TSLA Stock Forecast: 5 Top AIs Predict Tesla's Price for Dec 15-19

Disclaimer: This article is for informational and educational purposes only. The predictions and analyses presented herein were generated by AI systems and should not be construed as financial advice, investment recommendations, or solicitations to buy or sell any securities. Stock prices are inherently unpredictable, and all investments carry risk of loss. Past performance does not guarantee future results. Readers should consult qualified financial advisors before making any investment decisions. TheDayAfterAI News and its contributors do not accept liability for any losses arising from reliance on this content.

In an unprecedented experiment, TheDayAfterAI News tasked five leading AI chatbots with the same challenge: predict Tesla (TSLA) stock performance for the trading week of December 15-19, 2025. Each AI was given identical parameters and asked to analyze technical indicators, market sentiment, fundamental catalysts, and macroeconomic factors to provide price forecasts and probability assessments.

The participating AI models were: Claude (Anthropic), Perplexity, Gemini (Google), Grok (xAI), and ChatGPT (OpenAI). This article compares their methodologies, forecasts, and reasoning to help readers understand how AI tools approach financial analysis.

Market Context

As of Friday, December 12, 2025, Tesla closed at $458.96, up 2.71% on the day. The stock has been on a strong run, trading well above its key moving averages and near its 52-week high of $488.54. Several factors make this week particularly interesting for Tesla investors:

Quadruple Witching (December 19): The simultaneous expiration of stock options, index options, index futures, and single stock futures typically creates heightened volatility and volume.

Post-Fed Environment: The FOMC cut rates by 25 basis points on December 10, bringing the fed funds rate to 3.50%-3.75%, creating a generally supportive backdrop for growth stocks.

Robotaxi Developments: Elon Musk announced Tesla plans to remove safety monitors from Austin robotaxis within approximately three weeks, fueling the AI/autonomy narrative.

Weak Sales Data: U.S. sales fell nearly 23% in November to approximately 39,800 vehicles, the lowest since January 2022, presenting a bearish counterweight.

Summary Comparison: All Five AI Forecasts

The following table presents the key forecasts from each AI chatbot:

Table 1: Summary comparison of AI chatbot forecasts for TSLA (Dec 15-19, 2025)

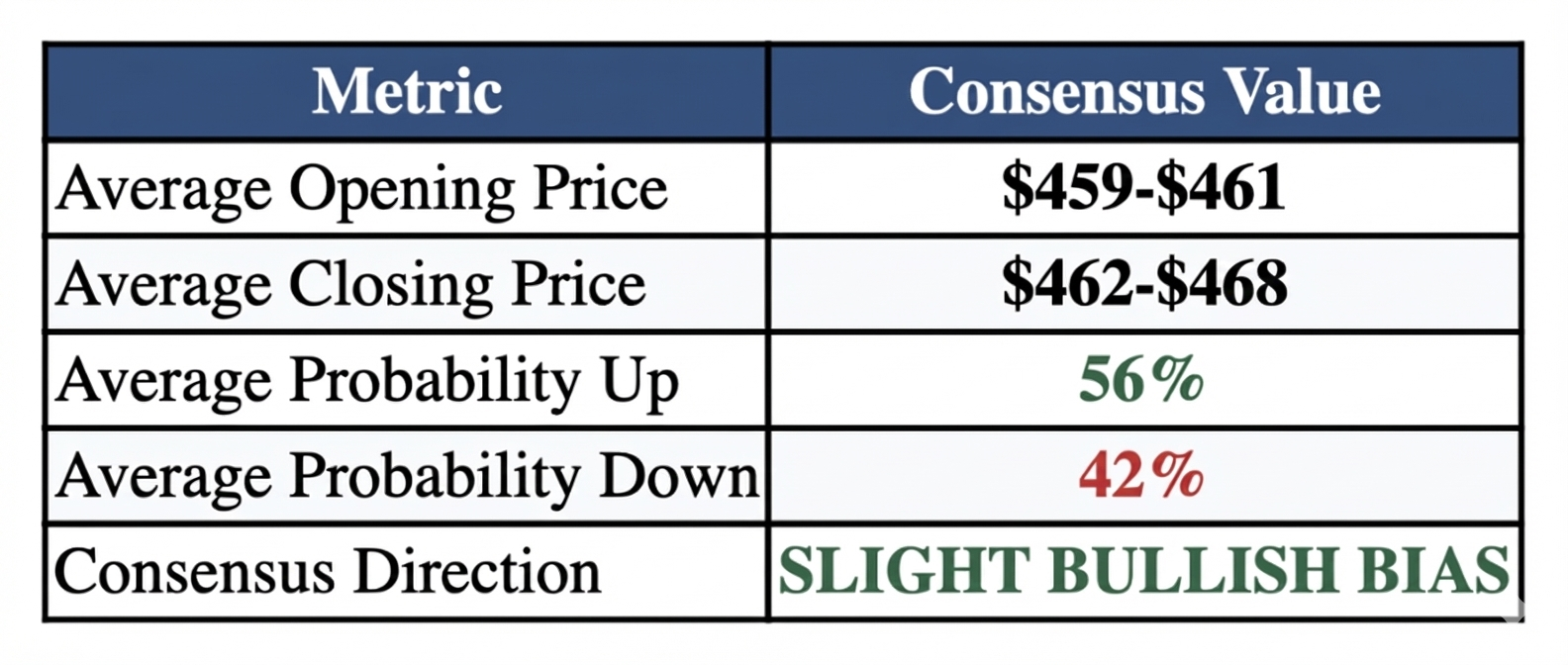

Consensus Analysis

Table 2: Consensus metrics across all five AI models

Claude (Anthropic) – The Cautious Contrarian

Key Stance: Bearish-leaning (50% down vs 40% up)

Claude was the most cautious of the five AIs, assigning a higher probability to a price decline than increase. The model emphasized quadruple witching's historically negative bias on the expiration day itself, December's bearish seasonality for TSLA specifically, and the disconnect between current price levels (~$459) and analyst consensus targets (~$389). Claude also highlighted the RSI approaching overbought territory and flagged the weak U.S. and European sales data as fundamental headwinds that the market may not be fully discounting.

Unique Insight: Claude was the only model to explicitly quantify the flat probability (10%), acknowledging that range-bound consolidation was unlikely given the multiple catalysts converging during the week.

Perplexity – The Technical Optimist

Key Stance: Modestly bullish (60% up vs 40% down)

Perplexity took a constructive view, citing TSLA's position above all key short-term moving averages (5-day, 10-day, 20-day) as the primary bullish signal. The model noted that options positioning showed call-heavy activity, with put/call ratios below 1.0 indicating bullish retail and institutional sentiment. However, Perplexity cautioned that volume on recent up-moves had not been strongly confirming, suggesting range-bound action rather than a clean breakout was more likely.

Unique Insight: Perplexity explicitly framed its analysis around the absence of hard catalysts, noting that price would likely trade "primarily off technicals, sector flows, and macro headlines" rather than company-specific news.

Gemini (Google) – The Bullish Momentum Trader

Key Stance: Most bullish (65% up vs 35% down)

Gemini was the most optimistic of the group, pointing to recent analyst upgrades (Piper Sandler's $500 target), the post-Fed "risk-on" environment, and bullish options skew as drivers of continued momentum. The model predicted a specific closing price of $468.50 and suggested TSLA would test the $470-$475 zone during the week. Gemini acknowledged triple witching as a volatility catalyst but framed it as more of a timing consideration than a directional threat.

Unique Insight: Gemini was the only model to explicitly recommend caution specifically on Friday (December 19) due to witching-related volatility, warning of a "choppy close regardless of the week's overall trend."

Grok (xAI) – The Balanced Analyst

Key Stance: Moderately bullish (60% up vs 40% down)

Grok provided perhaps the most balanced analysis, weighting technical and sentiment factors equally. The model noted the low VIX environment (~12-15) as supportive for growth stocks, while also flagging that short interest, though elevated, was not at extreme levels that would suggest an imminent squeeze. Grok was attentive to the broader market context, noting that retail investors were net buyers while institutions showed more caution, and incorporated X (formerly Twitter) sentiment analysis into its framework.

Unique Insight: Grok explicitly noted that options flow showed "49% bearish sentiment (puts edging calls)," providing a more granular breakdown than other models and suggesting hedging activity ahead of expiration.

ChatGPT (OpenAI) – The Macro-Aware Forecaster

Key Stance: Slightly bullish (55% up vs 45% down)

ChatGPT took a data-driven approach, incorporating the most extensive macro calendar analysis of any model. It highlighted the delayed jobs report (Tuesday, December 16), CPI release (Thursday), and consumer sentiment data (Friday) as key risk events that could shift sentiment rapidly. The model provided the widest expected trading range ($435-$495), reflecting uncertainty around these macro catalysts. ChatGPT's probability split was the closest to neutral among the bullish models.

Unique Insight: ChatGPT was the only model to provide specific source citations with URLs, enhancing transparency and allowing readers to verify the underlying data.

Key Themes Across All Models

Areas of Agreement

Technical Bullishness: All five models agreed that TSLA trading above its 5-day, 10-day, and 20-day moving averages represents a bullish short-term structure.

Quadruple Witching Impact: Every model flagged December 19 as a high-volatility event, though they differed on whether this represented opportunity or risk.

Support Levels: Consensus support was identified in the $435-$450 range, with deeper support around $420-$425.

Options Sentiment: All models noted the put/call ratio below 1.0 as indicating bullish options market positioning.

Areas of Divergence

Directional Probability: Estimates ranged from 40% (Claude) to 65% (Gemini) for an up week, a significant 25-percentage-point spread.

Closing Price Target: Forecasts ranged from $448-$462 (Claude) to $470 (Grok), reflecting different views on momentum sustainability.

Seasonality Weight: Claude heavily emphasized December's historically bearish seasonality for TSLA; other models gave this factor less weight.

Macro vs. Technical Focus: ChatGPT prioritized macro data releases; Perplexity and Gemini leaned more heavily on technical analysis.

Conclusion

The five AI chatbots reached a modest consensus favoring a slight bullish bias for TSLA during the week of December 15-19, 2025. The average probability of an up week across all models was 56%, suggesting that while the technical setup is constructive, significant uncertainty remains due to quadruple witching volatility, macro data releases, and the ongoing tension between Tesla's AI/robotaxi narrative and its near-term sales challenges.

The most striking finding is the dispersion in forecasts: a 25-percentage-point spread in directional probability and a roughly $20 spread in closing price targets. This highlights that even sophisticated AI analysis produces meaningfully different conclusions when interpreting the same market data—a useful reminder that forecasting stock prices remains inherently uncertain, regardless of the tools employed.

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.