Is Copper a Buy? Record $11,952 High & AI Demand Analyzed

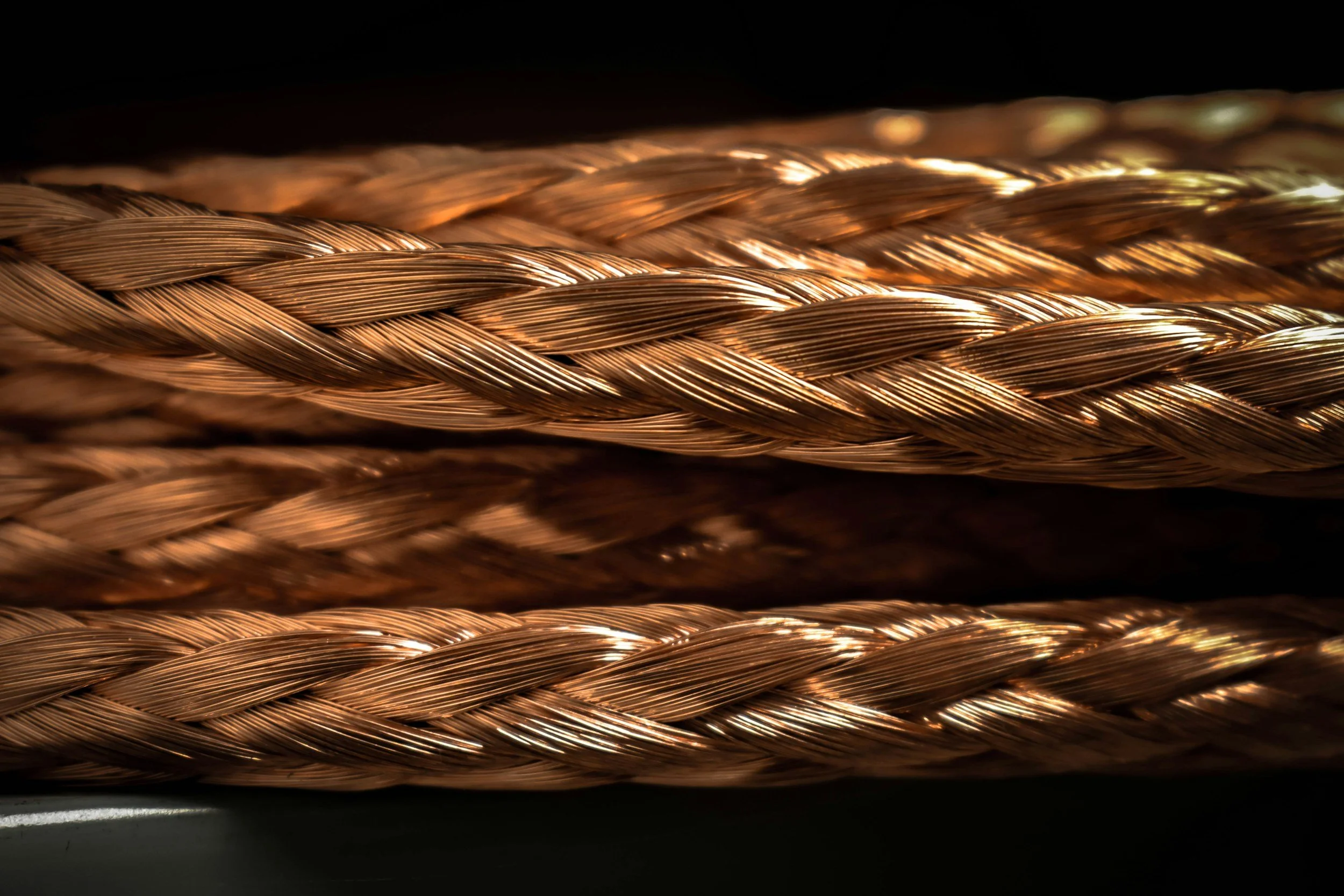

Image Credit: Erik Seth

Copper prices on the London Metal Exchange set new highs on 12 December 2025, with the benchmark three month contract reported by Reuters at USD 11,952 per tonne. Reuters also reported the metal is up about 35 per cent in 2025, its strongest annual rise since 2009.

While copper is a long established bellwether for industrial activity, this rally is being explained less by a single macro trigger and more by overlapping structural demand drivers. Reuters highlighted surging electricity related demand, including growth in AI powered data centres, alongside renewables and broader grid expansion, all colliding with supply constraints and low readily available inventories.

Why AI Shows up in a Copper Story

AI is not “buying copper” directly, but the infrastructure that runs AI tends to be electricity intensive. As data centres scale, they pull forward spending on grid connections, substation upgrades, transformers, switchgear, busbars and cabling, where copper remains a core conductor.

The International Energy Agency projects global electricity consumption by data centres is set to more than double by 2030 to around 945 terawatt hours, and says AI is the most important driver of that increase, with AI optimised data centres projected to more than quadruple their electricity demand by 2030.

Reuters analysis earlier in 2025 put a copper number on the same trend, citing CRU forecasts that copper demand from data centres could exceed 650,000 tonnes by 2030. In that framing, AI related compute becomes one of several large, measurable copper end uses sitting alongside grid build outs, renewables, and electric vehicles.

Demand Growth is Meeting Supply That Is Not Keeping Pace

Reuters reported that a survey of analysts forecasts points to a refined copper market deficit of about 124,000 tonnes in 2025 and 150,000 tonnes in 2026. Reuters also reported forecasts for demand growth of 2.7 per cent globally in 2025, led by a 3.7 per cent increase in China.

On the supply side, Reuters linked the tightening tone to disruptions and guidance changes, including a reported accident at the Grasberg mine and reduced output forecasts by producers such as Glencore.

From an IT infrastructure viewpoint, the key point is timing: data centre projects often run into power availability bottlenecks, but when approvals and grid works do proceed, copper demand tends to arrive early in the build through electrical and connection work, not only when servers are installed.

Inventory Moves and Cross Market Price Gaps are Amplifying Price Signals

Beyond fundamentals, the physical location of copper inventories is part of the story. Reuters reported that the United States has been absorbing a major share of global stocks because local prices were elevated, with flows influenced by uncertainty around import tariffs. In that context, Reuters said stocks on the United States Comex represented 61 per cent of exchange stocks.

Reuters reporting on 4 December said Mercuria cancelled or earmarked for delivery more than 40,000 tonnes of copper in London Metal Exchange storage facilities in South Korea and Taiwan, at a time when historically low LME inventories were already contributing to market tightness. Mercuria declined to comment in the Reuters report.

Another Reuters report dated 10 December said the share of available on warrant copper stocks of Chinese origin in LME warehouses rose to 85 per cent at the end of the prior month, up from 82 per cent in October. In absolute terms, Reuters reported Chinese copper stocks on the LME increased to 130,225 tonnes from 100,400 tonnes, driven by price incentives that made overseas shipment more profitable.

Together, these moves matter for IT and energy watchers because they can tighten near term deliverability even when longer term mine supply is the central constraint.

How This Rally Compares with Earlier AI Linked Copper Warnings

The “AI plus copper” linkage did not start this week. In April 2024, Reuters reported Trafigura said copper demand linked to AI and data centres could add up to one million metric tonnes by 2030, exacerbating deficits toward the end of the decade. That is a commodity trader view rather than a market wide consensus, but it illustrates how AI infrastructure has been increasingly treated as a distinct demand stream in copper forecasting.

In July 2025, Reuters analysis placed AI data centres within a broader structural shift, arguing copper demand is rising faster than expected because grids worldwide are being expanded and modernised to support both digital growth and clean energy. That same Reuters piece cited global power grid investment reaching USD 390 billion in 2024 and expected to exceed USD 400 billion in 2025, and noted that alternatives such as aluminium and fibre optic cables can substitute in some applications but come with performance and practical limits.

The comparison is useful for IT audiences: AI data centres are a fast growing driver, but they sit inside a larger electrification cycle that also includes renewables integration and electric transport. Copper is being pulled by the combined load.

Investor Products Are Turning Physical Copper into an IT Adjacent Trade

Reuters noted growing investor interest, pointing to Canada’s Sprott launching what Reuters described as the world’s first physically backed exchange traded copper fund in mid 2024, holding nearly 10,000 tonnes of physical copper.

Sprott’s own product description says the Sprott Physical Copper Trust invests and holds substantially all of its assets in physical copper.

For IT and AI coverage, the significance is less about financial product marketing and more about market plumbing: when physical copper is warehoused for investment vehicles during a period of tight inventories, it can affect availability at the margin, particularly if exchange stocks are already being drawn into higher premium regions.

Australia Context: Copper Supply, Exports, and AI Driven Energy Build

Australia is not the main price setter for copper, but it is economically exposed to copper’s cycle through resources, exports, and the domestic build out of energy and digital infrastructure.

Geoscience Australia’s AIMR 2024 world rankings table lists Australia as third globally for copper economic resources with a 10 per cent share, and eighth for production with a 4 per cent share, based on December 2023 comparisons.

Geoscience Australia also notes Australia has several copper mines of world significance including the Mt Isa deposit and the Olympic Dam deposit.

On trade, Australia’s Department of Foreign Affairs and Trade lists copper ores and concentrates and copper among Australia’s top 25 exports in its 2024 table.

That combination means the global AI data centre build out can reach Australia through two channels at once: stronger external demand for copper linked to electrification, and local pressure to expand grid capacity and data centre power access.

What to Watch Next

For readers tracking the AI infrastructure economy, the next signals are practical and measurable:

Exchange inventories and cancellations on LME and Comex, which can tighten near term availability and affect spreads.

Mine supply updates and output guidance, which Reuters highlighted as key to the deficit narrative.

Data centre electricity growth assumptions, where the IEA projects a step up through 2030 with AI as the main driver.

The pace of grid investment and build, which Reuters has described as central to copper demand beyond the usual economic cycle.

We are a leading AI-focused digital news platform, combining AI-generated reporting with human editorial oversight. By aggregating and synthesizing the latest developments in AI — spanning innovation, technology, ethics, policy and business — we deliver timely, accurate and thought-provoking content.