabilistic analysis, presenting four distinct scenarios with explicit probability weightings. Its methodology centred on integrating technical indicators with options market data, particularly emphasising the significance of the $180 max pain level for weekly options expiration.

Key Insights: Perplexity identified the oversold stochastic reading of 29.65 as historically generating mean reversion bounces. It highlighted that strong institutional flows ($215.2 billion net inflows over 12 months) provide substantial support floors during pullbacks.

Scenario Framework: The model assigned 50% probability to neutral recovery ($180–$185), 30% to bearish continuation ($170–$177), 15% to a bullish Santa Rally recovery ($187–$195), and 5% to a sharp selloff scenario ($160–$170).

Distinctive Feature: Perplexity was unique in providing detailed risk management frameworks for both bullish and bearish traders, including specific entry points, profit targets, and stop-loss levels.

Gemini: The Contrarian Bear

Gemini emerged as the most bearish of the five AI models, predicting a closing price of $171.50—notably below the Friday close of $175.02. This contrarian stance was driven by concerns over "AI fatigue" narratives and technical resistance patterns.

Key Insights: Gemini emphasised that NVDA was trading below both its 5-day and 10-day moving averages, signalling short-term weakness. It identified a potential "Broadening Formation" on the daily chart—a pattern often associated with high volatility and indecision at market tops.

Catalyst Focus: The model paid particular attention to China's economic weakness (industrial output hitting 15-month lows) and its implications for semiconductor demand. Gemini also highlighted the H200 chip export authorisation as a "sell the news" event rather than a bullish catalyst.

Distinctive Feature: Gemini was the only AI to suggest that triple witching (quad witching) could drive the stock toward option strike prices with high open interest near $175 or $180, creating downward "pinning" pressure.

Grok: The Optimistic Bull

Grok presented the most bullish outlook among the five AIs, predicting a closing price of $185 with a 65% probability of weekly gains. Its analysis heavily weighted positive analyst sentiment and strong fundamental catalysts.

Key Insights: Grok highlighted the overwhelming analyst consensus: 39 of 41 analysts rate NVDA a "Buy" with an average price target of $248–$258, implying approximately 40% upside. It noted the low short interest (1.00% of float) as indicating minimal bearish conviction.

Catalyst Focus: The model emphasised increased H200 production for China demand as a key tailwind and referenced strong Q3 earnings momentum (revenue of $57 billion, up 62% year-over-year).

Distinctive Feature: Grok provided extensive coverage of options market positioning, noting that a $27 million synthetic long position indicated institutional bullish bets. It also incorporated sentiment from social media platforms, noting predictions ranging from $150 (bearish) to $300 (bullish).

ChatGPT: The Balanced Pragmatist

ChatGPT delivered the most neutral assessment, with a 52% up versus 48% down probability split. Its analysis balanced technical considerations against macroeconomic uncertainty, resulting in a "coin flip" directional call.

Key Insights: ChatGPT noted that NVDA was sitting near its 200-day moving average support area (mid-$170s), which historically encourages mean-reversion bounces if macro risk doesn't overwhelm. However, it also identified "overhead supply" in the $180–$186 zone from recent selling.

Catalyst Focus: The model flagged Micron earnings (Wednesday, December 17) as a potential sector-wide catalyst and highlighted the "data-heavy week" with delayed economic releases due to government shutdown-related backlogs.

Distinctive Feature: ChatGPT uniquely offered conditional "If X then Y" checkpoints for updating forecasts mid-week, demonstrating a dynamic approach to prediction adjustment based on price action triggers.

Claude: The Risk-Aware Moderate

Claude's analysis occupied the middle ground, predicting a closing price of $180–$182 with a 58% probability of weekly gains. Its methodology emphasised risk factors alongside bullish catalysts, providing a balanced but cautiously optimistic outlook.

Key Insights: Claude identified a mixed but improving technical picture: RSI readings of 33–47 approaching oversold territory, negative MACD confirming bearish short-term momentum, but early signs of a potential bullish crossover emerging.

Catalyst Focus: The model provided the most comprehensive coverage of quad witching mechanics, noting that this quarterly convergence historically generates the highest volume trading days of the year with 50–100% higher than average volume.

Distinctive Feature: Claude was unique in addressing the seasonal "Santa Claus Rally" effect quantitatively: since 1950, the period has been positive 79% of the time with an average gain of 1.3%. It also noted that first-year presidential cycle Decembers following an up year show 100% positive returns across 13 historical occurrences.

Comparative Analysis: Where the AIs Agree and Diverge

Points of Agreement

Support Zone: All five AIs identified $170–$175 as critical support. A breach of $170 was universally flagged as a trigger for accelerated selling pressure.

Resistance Zone: The $182–$188 range was consistently identified as overhead resistance, with multiple failed breakout attempts noted in recent price action.

Volatility Expectation: All models anticipated elevated volatility due to quad witching options expiration on Friday, December 19.

Fundamental Strength: Despite short-term technical weakness, all AIs acknowledged NVIDIA's strong fundamental position: dominant AI market share, Blackwell demand "off the charts," and positive institutional fund flows.

Points of Divergence

China H200 Exports: Grok viewed the authorisation of H200 exports to China (with 25% fee) as bullish, estimating $25–30 billion annual revenue potential. Gemini, conversely, interpreted this as a "sell the news" event with limited upside impact.

Technical Interpretation: Perplexity and Claude emphasised oversold conditions as bounce opportunities, while Gemini focused on bearish patterns (broadening formation, lower highs/lower lows).

Probability Spread: The bullish probability ranged from 40% (Gemini) to 65% (Grok)—a 25 percentage point spread indicating significant uncertainty in directional forecasting.

Key Takeaways for Investors

The Consensus Leans Bullish but Not Overwhelmingly: With an average bullish probability of 55.4%, the AI collective suggests a slight edge for upside, but the margin is thin enough to warrant caution.

The $170–$175 Zone Is Critical: Every AI identified this as make-or-break support. Investors should monitor this level closely as a potential trigger for position adjustment.

Quad Witching Amplifies Risk: Friday's options expiration creates mechanical volatility that can overwhelm fundamental signals. Position sizing should account for 3–5% intraday swings.

Fundamentals Remain Strong: Despite short-term uncertainty, all AIs agreed that NVIDIA's dominant position in AI infrastructure, Blackwell demand, and institutional support provide a strong floor for the stock.

AI Analysis Has Limitations: The 25 percentage point spread in bullish probabilities (40%–65%) demonstrates that even sophisticated AI models can reach meaningfully different conclusions from the same data.

The Future of AI-Powered Market Analysis

This experiment reveals both the promise and limitations of AI in financial forecasting. On one hand, each chatbot demonstrated sophisticated understanding of technical analysis, options mechanics, macroeconomic factors, and market microstructure. On the other hand, the significant variance in predictions—particularly between Gemini's bearish $171.50 and Grok's bullish $185—underscores that AI analysis is not a crystal ball.

What emerges most clearly is that AI excels at synthesising vast amounts of information and presenting structured analytical frameworks. However, the ultimate investment decision must still incorporate human judgment, risk tolerance, and portfolio context that no AI can fully appreciate.

We at TheDayAfterAI News will continue to explore the intersection of artificial intelligence and financial markets.

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.